GroMo Support: All Your Support Queries Answered

GroMo is a financial services application using which you can earn money online. In this blog, you will find answers to all your support queries.

GroMo is a fintech mobile platform that enables GroMo Partners (its users) to earn money online by selling financial products. The company was founded in 2019 by Ankit Khandelwal and Darpan Khurana and is headquartered in Gurugram, India.

GroMo offers a wide range of financial products, including Demat accounts, loans, credit cards, and more. The GroMo Partners can sell these products to their customers through the GroMo app. GroMo also offers a variety of training and support resources to help GroMo Partners succeed.

As a GroMo Partner, you may have questions about the GroMo app or the products that you are selling. GroMo has a dedicated support team that is available to answer your questions and help you resolve any issues.

In this blog, we will discuss some of the most common support queries that GroMo Partners have. Along with this, we will also provide you with the solutions to these issues.

But before we dive deeper, if you want to earn a #PakkiIncome by selling financial products like Credit Cards, Demat Accounts, etc., then Download the GroMo App now!

In this blog, we will talk about how you can solve payout-related issues, how you can find relevant customers, what to do if a customer's application gets rejected, and much more. All to help you sell more and earn a #PakkiIncome every month!

So, let's get started!

How To Solve Payout-Related Issues On GroMo App?

GroMo always gives payout on time. As soon as the sale is successful, GroMo Partners can transfer their payout to their banks immediately. However, there are some cases where the brands might take a little more time to verify the sales and mark it as successful.

Even in cases like these, the maximum time frame in which a sale is marked as successful is 10-12 business days. If your payout is delayed for more than 10-12 business days, the first thing you should do is go on your GroMo app and 'Raise A Dispute'. Then upload all the documents or information required for raising a dispute so that your case can be verified correctly.

If you don't provide all the required documents or give the wrong information while raising a dispute, then your request won't be logged in for further investigation. To avoid this situation, keep a record of all your customers, the products sold to them, and the documents required.

Also, if you haven't got your payout for a product that had two Key Performance Indicators (KPIs), make sure you've fulfilled both the KPIs before raising a dispute. An example of these KPIs is: Account Opening or 1st Trade.

Some products would require you to get the 1st trade done from the customer too, so that you can get your complete payout. If you are unable to get the 2nd KPI fulfilled, then you will only receive money as per the 1st KPI. And in this case, your dispute request won't be taken into consideration for payout.

So, if you have all the correct reasons to Raise A Dispute and provide all the required information & documents, GroMo encourages you to Raise A Dispute and reach out to GroMo's customer support team.

After this, GroMo will thoroughly check your case and give you an update on the same within 7 business days. After 7 business days of raising the dispute, if your payout is still delayed, you can contact GroMo's support team. GroMo's support team will be able to investigate the issue and help you resolve it.

Also Check Out:

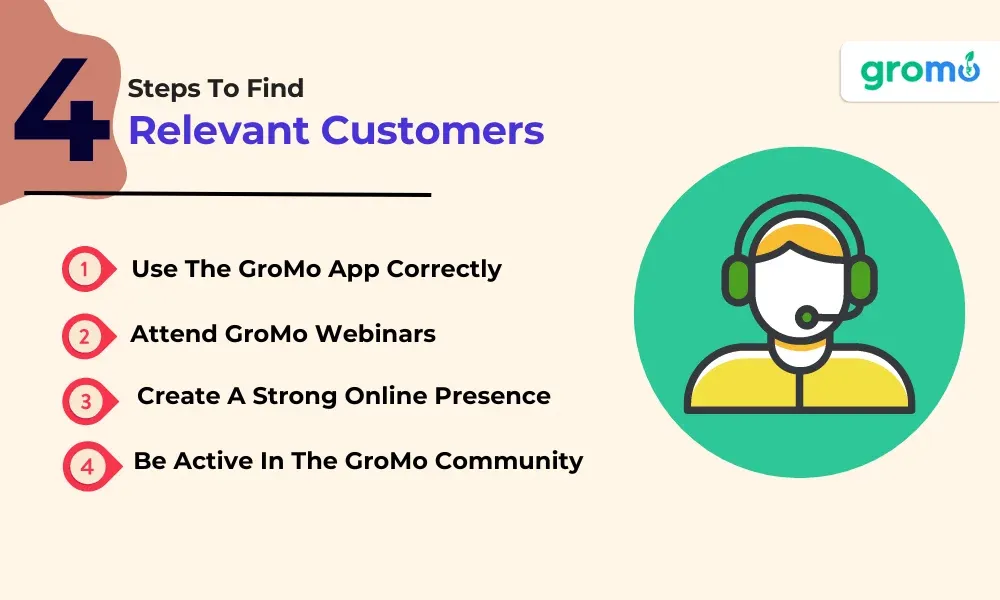

How To Find Relevant Customers?

If you are not getting any customers for selling financial products through the GroMo app, there are a few things you can do to find more customers.

1. Use The GroMo App Correctly

Make sure that you are using the GroMo app correctly. The GroMo app has several features that can help you find customers, such as the 'Share with Customer' section and the refer & earn program.

Share the posters available in the 'Share with Customer' section on your social media accounts and WhatsApp groups to get relevant customers from there. Also, use the refer & earn program to refer the GroMo app to other people and at the same time, network with them to get more customers.

2. Attend GroMo Training & Webinars

Start attending GroMo training and webinars. GroMo hosts many training and webinars every day. These training and webinars are a great way to learn how to find potential customers and learn more about using the GroMo app to its full potential.

Be a life-long learner because the financial services industry is constantly changing. Make sure that you are continuing to learn and grow so that you can stay ahead of the curve. Know about the financial products that you are selling to your customers.

Make sure that you understand the products and services that you are selling so that you can answer your customers' questions and help them make the best decision for their needs.

3. Create A Strong Online Presence

Make sure that your website and social media profiles are up-to-date and that you are actively promoting your GroMo business. You can also connect with other GroMo Partners on social media.

4. Be Active In The GroMo Community

GroMo has an online community on Telegram where you can stay connected with GroMo. Join GroMo's Telegram community and stay up-to-date on the latest GroMo news. GroMo regularly releases new products & features and sends updates about the same on its Telegram Community.

Make sure that you are staying up-to-date on these changes so that you can continue to provide your customers with the best possible service. To do so, you can also follow GroMo on Facebook, Instagram, and LinkedIn or join GroMo's WhatsApp Channel.

5. Offer Value-added Services

Go above and beyond to help your customers. This could include providing financial advice or simply being a friendly and helpful person to talk to. Be passionate about financial services. If you are passionate about financial services, it will show in your interactions with your customers.

Your passion will help to build trust and rapport with your customers, and it will make them more likely to do business with you. And be persistent. To ensure a #PakkiIncome, you have to give things enough time while continuing to make consistent efforts.

Remember that results don't come overnight, so you have to just keep going and not give up!

Keep working hard and eventually, you will achieve your goals. By following these tips, you can become a Top GroMo Partner and also grow your business.

What If Customer's Application Get's Rejected?

There are a few reasons why a customer's credit card application may get rejected.

1. Incomplete Application

The customer may not have provided all of the required information. Make sure that your customers are aware of all of the required information and that they have provided all the correct information.

2. Loans From Multiple Lenders

If the customer already has loans from multiple lenders, then this can lead to their application getting rejected. If this is the case, you can help the customer improve their credit score by providing them with financial advice or by connecting them with a credit counselor.

3. History Of Late Payments

The customer may have a history of late payments. If this is the case, you can help the customer improve their financial habits by providing them with financial advice or by connecting them with a financial coach.

If a customer's application is rejected, you can contact GroMo's support team. Our support team will provide you with more information about the reason for the rejection, and they will also help you resolve the issue.

If you are looking for a platform where you can learn how to become a financial expert and sell financial products at the same time, then GroMo is the answer!

So, download the GroMo App now!

How To Do Video KYC For Financial Products?

Video KYC (Know Your Customer) is a process that financial brands use to verify the identity of their customers. The video KYC process is simple and easy to follow.

To complete the video KYC process, you will need to provide your name, date of birth, mobile number, and PAN Card. You will also be asked to sign on a blank paper in real-time in front of the camera. Make sure that you provide all of this information correctly during the video KYC process.

Prepare yourself beforehand. Do not lie or provide inaccurate information.

Also Check Out:

What To Do If Credit Card Delivery Is Delayed?

There are a few reasons why a credit card delivery may get delayed:

1. Incorrect Address

The customer may have provided an incorrect address. Make sure that the customer has double-checked their address. You can also contact GroMo's support team if there is a problem.

2. Not Eligible For Credit Card

The customer may not have been eligible for the credit card. If this is the case, you can check the status of their application on the GroMo app.

3. Lost In The Mail

The credit card may have been lost in the mail. If this is the case, the GroMo Partner should contact GroMo's support team and they will help the GroMo Partner in solving the issue.

The average time it takes for a credit card to be delivered is 7-10 business days. However, there may be some cases where it takes longer. If it has been more than 10 business days and the customer has not received their credit card, you should contact GroMo's support team.

GroMo's support team will investigate the issue and help the GroMo Partner in resolving it.

These are just some of the most common support queries that GroMo Partners have. If you have a question or issue that is not covered in this blog, you can contact GroMo's support team. GroMo's support team is available 24/7 to help you resolve any issues that you may have.

Additional Tips

1. Be Patient: It may take some time to resolve your issue.

2. Be Polite: GroMo's support team is here to help you, so be respectful to the representatives that you speak to.

3. Keep Records: Keep a record of all of your sales done through the GroMo App, including customers' emails, chat transcripts, and phone calls. This will help you if you need to refer back to the issue at a later date.

Key Takeaways

- Contact GroMo's customer support team if you don't get your payout in 10-12 business days.

- Learn to use the GroMo app correctly and attend GroMo's training and webinars to find relevant customers.

- If a customer's application gets rejected, make sure that their application is complete and that they don't have loans from multiple lenders.

- For successful KYC, make sure that you are providing all the information correctly.

- If a customer's credit card delivery is delayed, make sure that the customer's address is correct and that they are eligible for it.

The information provided by us on our website or App ("Platform") is for general informational purposes only and is provided in good faith, however, we make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of any information on the Site or our mobile application.