Top Providers Of Buy Now Pay Later: 9 Best Providers In India

The Buy Now Pay Later concept is revolutionizing the Indian e-commerce industry, giving customers greater purchasing power with flexible payment options

The Buy Now Pay Later (BNPL) concept is revolutionizing the Indian e-commerce industry, giving customers greater purchasing power with flexible payment options. This article explores the top 5 BNPL providers in India, and their key features, benefits, and eligibility criteria.

1. ZestMoney: Fast, Paperless Credit Approval

ZestMoney is a popular BNPL provider in India, offering an instant credit line to customers without any paperwork.

Key Features:

- Instant approval with minimal documentation

- Flexible EMI options ranging from 3 to 24 months

- Partners with 3000+ online and offline merchants

- No pre-closure charges

Benefits:

Enhance your credit score with timely payments

Access to exclusive deals and discounts with partner merchants

Real-time credit approval for a hassle-free shopping experience

Eligibility Criteria:

Indian resident, 18 years or older

Valid PAN and Aadhaar cards

Bank account with a registered mobile number

2. LazyPay: One-Click Checkout Convenience

LazyPay offers a seamless shopping experience by simplifying the checkout process with a single click.

Key Features:

Credit limit up to INR 1,00,000

15-day interest-free repayment period

Integration with 250+ merchants

Smartphone app for easy account management

Benefits:

Faster checkout with fewer steps

Interest-free period for responsible credit management

Consolidated billing for all purchases

Eligibility Criteria:

Indian resident, 18 years or older

Valid ID and address proof

Good credit history

GO CHECK OUT!

Job Loss Insurance Meaning: Financial Planning Tips

Difference Between Insurance and Investment: Explained

How To Get Instant Loans: Step By Step Guide

Health Insurance Meaning: An Essential Financial Safety Net

3. Simpl: Consolidated Billing for Easier Payments

Simpl offers a unique BNPL experience by combining all your purchases into a single, easy-to-manage bill.

Key Features:

- Consolidated bi-weekly billing

- No-interest repayment period

- Partners with popular e-commerce platforms

- Smartphone app for tracking expenses and payments

Benefits:

- Manage multiple transactions with a single payment

- Zero interest charges for timely bill settlement

- Improved cash flow management

Eligibility Criteria

- Indian resident, 18 years or older

- Stable income source

- Good credit history

4. ePayLater: Shop First, Pay Within 14 Days

ePayLater offers a 14-day interest-free repayment window, giving customers ample time to manage their finances.

Key Features:

- Credit limit up to INR 20,000

- 14-day interest-free payment window

- Integration with popular e-commerce platforms

- Digital KYC for quick approvals

Benefits:

- Interest-free credit for a short repayment period

- Enhanced cash flow management

- Access to exclusive partner deals

- Eligibility Criteria:

- Indian resident, 18 years or older

- Valid PAN and Aadhaar cards

- Stable income source

5. Flexmoney: Personalized Credit for a Tailored Experience

Flexmoney is a BNPL platform that allows customers to access instant credit based on their credit profile.

Key Features:

- Personalized credit limits

- Flexible EMI options

- Integration with leading online retailers

- Mobile app for easy account management

Benefits:

Tailored credit solutions based on individual profiles

Eligibility Criteria:

- Indian resident, 18 years or older

- Valid PAN and Aadhaar cards

- Good credit history

To sell this product, and many other financial products. DOWNLOAD GROMO. Where you can sell and earn a substantial income sitting at home

Comparing Top BNPL Providers in India: Features at a Glance

To help you choose the right BNPL provider, here's a comparison table highlighting the features and benefits of each provider:

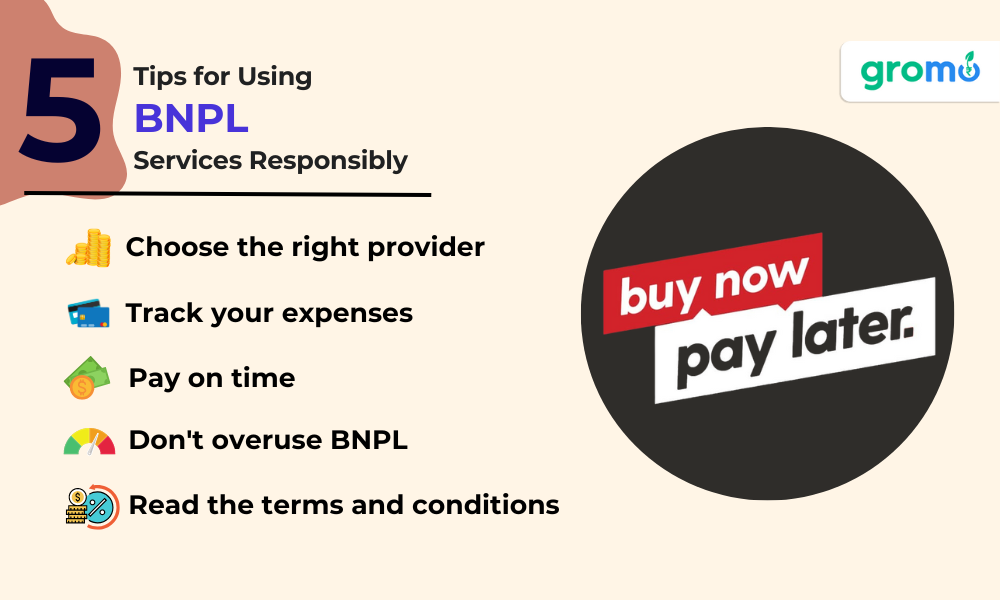

Tips for Using BNPL Services Responsibly

While BNPL services offer numerous benefits, responsible usage is crucial to avoid financial pitfalls. Here are a few tips to help you make the most of BNPL services:

-

Choose the right provider: Compare the features, benefits, and eligibility criteria of different BNPL providers to find the best fit for your needs.

-

Track your expenses: Regularly monitor your BNPL transactions to ensure you stay within your budget and avoid overspending.

-

Pay on time: Timely payments not only help you avoid late fees and interest charges but also improve your credit score.

-

Don't overuse BNPL: Use BNPL services judiciously, and avoid relying on them for all your purchases. Maintaining a healthy balance between BNPL and traditional payment methods is key to responsible credit management.

-

Read the terms and conditions: Understand the fees, charges, and penalties associated with your chosen BNPL provider to avoid any surprises.

BNPL services have become an integral part of the Indian e-commerce landscape, offering customers a convenient and flexible way to manage their finances.

By choosing the right provider and using BNPL services responsibly, you can enjoy the benefits of hassle-free shopping and improved cash flow management.

Additional BNPL Providers in India: Expanding the Landscape

While the top 5 BNPL providers cater to a large segment of the Indian market, there are other emerging players offering unique features and benefits.

Here are three more BNPL providers worth considering:

6. Paytm Postpaid: Exclusive Benefits for Paytm Users

Paytm Postpaid, a BNPL offering by Paytm, provides instant credit to Paytm users for a seamless shopping experience.

Key Features:

Credit limit up to INR 1,00,000

Integration with Paytm ecosystem

Flexible repayment options

Exclusive discounts and cashback offers

Benefits:

Convenient for Paytm users

Access to a wide range of services within the Paytm ecosystem

Attractive cashback and discount offers

Eligibility Criteria:

Existing Paytm user

Indian resident, 18 years or older

Good credit history

7. Ola Postpaid: Simplified Billing for Ola Services

Ola Postpaid, offered by the ride-hailing giant Ola, allows customers to use BNPL for Ola rides and other services.

Key Features:

- Credit limit up to INR 30,000

- Consolidated monthly billing

- Integration with Ola rides and partner services

- Interest-free repayment period

Benefits:

Simplified billing for Ola rides

Extended usage for partner services

Interest-free credit for a short repayment period

Eligibility Criteria:

Existing Ola user

Indian resident, 18 years or older

Good credit history

8. Amazon Pay Later: Instant Credit for Amazon Shoppers

Amazon Pay Later is a BNPL service exclusive to Amazon India customers, providing instant credit for a seamless shopping experience.

Key Features:

Credit limit up to INR 60,00

Comparing Top BNPL Providers in India: Features at a Glance

To help you choose the right BNPL provider, here's a comparison table highlighting the features and benefits of each provider:

Tips for Using BNPL Services Responsibly

While BNPL services offer numerous benefits, responsible usage is crucial to avoid financial pitfalls. Here are a few tips to help you make the most of BNPL services:

-

Choose the right provider: Compare the features, benefits, and eligibility criteria of different BNPL providers to find the best fit for your needs.

-

Track your expenses: Regularly monitor your BNPL transactions to ensure you stay within your budget and avoid overspending.

-

Pay on time: Timely payments not only help you avoid late fees and interest charges but also improve your credit score.

-

Read the terms and conditions: Understand the fees, charges, and penalties associated with your chosen BNPL provider to avoid any surprises.

BNPL services have become an integral part of the Indian e-commerce landscape, offering customers a convenient and flexible way to manage their finances. By choosing the right provider and using BNPL services responsibly, you can enjoy the benefits of hassle-free shopping and improved cash flow management.

Additional BNPL Providers in India: Expanding the Landscape

While the top 5 BNPL providers cater to a large segment of the Indian market, there are other emerging players offering unique features and benefits. Here are three more BNPL providers worth considering:

- Paytm Postpaid: Exclusive Benefits for Paytm Users

Paytm Postpaid, a BNPL offering by Paytm, provides instant credit to Paytm users for a seamless shopping experience.

Key Features:

Credit limit up to INR 1,00,000

Integration with Paytm ecosystem

Flexible repayment options

Exclusive discounts and cashback offers

Benefits:

Convenient for Paytm users

Access to a wide range of services within the Paytm ecosystem

Attractive cashback and discount offers

Eligibility Criteria:

Existing Paytm user

Indian resident, 18 years or older

Good credit history

*Looking for an app for earning online? GroMo is your answer! Now earn with each sale by selling various kinds of financial products

9. Ola Postpaid: Simplified Billing for Ola Services

Ola Postpaid, offered by the ride-hailing giant Ola, allows customers to use BNPL for Ola rides and other services.

Key Features:

Credit limit up to INR 30,000

Consolidated monthly billing

Integration with Ola rides and partner services

Interest-free repayment period

Benefits:

Simplified billing for Ola rides

Extended usage for partner services

Interest-free credit for a short repayment period

Eligibility Criteria:

Existing Ola user

Indian resident, 18 years or older

Good credit history

Flexible EMI options ranging from 3 to 12 months

Exclusive to Amazon India platform

Digital KYC for quick approvals

Benefits:

Convenient for Amazon shoppers

Flexible EMI options for easy repayments

Access to exclusive Amazon deals and discounts

Eligibility Criteria:

Existing Amazon India customer

Indian resident, 23 years or older

Valid PAN and Aadhaar cards

How to Choose the Right BNPL Provider for You

With a plethora of BNPL providers in the market, choosing the right one for your needs might seem daunting.

Consider the following factors to make an informed decision:

Credit limit: Evaluate the credit limit offered by different providers to ensure it meets your requirements.

Repayment period: Compare the interest-free repayment periods and EMI options to find a suitable plan.

Merchant partnerships: Assess the range of merchants associated with the BNPL provider to determine if they align with your shopping preferences.

Fees and charges: Understand the associated fees, charges, and penalties to avoid unexpected costs.

Customer support: Opt for a provider with robust customer support to address any issues that may arise.

By assessing these factors, you can find a BNPL provider that fits your shopping habits and financial needs, enabling you to enjoy the advantages of flexible payment solutions.

The Future of BNPL in India: A Promising Outlook

The Indian market is witnessing rapid growth in the BNPL sector, driven by increasing internet penetration, a burgeoning middle class, and the rising popularity of e-commerce. This growth trajectory is expected to continue, with further advancements and innovations in the BNPL landscape. Here's a glimpse of what the future may hold for BNPL in India:

Expanding Merchant Network

As BNPL gains widespread acceptance, more merchants are expected to integrate these services into their payment platforms. This expansion will offer customers a broader range of shopping options, enabling them to use BNPL for various products and services.

Increased Competition and Innovation

The growing BNPL market is expected to attract more players, leading to increased competition and innovation. As a result, BNPL providers may introduce new features, payment plans, and benefits to differentiate themselves and attract customers.

As the BNPL sector matures, regulatory authorities may introduce guidelines to protect consumer interests and ensure the responsible growth of the industry. These regulations may encompass aspects like transparent fee structures, fair lending practices, and data privacy.

Integration with Traditional Banking Services

BNPL providers may collaborate with traditional banks and financial institutions to offer a more comprehensive suite of financial products and services. This integration may include features like credit cards, personal loans, and insurance, providing customers with a one-stop solution for their financial needs.

Improved Credit Scoring Mechanisms

BNPL providers may adopt advanced credit scoring mechanisms, leveraging alternative data sources and AI-powered algorithms. These improved systems may enable more accurate assessment of customers' creditworthiness, allowing for better risk management and personalized credit offerings.

The BNPL sector in India is poised for significant growth and transformation, offering customers greater financial flexibility and convenience. By staying informed about the latest developments and choosing the right provider, consumers can make the most of this emerging trend and enjoy a seamless shopping experience.

CHECK OUT!

- Buy Now Pay Later Meaning: Guide To All Reated Terms

- Demat Account Meaning: Meaning, Significance, and Other Key Details

- Savings Account Meaning: Important Related Terms

KEY TAKEAWAYS

-

Increasing Popularity: The "Buy Now Pay Later" (BNPL) model is becoming increasingly popular worldwide, with many providers emerging in the market. This is largely due to its flexible payment options, allowing consumers to break down purchases into smaller, manageable payments.

-

Notable Providers: Some of the leading providers of BNPL services include Afterpay, Klarna, Affirm, and Zip. These companies have established significant user bases and are continuously expanding their services to new markets.

-

Credit Checks: Some BNPL providers require credit checks while others do not. It's important for consumers to understand the terms and conditions of the service before using it, as missed payments could potentially impact credit scores.

-

Fees and Interest Rates: Different BNPL providers have different fee structures and interest rates. Some offer interest-free periods, while others may charge interest from the outset. Late payment penalties can also vary between providers.

-

Consumer Responsibility: Despite the convenience of BNPL, the blog emphasizes the importance of consumer responsibility. It's crucial for users to manage their finances effectively to avoid falling into debt, as the ease of BNPL can lead to overspending.