Buy Now Pay Later: What Is BNPL?

Buy now pay later is a flexible payment option that's gaining popularity among online shoppers. It allows you to purchase a product and pay later.

Buy Now Pay Later (BNPL) is a modern payment method that allows shoppers to purchase goods and services upfront, and pay for them later in installments, usually interest-free. Buy now pay later services are offered by various companies, including credit card issuers, banks, e-commerce websites, payment apps, etc. In this article, we will discuss what Boy now pay later is, how it works, the best Buy now pay later apps, BNPL companies, and BNPL beauty products.

What is Buy Now Pay Later?

BNPL is a payment option that allows customers to buy products without making full payments upfront. Instead, customers can pay in installments over a specific period. BNPL is a great option for people who want to buy expensive products, but do not have enough cash at hand or prefer to pay in installments. Buy now pay later services are typically interest-free, but some companies charge interest rates or fees.

How Does Buy Now Pay Later Work?

Buy now pay later works by allowing customers to split their payments into several installments. The number of installments, frequency of payments, and due dates vary depending on the BNPL provider. Typically, BNPL services require customers to create an account, verify their identity, and provide payment information. Once the account is set up, customers can start shopping and choose the BNPL option at checkout.

The first payment is usually due at the time of purchase, and the remaining payments are spread out over several weeks or months. BNPL providers usually charge fees or interest rates for missed payments or late payments.

Buy Now Pay Later Companies

Apart from standalone apps, many companies offer Buy now pay later apps. Here are some of the top BNPL companies:

-

PayPal - PayPal is a popular online payment platform that offers a BNPL service called PayPal Credit. PayPal Credit allows customers to finance purchases and pay in installments. PayPal Credit charges interest rates, and the payment terms range from six to 24 months.

-

Visa - Visa is a credit card issuer that offers a BNPL service called Visa Installments. Visa Installments allows customers to split their payments into equal installments. Visa Installments charges interest rates, and the payment terms vary depending on the merchant

-

Mastercard - Mastercard is another credit card issuer that offers a BNPL service called Mastercard Installments. Mastercard Installments allows customers to pay for purchases in installments. Mastercard Installments charges interest rates, and the payment terms vary depending on the merchant.

-

American Express - American Express is a credit card issuer that offers a BNPL service called Pay It Plan It. Pay It Plan It allows customers to split their payments into installments or pay off small purchases immediately. Pay It Plan It charges interest rates, and the payment terms vary depending on the customer's plan.

Go check out!!

Simpl Buy Now Pay Later

Simpl is a Buy now pay later app that allows customers to split their payments into four installments. Simpl is a popular BNPL app in India and is gaining popularity in other countries. Simpl charges late fees for missed payments, and the payment terms range from 15 to 45 days. Simpl also offers a Simpl Card, which is a physical card that can be used to make BNPL purchases.

Buy Now Pay Later apps

There are many BNPL apps available in the market, as discussed earlier. BNPL apps offer a convenient and flexible payment option for customers.

** Here are some of the benefits of using BNPL apps:**

-

Easy to use - Buy now pay later apps are easy to use and allow customers to split their payments into installments quickly.

-

Interest-free - Most Buy now pay later apps offer interest-free payments, which can save customers money.

-

Flexibility - Buy now pay later apps offer flexible payment options, including pay in installments or pay later.

If you're searching for a platform where you can smoothly get a detailed understanding and access to buy and sell financial products to earn.

Buy Now Pay Later Beauty Products

BNPL services are also available for beauty products. Here are some of the popular BNPL beauty products:

-

Sephora - Sephora offers a Buy now pay later india service called Afterpay. Afterpay allows customers to split their payments into four installments.

-

Ulta - Ulta offers a Buy now pay later india service called Klarna. Klarna allows customers to pay in four installments.

-

Glossier - Glossier offers a Buy now pay later india service called Afterpay. Afterpay allows customers to split their payments into four installments.

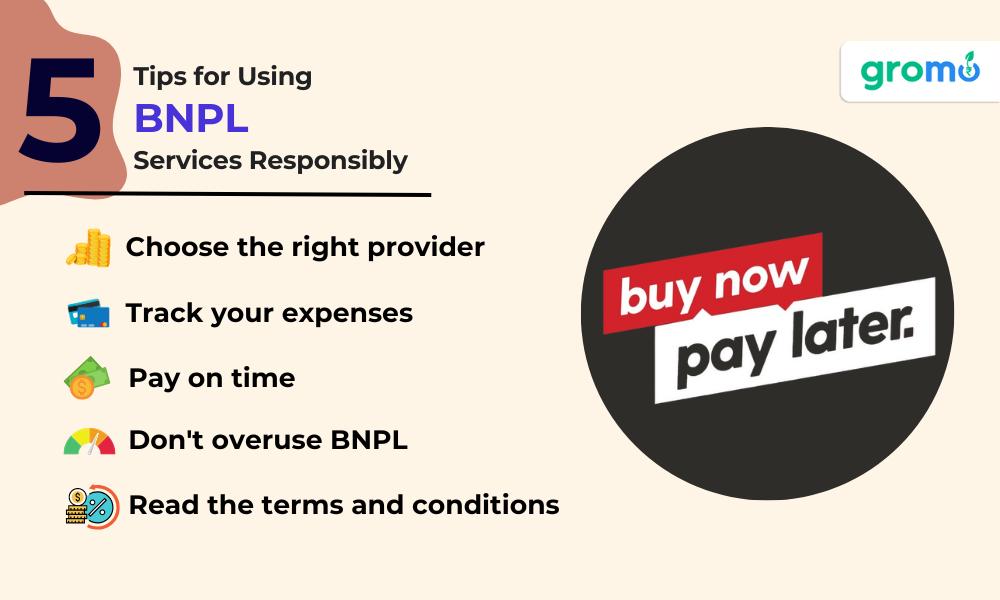

Using BNPL services can be a good option for customers who want to manage their finances effectively, but it is important to use these services responsibly.

Here are some tips for using BNPL services responsibly:

-

Understand the terms and conditions - Before using a Buy now pay later India service, make sure you understand the fees, interest rates, and payment terms. Be aware of the consequences of missed payments or late payments.

-

Budget effectively - Before using a Buy now pay later India service, make sure you have a budget in place. Make sure you can afford to make the payments on time and avoid accumulating debt.

-

Use BNPL services for necessary purchases - Use BNPL services for necessary purchases, such as medical bills or home repairs. Avoid using BNPL services for luxury items or non-essential purchases.

-

Avoid multiple BNPL services - Avoid using multiple BNPL services at the same time. Using multiple BNPL services can make it difficult to keep track of payments and can lead to debt.

-

Pay on time - Make sure you make payments on time to avoid late fees and penalties. Late payments can negatively impact your credit score.

Buy now pay later India services are a convenient and flexible payment option for customers, but it is important to use these services responsibly. Customers should understand the terms and conditions, budget effectively, use BNPL services for necessary purchases, avoid multiple BNPL services, and make payments on time.

By following these tips, customers can use BNPL services effectively and avoid accumulating debt.

Now let's take a look at some of the popular BNPL apps in India:

Buy now pay later India

-

Simpl - Simpl is a popular BNPL app in India that allows users to make purchases and pay later in monthly installments. Simpl offers a credit limit of up to Rs. 5,000 and charges interest rates of 1.5% per month.

-

ZestMoney - ZestMoney is a BNPL app that partners with various e-commerce websites to offer users the option to pay in monthly installments. ZestMoney offers credit limits of up to Rs. 5,00,000 and charges interest rates ranging from 0% to 30% per annum.

-

LazyPay - LazyPay is a BNPL app that allows users to pay for their purchases in monthly installments. LazyPay offers credit limits of up to Rs. 1,00,000 and charges interest rates ranging from 15% to 28% per annum.

-

Paytm Postpaid - Paytm Postpaid is a BNPL service that allows users to pay for their purchases on Paytm in monthly installments. Paytm Postpaid offers credit limits of up to Rs. 1,00,000 and charges interest rates ranging from 0% to 3% per month.

-

Amazon Pay Later - Amazon Pay Later is a BNPL service offered by Amazon India that allows users to make purchases on Amazon and pay later in monthly installments. Amazon Pay Later offers credit limits of up to Rs. 60,000 and charges interest rates ranging from 0% to 18% per annum.

Despite these risks, BNPL services can still be a valuable payment option for customers who use them responsibly.

Here are some tips to help you use Buy now pay later services responsibly:

-

Read the Terms and Conditions - Before using a BNPL service, make sure you read the terms and conditions carefully to understand the interest rates, fees, and payment options.

-

Plan Your Payments - Plan your payments in advance and make sure you have enough funds to make your payments on time to avoid late fees and interest charges.

-

Stick to Your Budget - Avoid overspending by sticking to your budget and only using Buy now pay later India services for purchases that you can afford to pay back.

-

Monitor Your Credit Score - Regularly check your credit score to ensure that your use of BNPL services is not negatively impacting your credit history.

-

Use Multiple Payment Options - Consider using multiple payment options, such as credit cards and debit cards, in addition to BNPL services to ensure that you have a variety of payment options available to you.

In summary, while Buy now pay later India services have become increasingly popular among customers worldwide, it is important to use them responsibly and understand the risks associated with them. By following the tips outlined above, you can enjoy the benefits of BNPL services while minimizing the risks.

Now that we have discussed the benefits and risks of BNPL services, let's take a closer look at some of the best BNPL apps and companies available on the market today.

1- GroMo- is building India's largest financial products distribution company. GroMo has built a network of 1.2 million agents on its platform. GroMo has built a tech-enabled social commerce platform that helps agents not only improve access to better financial products for consumers, but also bridge the financial literacy gap by helping them choose the right offerings.

-

Afterpay - Afterpay is one of the most popular BNPL services, with over 16 million customers worldwide. Afterpay allows customers to split their payments into four equal installments, with no interest or fees if payments are made on time. Afterpay is available at over 86,000 retailers worldwide, including major brands like Nike, Sephora, and Target.

-

Klarna - Klarna is another popular Buy now pay later India service, with over 90 million customers worldwide. Klarna offers a variety of payment options, including interest-free financing and pay later options, depending on the retailer. Klarna is available at over 250,000 retailers worldwide, including H&M, IKEA, and Adidas.

-

Affirm - Affirm is a BNPL service that offers flexible payment options, including three, six, and twelve-month payment plans. Affirm offers interest rates ranging from 0% to 30% APR, depending on the retailer and payment plan. Affirm is available at over 6,000 retailers, including Walmart, Peloton, and Expedia.

-

Quadpay - Quadpay is a BNPL service that allows customers to split their payments into four interest-free installments. Quadpay is available at over 4,500 retailers, including Amazon, Apple, and Walmart.

-

Zip - Zip is a Buy now later India service based in Australia that offers flexible payment options, including interest-free financing and pay later options. Zip is available at over 34,000 retailers in Australia, including major brands like The Iconic, Kmart, and Bunnings.

In addition to these popular BNPL services, there are many other companies and apps available on the market today, including Sezzle, Splitit, Laybuy, and more. Customers should do their research and compare the terms and conditions of each service to determine which one is right for them.

In conclusion, BNPL services offer customers a flexible and convenient payment option that can help them manage their finances and make purchases they may not be able to afford upfront. While there are some risks associated with BNPL services, by using them responsibly and following the tips outlined above, customers can enjoy the benefits of Buy now pay later services while minimizing the risks.

Go check out-

Some of the key factors that can impact the success of a Buy now pay later service:

-

Interest rates and fees - One of the most important factors to consider when choosing a Buy now pay later service is the interest rates and fees associated with the service. Some BNPL services offer interest-free financing, while others may charge high-interest rates or fees for missed payments or late payments. Customers should carefully review the terms and conditions of each service to determine the costs and risks associated with using the service.

-

Availability - Another important factor to consider is the availability of the BNPL service. Some Buy now pay later services are only available at certain retailers or in certain countries, while others may be available at a wide range of retailers and locations. Customers should ensure that the BNPL service they choose is available at the retailers they frequent and in the countries where they shop.

-

Ease of use - The ease of use of the Buy now pay later service can also impact its success. Customers should look for services that are easy to set up and use, with clear instructions and a user-friendly interface. Customers should also ensure that the service integrates well with the retailers they frequent, making it easy to use the service when making purchases.

-

Customer service - Customer service is another important factor to consider when choosing a BNPL service. Customers should look for services that offer responsive and helpful customer service, with multiple channels for contacting the service in case of issues or questions.

-

Reputation - Finally, the reputation of the Buy now pay later service is an important factor to consider. Customers should research the company behind the service and look for reviews and ratings from other customers. Services with a good reputation for customer service, transparency, and fair practices are likely to be more successful and trustworthy than those with a poor reputation.

Key Takeaways

-

Advantages of using BNPL services for consumers include increased flexibility in making purchases, the ability to spread out payments over time, and potentially lower costs compared to using traditional credit cards or loans.

-

However, there are also disadvantages to using BNPL services, including the potential for consumers to accumulate more debt than they can manage, the risk of high-interest rates and fees, and the potential for overspending.

-

It's important for consumers to carefully consider the terms and conditions of any Buy now pay later service they are considering using, including interest rates, fees, and repayment schedules.

-

Consumers should also be aware of their own financial situation and ability to repay any debts incurred through BNPL services before deciding whether to use them.

-

Additionally, consumers should be aware that using Buy now pay later india services may have an impact on their credit score, as missed payments or defaulting on payments could lead to negative marks on their credit report.