Personal Loan Terms And Definitions: Exhaustive List

A personal loan is an unsecured form of credit provided by financial institutions, like banks and non-banking financial companies (NBFCs).

A personal loan is an unsecured form of credit provided by financial institutions, like banks and non-banking financial companies (NBFCs). Lenders extend these loans based on the borrower's credit history and ability to repay from personal income.

If you are a financial advisor seeking a platform to facilitate the sale of savings accounts, then you should check the GroMo App. You can make up to Rs. 1 Lakhs by selling savings accounts through GroMo.

Definitions and Related Terms

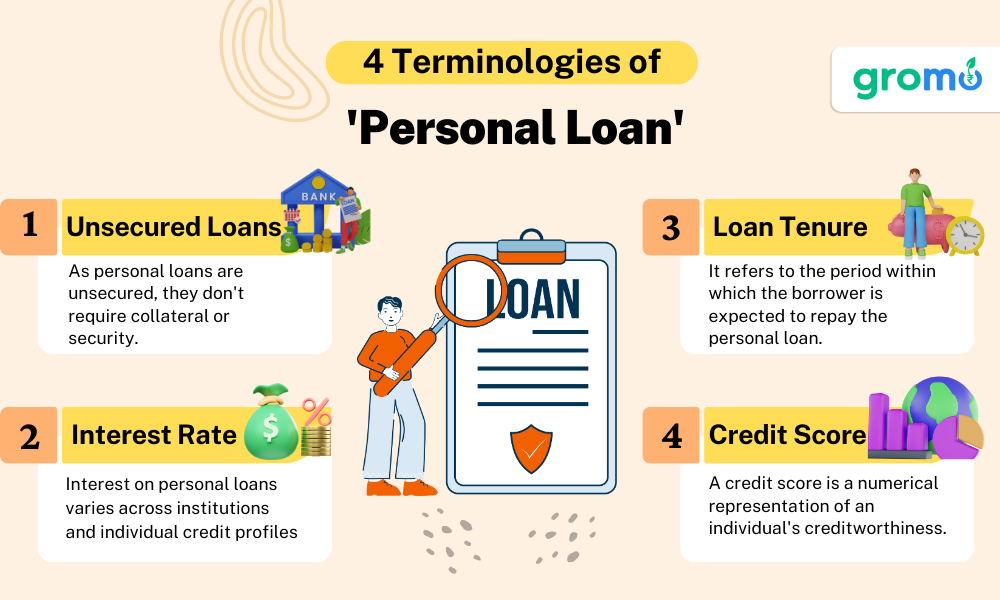

1. Unsecured Loans

As personal loans are unsecured, they don't require collateral or security. In contrast, secured loans, such as home loans or car loans, involve providing an asset as collateral.

2. Interest Rate

The interest rate on personal loans varies across institutions and individual credit profiles. It is largely dependent on the borrower's credit score, income level, and repayment history.

3. Loan Tenure

Loan tenure refers to the period within which the borrower is expected to repay the personal loan. The tenure can range from 12 months to 60 months, depending on the agreement between the lender and borrower.

4. Credit Score

A credit score is a numerical representation of an individual's creditworthiness, largely determining personal loan eligibility and interest rates. The higher the credit score, the better the chances of loan approval at a competitive interest rate.

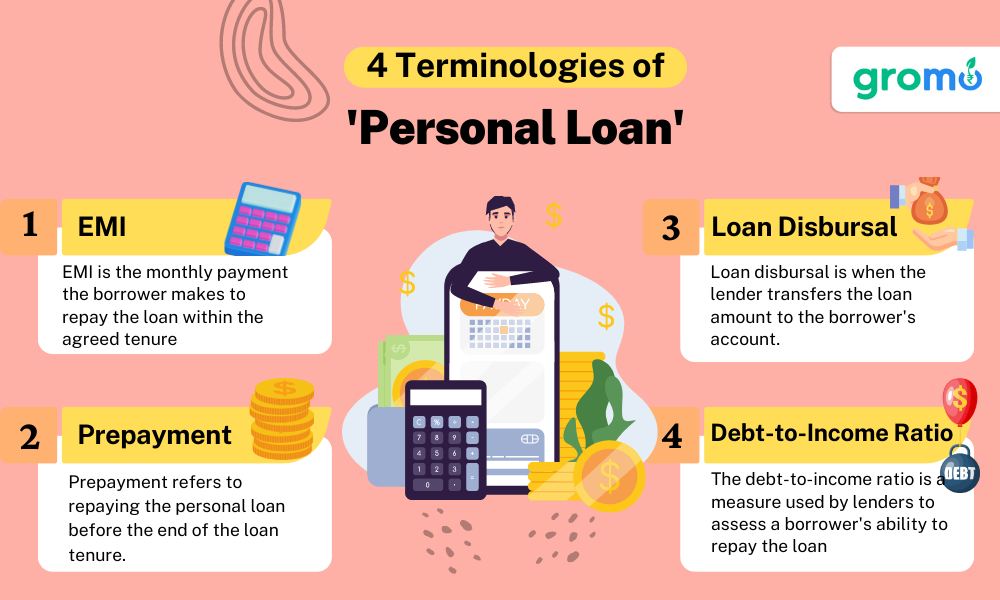

5. EMI

Equated Monthly Installment (EMI) is the monthly payment the borrower makes to repay the loan within the agreed tenure. EMI is calculated based on the loan amount, interest rate, and tenure.

6. Prepayment

Prepayment refers to repaying the personal loan before the end of the loan tenure. Some lenders charge a prepayment penalty, while others don't.

7. Late Payment Fees

If the EMI is not paid on time, lenders charge a late payment fee. Consistent late payments negatively affect the borrower's credit score.

8. Loan Disbursal

Loan disbursal is when the lender transfers the loan amount to the borrower's account. This occurs after the loan approval and agreement signing.

9. Debt-to-Income Ratio

The debt-to-income ratio is a measure used by lenders to assess a borrower's ability to repay the loan. It is the percentage of a borrower's monthly gross income that goes towards paying debts.

Personal loans can be a viable option for meeting immediate financial needs, provided the borrower is confident in their ability to repay on time. Understanding the associated terms is crucial to making informed borrowing decisions.

CHECK OUT!!

- Job Loss Insurance Meaning: Financial Planning Tips

- Difference Between Insurance and Investment: Explained

- How To Get Instant Loans: Step By Step Guide

- Health Insurance Meaning: An Essential Financial Safety Net

10. Fixed-Rate Personal Loans

Fixed-rate personal loans have an interest rate that remains the same throughout the loan's duration. This feature allows borrowers to know exactly how much they will need to repay each month.

11. Variable-Rate Personal Loans

Variable-rate personal loans, on the other hand, have an interest rate that fluctuates over the duration of the loan. These fluctuations are generally based on changes in the market interest rate. As a result, the monthly payments may vary over time.

12. Co-Signer

A co-signer is a person who agrees to repay a borrower's personal loan if the borrower defaults on their loan repayments. Having a co-signer with a strong credit history can enhance the chances of loan approval and possibly secure a lower interest rate.

13. Loan Origination Fee

The loan origination fee is a charge that lenders may require for processing a new loan application. It is typically a percentage of the loan amount and is often deducted from the loan proceeds.

14. Loan Repayment Schedule

A loan repayment schedule is a detailed breakdown of the loan's repayment structure. It outlines the principal and interest components of each EMI over the loan's tenure.

15. Loan Default

Loan default occurs when a borrower fails to repay the personal loan as per the agreed terms. Defaults negatively impact the borrower's credit score and future borrowing potential.

Understanding the various aspects of personal loans and their related terms can help borrowers make more informed decisions. Whether it's managing loan repayments or understanding the implications of defaulting on a loan, being aware of these terms will enable borrowers to better navigate the lending landscape. Remember, personal loans should be used responsibly and as a last resort for immediate financial needs.

16. Debt Consolidation

Debt consolidation is a common reason why people take out personal loans. It involves taking a new loan to pay off other existing debts. It allows the borrower to simplify their financial management by having just one monthly payment instead of many. Additionally, the new loan might have a lower interest rate, which can help save money in the long run.

17. Debt-to-Income Ratio

The debt-to-income ratio (DTI) is a key metric that lenders use when assessing your eligibility for a personal loan. It’s calculated by dividing your monthly debt payments by your monthly gross income. A lower DTI indicates that you have a good balance between debt and income, which can make you more attractive to lenders.

18. Early Repayment Charge

An early repayment charge is a fee you might have to pay if you choose to pay off your personal loan before the end of its term. Not all lenders charge this fee, but it's important to check the terms and conditions before you decide to repay early.

19. Loan Agreement

A loan agreement is a contract between a borrower and a lender that outlines the rules and regulations regarding the loan. It includes details such as the loan amount, interest rate, repayment schedule, fees, and what happens in case of default. It's important to read and understand the loan agreement before signing it.

20. Unsecured Personal Loan

An unsecured personal loan doesn't require you to put up any collateral. This means that if you default on the loan, the lender can't immediately take possession of any of your assets. However, the lender can take other collection actions like hiring a collection agency or suing you.

CHECK OUT!!

- Demat Account Meaning: Meaning, Significance, and Other Key Details

- Buy Now Pay Later App: Popular Apps In India

- Instant Loan Meaning: A Comprehensive Guide to Related Terms

- Investment Products: A Comprehensive Guide

21. Secured Personal Loan

A secured personal loan, on the other hand, requires you to provide collateral such as a car or house. If you default on the loan, the lender has the right to seize the collateral to recoup their loss. Because secured loans are less risky for lenders, they usually come with lower interest rates than unsecured loans.

Personal loans can be a useful financial tool when used responsibly. Understanding these related terms and their implications can help you navigate the lending process more confidently and make the best decisions for your financial situation. Always remember to borrow within your means and make loan repayments on time.

22. Installment Loan

An installment loan is a type of loan that you repay over time with a set number of scheduled payments. Personal loans are often installment loans, and payments usually cover both the principal and the interest.

23. Fixed-Rate Loan

A fixed-rate loan is a loan where the interest rate doesn't change over the life of the loan. This means your monthly loan payments will remain consistent throughout the loan term, which can make budgeting easier.

24. Variable-Rate Loan

In contrast, a variable-rate loan has an interest rate that can change over time. These rates are usually tied to a benchmark interest rate, and if the benchmark rate changes, your loan interest rate (and therefore, your monthly payments) can change too.

25. Credit Bureau

A credit bureau is an agency that collects and researches individual credit information and sells it to creditors for a fee. Lenders often check with credit bureaus to understand a potential borrower's credit history and credit score.

26. Credit Report

Your credit report is a detailed report of your credit history. It includes information such as the number and types of credit accounts you have, how long each account has been open, amounts owed, whether you’ve paid your bills on time, and any actions taken against you for unpaid bills.

27. Credit Score

A credit score is a numerical expression based on a level analysis of a person's credit files, representing the creditworthiness of that person. A high credit score makes it easier to qualify for a personal loan and may get you a better interest rate.

28. Prepayment

Prepayment is the early repayment of a loan by a borrower. This could be in part or in full. It is often done to save on interest payments over the life of the loan.

29. Loan Term

The loan term is the length of time that you agree to repay the lender. It could be as short as a few months or as long as several years.

30. Amortization

Amortization refers to the process of paying off debt over time through regular payments. A portion of each payment is for interest while the remaining amount is applied towards the principal balance.

To sell this product, and many other financial products. DOWNLOAD GROMO. Where you can sell and earn a substantial income sitting at home

KEY TAKEAWAYS

-

Understanding Personal Loans: Personal loans are versatile, unsecured loans typically used for general expenses, debt consolidation, or unexpected costs. Unlike home or auto loans, they don't require collateral and are approved based on creditworthiness, income, and debt-to-income ratio.

-

Diverse Repayment Options: Personal loans offer diverse repayment options, including installment loans, fixed-rate loans, and variable-rate loans. Understanding the nature of each of these can help you plan your repayments effectively and avoid financial strain.

-

Credit Matters: Your credit history, as recorded by credit bureaus and reflected in your credit report and score, plays a significant role in your ability to secure a personal loan and the interest rate you're offered.

-

Prepayment Possibilities: Some personal loans offer the ability to make prepayments, which can save on interest payments over the life of the loan. However, it's crucial to understand the lender's terms as some may charge prepayment penalties.

-

Loan Term and Amortization: The term of the loan and its amortization schedule significantly influence the total cost of the loan and the monthly repayment amount. Understanding these terms helps in managing finances and deciding the most suitable loan structure.