Difference Between Insurance and Investment: Explained

Insurance and investment are two different concepts with distinct purposes.

Insurance and investment are two different concepts with distinct purposes. The primary purpose of insurance is to protect an individual against financial loss, whereas the primary purpose of investment is to grow an individual's wealth.

The following are the key differences between insurance and investment:

Purpose: Insurance is designed to protect an individual against financial loss due to unforeseen events, such as accidents, illnesses, or death, while investment is intended to grow an individual's wealth by generating income or capital gains.

Risk: Insurance involves the transfer of risk from an individual to an insurance company, which assumes the risk in exchange for a premium. In contrast, investment involves assuming a certain level of risk in the expectation of earning a return.

Returns: Insurance does not generate returns as it is not designed to do so. However, certain types of insurance, such as investment-linked insurance, may offer investment returns in addition to insurance coverage.

On the other hand, investment is designed to generate returns in the form of income or capital gains.

Individual Invest in Insurance Policy for an individual invests in an insurance policy to protect against financial loss due to unforeseen events such as accidents, illnesses, or death. The insurance policy provides financial compensation in the event of a covered loss, helping the individual avoid financial ruin.

Investment Linked Insurance

Investment-linked insurance is a type of insurance policy that offers both insurance coverage and investment opportunities. It is a hybrid product that combines the benefits of insurance with the potential returns of investment. In an investment-linked insurance policy, a portion of the premium is used to provide insurance coverage, while the rest is invested in a range of investment options such as stocks, bonds, and mutual funds.

ALSO CHECK OUT!

- Job Loss Insurance: What Is Job Loss Insurance?

- Vehicle Loan Interest Rate: What Is The Meaning Of Vehicle Loan Interest?

- Benefits Of Health Insurance: 5 Benefits Of Health Insurance

- Motor Insurance Policy: Benefits of Motor Insurance

Is Insurance an Investment?

Insurance is not an investment as it is not designed to generate returns or grow an individual's wealth. Insurance is designed to protect against financial loss due to unforeseen events such as accidents, illnesses, or death. However, certain types of insurance, such as investment-linked insurance, may offer investment opportunities in addition to insurance coverage.

Insurance and investment are two different concepts with distinct purposes. Insurance is designed to protect an individual against financial loss, while investment is intended to grow an individual's wealth. Although certain types of insurance, such as investment-linked insurance, may offer investment opportunities in addition to insurance coverage, insurance is not considered an investment in general.

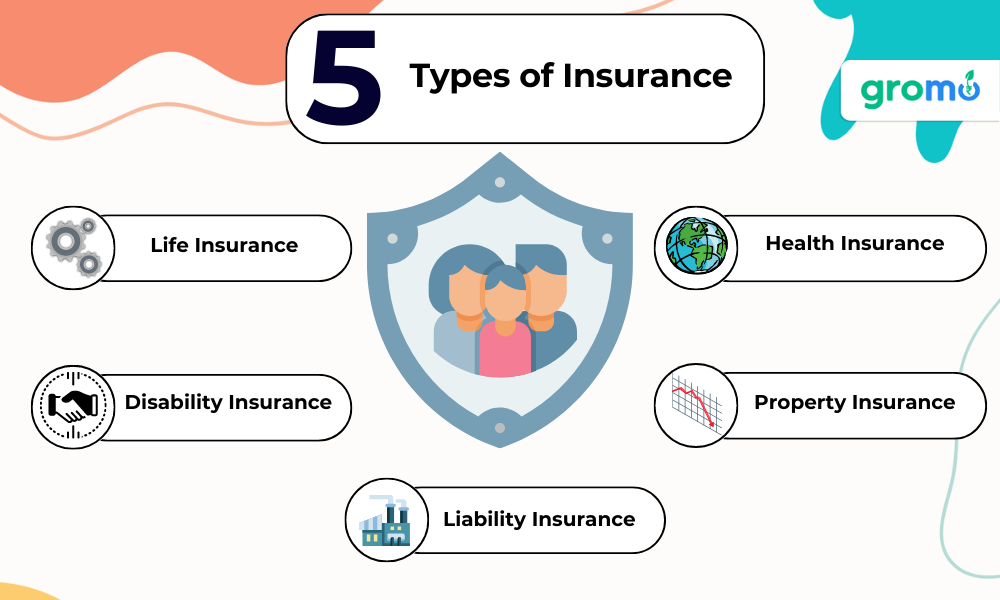

Insurance is an essential aspect of financial planning as it provides protection against unforeseen events that can cause significant financial damage. There are several types of insurance policies available, such as life insurance, health insurance, disability insurance, and property insurance, among others.

Each type of insurance policy is designed to provide coverage against specific risks.

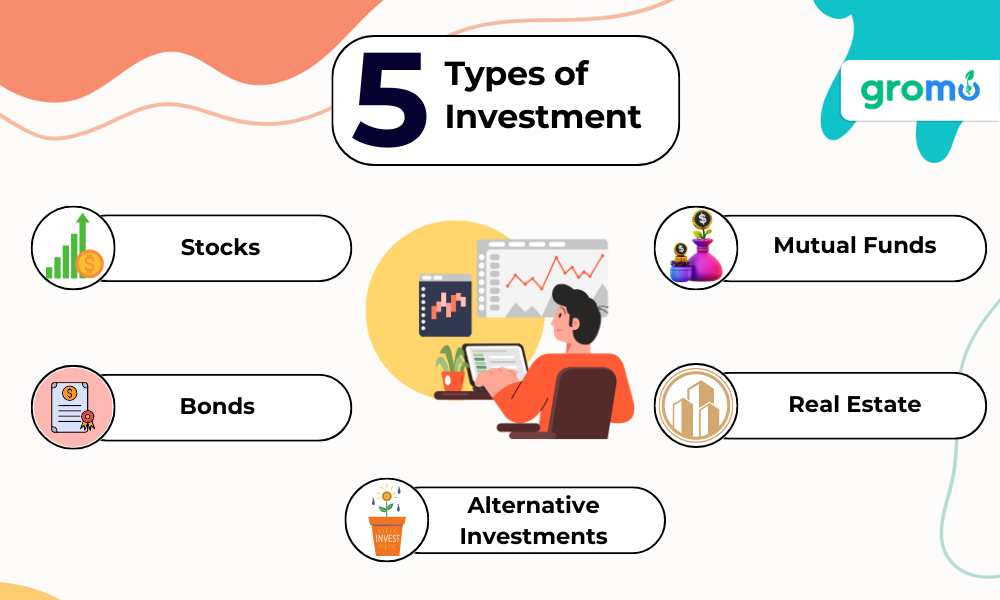

Investment, on the other hand, involves taking a certain level of risk with the expectation of generating returns. There are various investment options available, such as stocks, bonds, mutual funds, real estate, and alternative investments, among others. Each investment option carries a certain level of risk, and the potential returns depend on the performance of the investment.

It is important to understand the difference between insurance and investment and how they can be used to achieve financial goals. While insurance provides protection against financial loss, investment can help an individual grow their wealth.

A comprehensive financial plan should include both insurance and investment to ensure adequate protection against unforeseen events and the potential for long-term growth.

Now you can sell insurance and many other financial products at GroMo!!

DOWNLOAD GROMO

I. Insurance

A. Types of Insurance

- Life Insurance

- Health Insurance

- Disability Insurance

- Property Insurance

- Liability Insurance

B. Factors Affecting Insurance Premiums

- Age and Gender

- Health Status

- Occupation

- Lifestyle

- Coverage Amount

II. Investment

A. Types of Investment

- Stocks

- Bonds

- Mutual Funds

- Real Estate

- Alternative Investments

B. Factors Affecting Investment Returns

- Risk

- Time Horizon

- Diversification

- Asset Allocation

- Market Conditions

Insurance and investment are two different concepts with distinct purposes. Insurance is designed to protect against financial loss, while investment is intended to grow an individual's wealth.

While insurance is an essential aspect of financial planning, investment can help an individual achieve long-term financial goals. A comprehensive financial plan should include both insurance and investment, tailored to an individual's specific needs and goals. By understanding the differences between insurance and investment and how they can be used effectively, individuals can achieve financial security and long-term growth.

To further illustrate the differences between insurance and investment, let us take a closer look at each topic.

Insurance

Insurance is a contract between an individual and an insurance company, where the individual pays a premium in exchange for coverage against specific risks. The purpose of insurance is to protect an individual against financial loss due to unforeseen events.

The following are the types of insurance available:

1- Life Insurance - provides coverage in the event of an individual's death.

It is intended to provide financial security to the individual's dependents or beneficiaries.

-

Health Insurance - provides coverage for medical expenses in the event of an illness or injury. It can also cover the cost of preventive care, such as regular check-ups and screenings.

-

Disability Insurance - provides coverage for income replacement in the event of a disability that prevents an individual from working. It can also cover the cost of rehabilitation and other related expenses.

-

Property Insurance - provides coverage for damage or loss to property, such as a home or vehicle, due to unforeseen events, such as theft or natural disasters.

Liability Insurance - provides coverage for legal liability in the event of injury or damage caused by the insured.

The factors that affect insurance premiums include an individual's age, gender, health status, occupation, lifestyle, and coverage amount. The higher the risk of an event occurring, the higher the premium.

Investment

Investment involves taking a certain level of risk with the expectation of generating returns.

The purpose of investment is to grow an individual's wealth.

The following are the types of investment available:

-

Stocks - represent ownership in a company and offer the potential for long-term growth and income through dividends.

-

Bonds - represent debt issued by companies or governments and offer a fixed income.

-

Mutual Funds - pool funds from multiple investors and invest in a diversified portfolio of stocks, bonds, or other securities.

-

Real Estate - involves investing in property, such as rental properties, commercial properties, or land.

Alternative Investments - include assets such as commodities, hedge funds, private equity, and cryptocurrency.

The factors that affect investment returns include risk, time horizon, diversification, asset allocation, and market conditions. The higher the risk, the higher the potential return.

Insurance and investment are two different concepts with distinct purposes. Insurance is designed to protect an individual against financial loss due to unforeseen events, while investment is intended to grow an individual's wealth.

A comprehensive financial plan should include both insurance and investment, tailored to an individual's specific needs and goals. By understanding the differences between insurance and investment and how they can be used effectively, individuals can achieve financial security and long-term growth.

To further enhance our understanding of the difference between insurance and investment, let us explore some common misconceptions about insurance and investment.

ALSO CHECK OUT!!

- 5 Best Motor Insurance Policies To Buy in India

- How To Apply For A Personal Loan With Low CIBIL Score?

- How To Improve CIBIL Score Using Your Credit Card?

- Does Your Credit Card Help You Build A Good Credit Score?

Misconceptions About Insurance

Insurance is a waste of money - Some people may see insurance as an unnecessary expense, especially if they have never experienced a significant loss. However, insurance provides peace of mind and financial security in the event of an unforeseen event.

Insurance is only for the elderly or sick - Insurance is for anyone who wants to protect themselves against financial loss due to unforeseen events. It is recommended to purchase insurance at a younger age when premiums are lower.

All insurance policies are the same - Each insurance policy is unique and offers coverage against specific risks. It is essential to understand the terms and conditions of the policy before purchasing it.

Misconceptions About Investment

-

Investment is only for the wealthy - Investment is for anyone who wants to grow their wealth. There are various investment options available for individuals with different income levels.

-

Investment is a get-rich-quick scheme - Investment involves taking a certain level of risk and requires patience and discipline. There is no guarantee of returns, and individuals should invest according to their risk tolerance and long-term financial goals.

-

Investment is too complicated - Investment can seem complicated, but there are many resources available to help individuals understand the different investment options available. It is recommended to seek the advice of a financial advisor to create an investment plan that aligns with an individual's specific needs and goals.

Insurance and investment are essential aspects of financial planning. Insurance provides protection against financial loss due to unforeseen events, while investment helps an individual grow their wealth.

It is essential to understand the differences between insurance and investment and how they can be used effectively to achieve financial security and long-term growth. By debunking common misconceptions about insurance and investment, individuals can make informed decisions about their financial future.

When it comes to choosing between insurance and investment, it is important to understand that both play important roles in an individual's financial plan.

Insurance provides protection against financial loss due to unforeseen events, while investment helps an individual grow their wealth. An individual should consider their specific needs and goals when deciding how much to allocate towards insurance and investment.

For example, an individual with dependents may need more life insurance coverage to provide financial security for their loved ones in the event of their death. On the other hand, an individual with a long-term investment horizon may choose to allocate more funds towards investment options such as stocks or mutual funds to grow their wealth over time.

It is also important to regularly review insurance and investment plans to ensure they align with an individual's changing needs and goals. For example, as an individual's income or family situation changes, they may need to adjust their insurance coverage or investment strategy accordingly.

Insurance and investment are both important aspects of financial planning. Insurance provides protection against financial loss due to unforeseen events, while investment helps an individual grow their wealth.

By understanding the differences between insurance and investment and how they can be used effectively, individuals can achieve financial security and long-term growth.

A comprehensive financial plan should include both insurance and investment, tailored to an individual's specific needs and goals. Regular reviews of insurance and investment plans can ensure they align with an individual's changing circumstances.

Now you understand the difference between Investment and Insurance. For more knowledge in detail and to learn and sell financial products like insurance, credits cards etc.

DOWNLOAD GROMO

KEY TAKEWAYS

-

Investment and insurance serve different purposes - one helps you grow your wealth while the other protects it.

-

Insurance provides a safety net for unexpected events, while investments are meant to generate returns over time.

-

Investing requires a higher degree of risk-taking, while insurance focuses on risk mitigation.

-

Insurance premiums are typically fixed and predetermined, while investment returns are uncertain and dependent on market conditions.

-

Both investment and insurance should be part of a well-rounded financial plan that aligns with your goals and risk tolerance.