Instant Loan Terms And Definitions: Exhaustive List

Introduction Instant loans, as the name suggests, are loan products designed to provide quick financial relief to borrowers.

Introduction

Instant loans, as the name suggests, are loan products designed to provide quick financial relief to borrowers. They come in various forms and are offered by different types of lenders, including banks, non-banking financial companies (NBFCs), and online lenders.

What are Instant Loans?

Instant loans are types of unsecured loans where the application, approval, and disbursal process is significantly quicker than traditional loans. They are typically used to address urgent financial needs. The advent of technology has made it possible for instant loan transactions to be conducted entirely online, offering convenience, speed, and a paperless environment.

Key Terms Related to Instant Loans

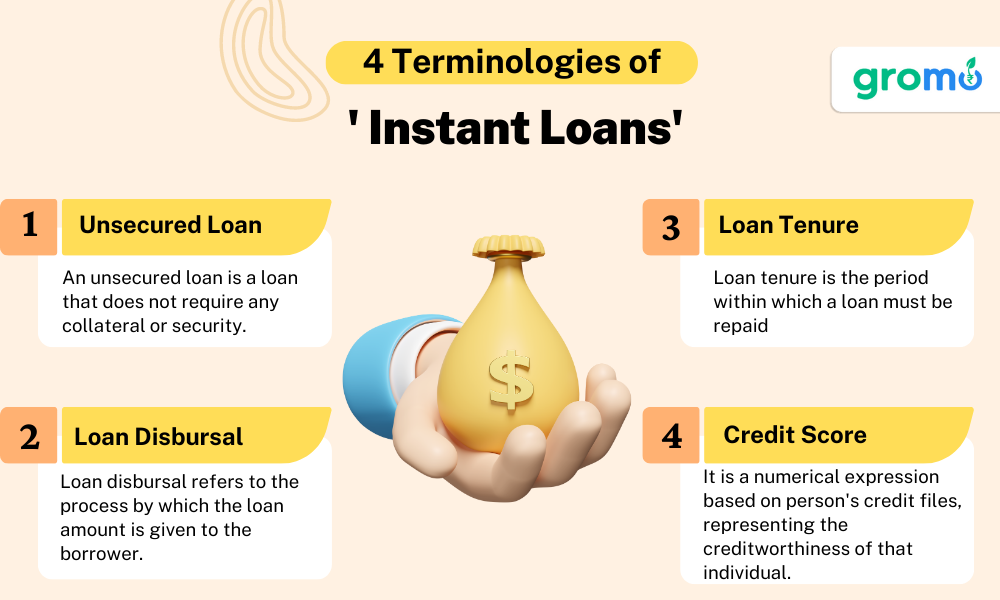

1. Unsecured Loan

An unsecured loan is a loan that does not require any collateral or security. Instant loans fall under this category, as they are typically granted based on the borrower's creditworthiness rather than any asset they can provide as security.

2. Loan Disbursal

Loan disbursal refers to the process by which the loan amount is given to the borrower. In the case of instant loans, this process is swift, and borrowers can expect to receive funds in their account within a few hours of approval.

3. Loan Tenure

Loan tenure is the period within which a loan must be repaid. Instant loans typically have shorter tenures, ranging from a few weeks to a few months, although some lenders may offer longer repayment periods.

4. Credit Score

A credit score is a numerical expression based on an analysis of a person's credit files, representing the creditworthiness of that individual. A high credit score can increase the chances of an instant loan application being approved.

5. Interest Rate

The interest rate is the amount charged by the lender to the borrower for the loan and is typically expressed as a percentage of the principal loan amount. Instant loans often have higher interest rates than conventional loans due to their unsecured nature.

Looking for an app for earning online? GroMo is your answer! Now earn with each sale by selling various kinds of financial products

6. EMI

EMI, or equated monthly installment, is the fixed payment amount made by a borrower to a lender at a specified date each calendar month. EMIs are used to pay off both interest and principal each month, so that over a specified loan tenure, the loan is fully paid off.

7. Loan Agreement

A loan agreement is a contract between the borrower and the lender which lays down the terms and conditions of the loan. It includes information about the loan amount, interest rate, repayment schedule, and other relevant details.

8. Prepayment

Prepayment refers to repaying a loan in part or in full before its due date. Some lenders may allow prepayment of instant loans without any penalty, while others may charge a fee for the same.

9. Loan Repayment

Loan repayment is the act of paying back the money borrowed from the lender, typically in the form of EMIs over the agreed loan tenure.

10. Default

Default refers to the failure of the borrower to repay the loan as per the terms and conditions laid out in the loan agreement. Defaulting on a loan can lead to serious consequences, including a negative impact on the borrower's credit score.

Instant loans can be a valuable financial tool when used wisely. By understanding the key terms related to instant loans, borrowers can make more informed decisions and navigate the loan process with greater confidence.

Whether it's meeting an urgent expense or dealing with a financial emergency, instant loans can provide quick and convenient financial relief. However, it's always advisable to read the fine print and understand all the terms and conditions before borrowing.

After all, being informed is the first step towards making the best financial decisions for your unique situation.

Common Types of Instant Loans

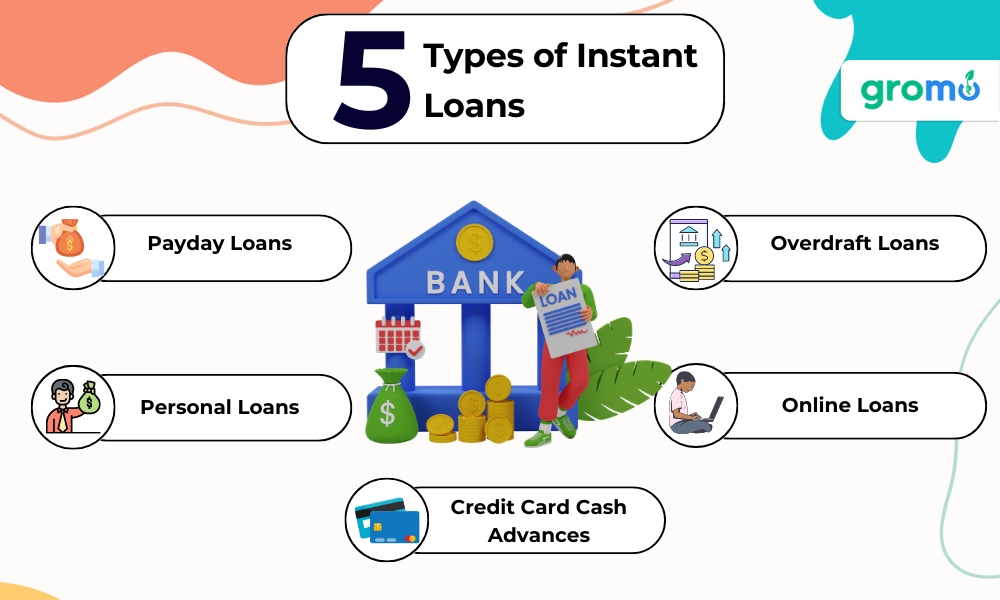

1. Payday Loans

Payday loans are a type of short-term unsecured loan that is typically due on the borrower's next payday. These loans are characterized by their high-interest rates and are intended to cover unexpected expenses until the next wage arrives.

2. Personal Loans

Personal loans are versatile unsecured loans that can be used for a variety of purposes, such as medical emergencies, travel, home renovations, debt consolidation, etc. Some lenders offer instant personal loans, where approval and disbursal can happen within a few hours.

3. Credit Card Cash Advances

A credit card cash advance is a type of instant loan where the borrower can withdraw cash up to a certain limit through their credit card. The interest begins to accrue immediately, and the interest rates are usually higher than regular credit card purchases.

4. Overdraft Loans

An overdraft loan allows you to withdraw money from your bank account, even if your account balance is zero. The bank or financial institution charges an interest rate on the overdrawn amount.

5. Online Loans

Online loans are offered by digital platforms or online lenders. The entire process from loan application to loan disbursal happens online, offering high convenience and quick processing times.

Factors Affecting Instant Loan Approval

Understanding the factors that can impact the approval of your instant loan application can help you increase your chances of approval and secure better terms on your loan.

1. Credit Score

As mentioned, your credit score plays a crucial role in your instant loan approval. A higher credit score not only increases the chance of your loan getting approved but can also fetch you a lower interest rate.

2. Income Level

Your income level and stability of income are other significant factors. Lenders need assurance that you have a steady income source to repay the loan.

3. Debt-to-Income Ratio

The debt-to-income ratio is the percentage of your monthly income that goes towards paying debts. A lower debt-to-income ratio increases your chances of securing an instant loan.

4. Employment Status

Your employment status and the length of service also matter. Being employed with a reputed organization for a considerable period gives lenders more confidence in your loan repayment ability.

5. Loan Amount and Tenure

The amount you wish to borrow and the repayment periodhttps://www.gromo.in/blog/job-loss-meaning you choose can also influence the approval of your loan application. A smaller loan amount and shorter tenure might increase the chances of loan approval.

CHECK OUT!!

- Job Loss Insurance Meaning: Financial Planning Tips

- Difference Between Insurance and Investment: Explained

- How To Get Instant Loans: Step By Step Guide

- Health Insurance Meaning: An Essential Financial Safety Net

Risks and Responsibilities Associated with Instant Loans

While instant loans provide quick access to funds, they come with certain responsibilities and risks:

1. Higher Interest Rates

Instant loans typically carry higher interest rates than other types of loans. This is mainly due to the risk lenders undertake, as they approve loans quickly without collateral.

2. Impact on Credit Score

Failing to repay the loan on time can negatively impact your credit score. A low credit score can make it difficult for you to avail of credit facilities in the future.

3. Debt Trap

The easy availability of instant loans might lead some individuals into a debt trap, especially those who lack financial discipline.

4. Fees and Charges

Apart from the interest rate, instant loans may also involve other fees and charges, including processing fees, late payment penalties, prepayment charges, etc. It’s essential to be aware of all the associated costs before availing of an instant loan.

5. Loan Agreement Terms and Conditions

The loan agreement contains all the details of the loan, including the rate of interest, repayment tenure, penalties, etc. Ensure that you thoroughly read and understand the terms and conditions before signing the agreement.

Instant loans are an excellent way to address your immediate

financial needs. But, like any financial product, they should be availed responsibly, after considering your repayment capacity and understanding all the terms and conditions involved.

Advantages and Disadvantages of Instant Loans

Just like any other financial products, instant loans also have their pros and cons. Understanding these can help you make a more informed decision.

Advantages

Quick Access to Funds: As the name suggests, one of the primary advantages of instant loans is the speed at which the funds are disbursed. This makes them an ideal choice for dealing with emergencies.

Easy Application Process: The application process for instant loans is typically simple and can be done online. This can save you a lot of time and effort.

No Collateral Required: Most instant loans are unsecured, meaning they do not require any collateral. This is beneficial if you do not have any assets to pledge.

Flexible Usage: Instant loans do not have restrictions on their use. You can use the funds for any purpose, from paying medical bills to funding a vacation.

Disadvantages

High Interest Rates: As mentioned before, instant loans generally come with high interest rates. This is because the lenders are taking on a higher risk by providing loans without collateral and with speedy approval.

Can Lead to a Debt Trap: Easy availability and instant disbursal of loans can lead to impulsive borrowing. This can eventually lead to a debt trap, especially for those with poor financial discipline.

Fees and Charges: In addition to the interest rates, there can also be various fees and charges associated with instant loans. These can include processing fees, prepayment charges, and late payment penalties, among others.

Impact on Credit Score: If not managed properly, instant loans can negatively impact your credit score. Late payments or defaults on the loan will reflect poorly on your credit history, making it harder for you to secure credit in the future.

While instant loans can be a boon in times of financial distress, they should be availed responsibly. Be sure to understand all the terms and conditions associated with the loan and assess your repayment capacity before borrowing.

The Role of Instant Loans in Personal Finance

Instant loans play a crucial role in personal finance, offering a lifeline in times of emergencies. The quick access to funds can help deal with sudden expenses, be it medical emergencies, unexpected home repairs, or last-minute travel plans.

However, instant loans should be seen as a short-term solution and not a regular part of your financial planning. It's important to remember that these loans come with high interest rates, and relying on them frequently can lead to a debt trap.

Proper financial planning and maintaining an emergency fund are essential to avoid over-reliance on instant loans. Also, responsible borrowing, which involves borrowing only as much as you can repay and making timely repayments, is vital to maintain a healthy credit score and overall financial health.

In the end, instant loans, when used responsibly, can be a powerful tool to manage your finances. They provide the much-needed financial assistance when required and can help you navigate through difficult times. But, like all financial products, understanding its intricacies, advantages, disadvantages, and its role in your personal finance is important before you decide to borrow.

To sell this product, and many other financial products. DOWNLOAD GROMO. Where you can sell and earn a substantial income sitting at home.

Instant Loan Providers

There are numerous providers of instant loans in the market. These can be broadly classified into traditional banks, Non-Banking Financial Companies (NBFCs), and fintech companies.

Traditional Banks: Many traditional banks offer instant loans to their customers. These loans usually come with competitive interest rates, but the approval process may not be as quick as other providers.

Non-Banking Financial Companies (NBFCs): NBFCs often specialize in loans and may offer instant loans with less stringent eligibility criteria than traditional banks. However, the interest rates may be higher.

Fintech Companies: With the advancement of technology, several fintech companies now offer instant loans online. These companies usually have a quick approval process and require minimal paperwork. However, the interest rates can be quite high, and the loan amounts may be smaller compared to banks and NBFCs.

When choosing a provider, it is crucial to compare the interest rates, fees, loan amount, and the approval process to find the one that best fits your needs.

Role of Credit Score in Availing Instant Loans

A credit score plays a crucial role in availing of an instant loan. A higher credit score can make it easier for you to get approved for the loan and may also help you secure a lower interest rate. Here's why:

Risk Assessment: Lenders use credit scores to assess the risk associated with lending to you. A higher credit score indicates that you have a history of responsible credit behavior, making you a less risky borrower.

Loan Approval: A good credit score increases the chances of your loan application getting approved.

Interest Rates: Lenders may offer lower interest rates to borrowers with high credit scores, as they are considered less likely to default on the loan.

Loan Amount and Tenure: Your credit score can also influence the loan amount and the loan tenure. A higher credit score may allow you to borrow a larger amount and for a longer duration.

While a good credit score can ease the process of availing an instant loan, some lenders do offer loans to individuals with low credit scores. However, these loans may come with higher interest rates and stricter repayment terms.

Instant loans are an effective tool to manage unforeseen financial emergencies. However, like any financial product, they need to be used responsibly. Understanding your requirement, assessing your repayment capability, and reading the fine print are crucial before you avail of an instant loan.

ALSO CHECK OUT!!

- Demat Account Meaning: Meaning, Significance, and Other Key Details

- Buy Now Pay Later App: Popular Apps In India

- Instant Loan Meaning: A Comprehensive Guide to Related Terms

- Investment Products: A Comprehensive Guide

KEY TAKEAWAYS

-

Understanding Instant Loans: Instant loans, also known as payday loans or cash advances, are short-term unsecured loans provided to borrowers, usually processed and disbursed quickly. They serve as a financial tool to cater to urgent financial needs.

-

Components of Instant Loans: Instant loans comprise various elements such as the principal amount, interest rate, repayment schedule, and associated fees. Understanding these components is crucial before availing a loan.

-

Different Instant Loan Providers: The instant loan market consists of different types of providers including traditional banks, Non-Banking Financial Companies (NBFCs), and fintech companies. Each provider has unique advantages, with varying interest rates, approval processes, and loan amounts.

-

Credit Score’s Role: A credit score is an essential factor in the loan approval process. Higher scores generally indicate responsible credit behavior, potentially leading to easier loan approvals and lower interest rates.

-

Responsible Borrowing: Despite the ease of acquiring instant loans, they should be used responsibly. Properly assessing one’s requirement, understanding the repayment capability, and thoroughly reading the loan agreement is crucial before availing of such a loan.