Health Insurance: What Is Health Insurance?

Health insurance is one of the most important personal finances, as it provides financial assistance in the event of a medical emergency.

Health insurance is an important aspect of personal finance, providing financial support in case of medical emergencies. With the rising cost of healthcare services, it has become essential to have health insurance in India.

In this article, we will cover everything you need to know about health insurance, including the top insurance providers, their plans, and the factors to consider while buying health insurance in India.

In this comprehensive guide, we will delve into the intricacies of health insurance, helping you understand its importance, how it works, key terminologies, and tips for selecting the right coverage.

Whether you're a newcomer to the world of health insurance or seeking to enhance your existing coverage, this guide will equip you with the knowledge needed to make informed decisions about your healthcare.

Health Insurance Providers in India

Several insurance providers offer health insurance plans in India. Some of the top health insurance providers in India are:

- Star Health Insurance

- Care Health Insurance

- Aditya Birla Health Insurance

- HDFC Ergo Health Insurance

- ICICI Lombard Health Insurance

- Tata AIG Health Insurance

- Niva Bupa Health Insurance

- Manipal Cigna Health Insurance

- SBI Health Insurance

- Bajaj Allianz Health Insurance

You can get access to many more banks in the GroMo app, where you can sell other financial products as well and earn with every sale.

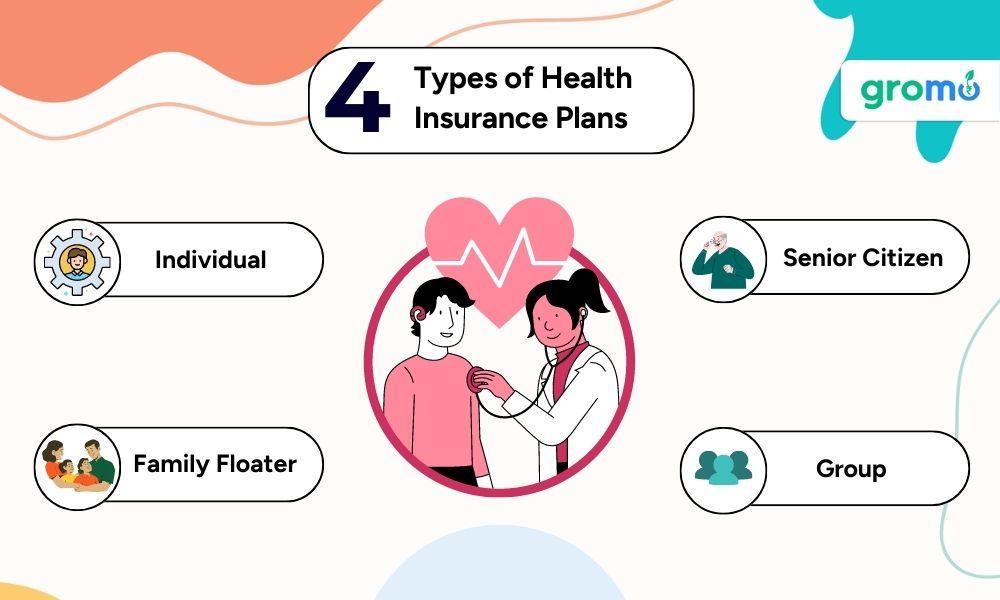

Types of Health Insurance Plans

Health insurance plans in India can be broadly classified into the following categories:

1. Individual Health Insurance Plans

Individual health insurance plans provide coverage to an individual. The premium for an individual health insurance plan is based on the age, health condition, and medical history of the insured person.

2. Family Floater Health Insurance Plans

A family floater is a type of health insurance plan that covers the whole family in one policy. The premium for a family floater health insurance plan is based on the age of the eldest member of the family.

3. Senior Citizen Health Insurance Plans

Senior citizen health insurance plans provide coverage to individuals above the age of 60 years. The premium for a senior citizen health insurance plan is higher compared to other health insurance plans due to the higher risk of medical emergencies.

4. Group Health Insurance Plans

Group health insurance plans provide coverage to a group of individuals, such as employees of a company or members of a society. The premium for a group health insurance plan is lower compared to individual health insurance plans.

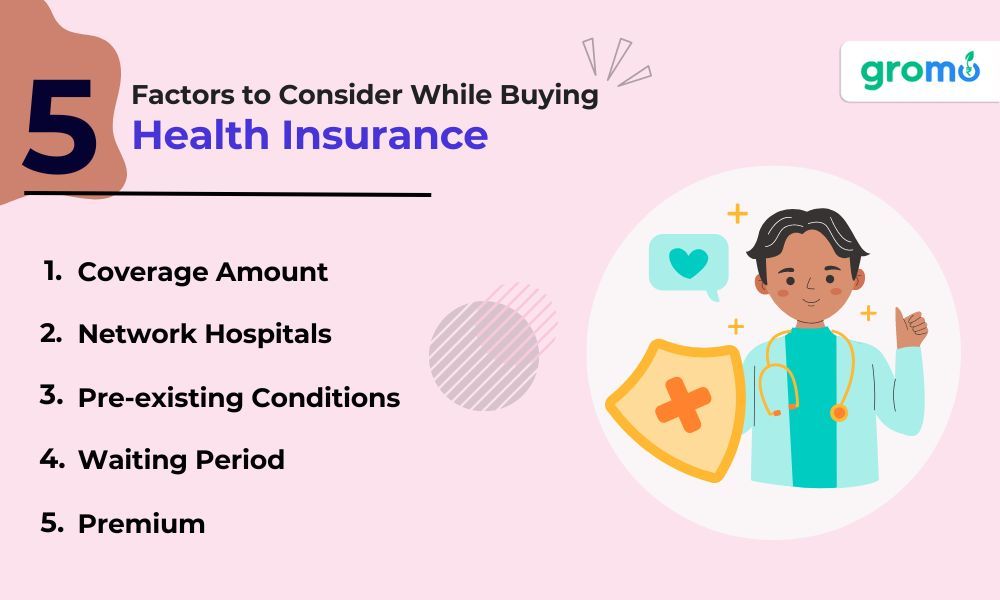

Factors to Consider While Buying Health Insurance

Before buying a health insurance plan in India, there are several factors to consider. These include:

1. Coverage Amount

The coverage amount or sum assured is the maximum amount that the insurance provider will pay in case of a medical emergency. It is essential to choose a coverage amount that is sufficient to cover the cost of medical treatment in case of a medical emergency.

2. Network Hospitals

Insurance providers have tie-ups with network hospitals, where the insured person can avail cashless treatment. It is important to choose an insurance provider with a wide network of hospitals to ensure that the insured person can avail cashless treatment in case of a medical emergency.

3. Pre-existing Conditions

Pre-existing conditions refer to medical conditions that the insured person had before buying the health insurance plan. It is important to choose an insurance provider that covers pre-existing conditions to ensure that the insured person is not denied coverage in case of a medical emergency related to the pre-existing condition.

4. Waiting Period

The waiting period is the period during which the insured person cannot claim certain medical conditions. It is important to choose an insurance provider with a shorter waiting period to ensure that the insured person can make a claim as soon as possible in case of a medical emergency.

5. Premium

The premium is the amount that the insured person pays to the insurance provider for the health insurance plan. It is important to choose a health insurance plan with a premium that is affordable and within the budget of the insured person.

ALSO CHECK OUT:

- How To Buy The Best Health Insurance In India

- How Can Financial Advisors Help You To Get The Best Health Insurance?

- Top Providers of Health Insurance: 16 Providers In India

- Need Guidance In Buying Health Insurance - GroMo Might Be The Solution

Best Health Insurance Plans in India

The following are some of the best health insurance plans in India:

Star Health Insurance

Star Health Insurance offers a wide range of health insurance plans, including individual health insurance plans, family floater health insurance plans, and senior citizen health insurance plans.

Care Health Insurance

Care Health Insurance offers health insurance plans with a coverage amount of up to Rs. 6 crore. The plans also offer coverage for alternative treatments such as Ayurveda, Unani, and Siddha.

Aditya Birla Health Insurance

Aditya Birla Health Insurance offers health insurance plans with a coverage amount of up to Rs. 2 crore. The plans also offer coverage for mental health treatments.

HDFC Ergo Health Insurance

HDFC Ergo Health Insurance offers health insurance plans with a coverage amount of up to Rs. 1 crore. The plans also offer coverage for organ donor expenses.

ICICI Lombard Health Insurance

ICICI Lombard Health Insurance offers health insurance plans with a coverage amount of up to Rs. 1 crore. The plans also offer coverage for international treatments and emergency medical evacuation.

Tata AIG Health Insurance

Tata AIG Health Insurance offers health insurance plans with a coverage amount of up to Rs. 1 crore. The plans also offer coverage for critical illnesses and daycare procedures.

Niva Bupa Health Insurance

Niva Bupa Health Insurance offers health insurance plans with a coverage amount of up to Rs. 3 crore. The plans also offer coverage for maternity and newborn baby expenses.

Manipal Cigna Health Insurance

Manipal Cigna Health Insurance offers health insurance plans with a coverage amount of up to Rs. 1 crore. The plans also offer coverage for alternative treatments such as Ayurveda, Unani, and Siddha.

SBI Health Insurance

SBI Health Insurance is one of the leading health insurance providers in India, offering a wide range of health insurance plans to suit the needs of individuals and families. SBI Health Insurance plans offer coverage amounts of up to Rs. 1 crore, and also cover critical illnesses and daycare procedures.

Bajaj Allianz Health Insurance

Bajaj Allianz Health Insurance offers health insurance plans with a coverage amount of up to Rs. 1 crore. The plans also offer coverage for critical illnesses and daycare procedures.

In today's fast-paced and unpredictable world, maintaining good health is of paramount importance. However, unexpected illnesses and medical emergencies can be financially devastating without the protection of health insurance.

Health insurance provides individuals and families with the peace of mind that comes with knowing they have access to quality healthcare without shouldering the burden of exorbitant medical expenses.

Health insurance serves as a vital safeguard against the ever-increasing cost of medical care. It offers financial protection by covering a significant portion of medical expenses, including doctor visits, hospital stays, surgeries, prescription medications, and preventive services.

By having health insurance, individuals can receive timely and appropriate medical care, leading to better health outcomes.

One of the primary benefits of health insurance is its ability to mitigate the financial risk associated with unexpected medical emergencies. Without insurance, even a minor injury or illness can result in substantial medical bills that may plunge individuals into debt or force them to forgo necessary treatment.

Health insurance acts as a safety net, providing access to a wide range of healthcare services and reducing the financial burden on individuals and families.

Understanding How Health Insurance Works

To comprehend health insurance fully, it's crucial to understand the key concepts and mechanisms involved. Health insurance operates on the principle of risk pooling, where a large number of individuals contribute premiums into a collective fund.

This fund is then used to cover the medical expenses of those insured.

It's important to understand common health insurance terminologies such as premiums, deductibles, copayments, and coinsurance. Premiums are the regular payments made to the insurance provider to maintain coverage.

Deductibles represent the amount individuals must pay out of pocket before insurance coverage kicks in.

Copayments are fixed amounts paid at the time of receiving specific services, while coinsurance refers to the percentage individuals are responsible for paying after reaching their deductible.

Also Check Out:

- How To Become A GroMo Insure Agent And Sell Insurance Online To Earn Money?

- What Is A POSP?

- EMI: What Is EMI (Equated Monthly Instalment)?

- Zero Investment Business: GroMo Is The Answer

Selecting the Right Health Insurance Coverage

Choosing the right health insurance coverage requires careful consideration of individual needs and priorities. Start by evaluating your healthcare requirements, including existing medical conditions, prescription medications, and anticipated medical needs.

Take a look at your budget and figure out how much of a premium you can afford.

Consider the network of healthcare providers offered by each plan. Ensure that your preferred doctors, hospitals, and specialists are within the network to avoid higher out-of-pocket costs.

Additionally, review the coverage provided for prescription medications and any limitations or restrictions on specific treatments or services.

Compare the different plans' cost-sharing features, such as deductibles, copayments, and coinsurance. Determine the level of financial risk you are comfortable assuming and choose a plan that strikes the right balance between premiums and out-of-pocket costs.

Research the insurance provider's reputation and customer satisfaction ratings. Look for reviews and ratings from existing policyholders to gauge their overall satisfaction with the insurance company's services.

A reputable and reliable insurance provider will offer prompt claims processing, efficient customer service, and a wide network of healthcare providers.

Another essential factor to consider is the plan's coverage for preventive care and wellness programs. Many health insurance plans now include preventive services such as vaccinations, screenings, and annual check-ups at no additional cost.

Investing in preventive care can help detect health issues early on, leading to better health outcomes and potentially reducing long-term healthcare expenses.

When comparing different health insurance plans, carefully review the exclusions and limitations outlined in the policy documents. Some plans may have restrictions on pre-existing conditions, specific treatments, or coverage for certain procedures.

Understanding these limitations will help you avoid surprises when seeking medical care.

If you have dependent individuals, it is important to take into account their healthcare requirements. Family plans often provide coverage for spouses and children, and some plans may offer maternity benefits or pediatric care. Ensure that the plan adequately covers the medical requirements of all family members.

Lastly, take advantage of the resources available to assist you in making an informed decision. Utilize online comparison tools that allow you to compare different plans side by side, considering factors such as coverage, premiums, and out-of-pocket costs.

Additionally, seek guidance from insurance brokers or consult with healthcare professionals who can offer insights into the specific coverage options that align with your needs.

Health insurance is an invaluable asset that provides financial protection and access to quality healthcare. By understanding the importance of health insurance, how it works, and how to choose the right coverage, individuals can make informed decisions about their healthcare needs.

Remember to assess your requirements, compare plans, review networks, consider costs, and evaluate the reputation of insurance providers.

Taking the time to research and select the right health insurance coverage will provide you and your loved ones with the peace of mind that comes with knowing you are protected in times of medical need.

Prioritize your health by investing in a comprehensive health insurance plan, and safeguard your financial well-being against unexpected medical expenses.

To get access to many more financial products that you can sell and earn up to ₹1 Lakh every month, check the GroMo app today.

KEY TAKEAWAYS

-

Health insurance is a vital investment that can help you manage your health insurance expenses and provide financial security.

-

There are various types of health insurance plans available in India, including individual, family floater, and senior citizen plans.

-

It is important to compare and choose a plan that offers adequate coverage & benefits and also meets your specific health insurance needs.

-

Some of the top health insurance providers in India include Star Health Insurance, Care Health Insurance, and Aditya Birla Health Insurance.

-

You should also focus on maintaining a healthy lifestyle to reduce the likelihood of health problems and the need for medical treatment.

GroMo Insure - A brand of Vitrak Insurance Brokers Private Limited

IRDAI Regn. No. 826