Investment Products Terms And Definitions: Exhaustive List

Understanding Investment Products and Their Related Terms In the world of finance, a myriad of investment products, each possessing its unique features

Understanding Investment Products and Their Related Terms

In the world of finance, a myriad of investment products exist, each possessing its unique features, benefits, risks, and related terms. This comprehensive guide explores the meaning of investment products and the definitions of their associated terms.

Investment Products: A Closer Look

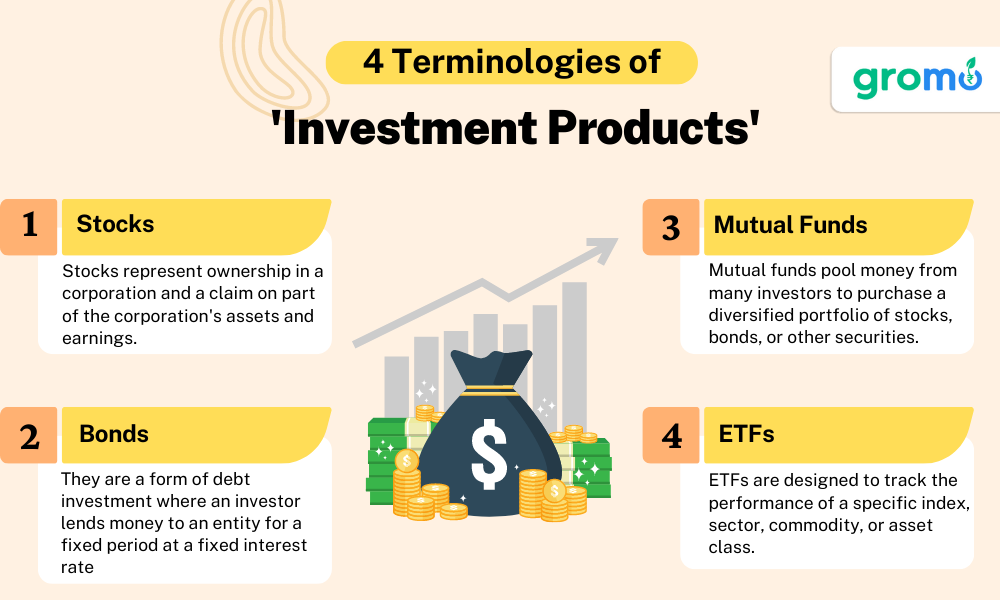

Investment products, also known as financial instruments or securities, are a type of financial contract between parties. They can take various forms such as stocks, bonds, mutual funds, and ETFs, serving as a means for investors to generate returns and achieve financial goals.

Associated Terms in the World of Investment

1. Stocks

Stocks, also known as shares or equities, represent ownership in a corporation and constitute a claim on part of the corporation's assets and earnings. Here are some related terms:

Dividend: A dividend is a portion of a company's earnings distributed to its shareholders, usually in the form of cash or additional shares.

Capital Gain: Capital gain refers to the increase in a stock's value from the time it was bought to the time it's sold.

2. Bonds

Bonds are a form of debt investment where an investor lends money to an entity (typically a corporation or government) that borrows the funds for a defined period at a fixed interest rate. Related terms include:

-

Coupon: In bond terminology, a coupon refers to the periodic interest payment that the bondholder receives during the life of the bond.

-

Maturity: Maturity is the date when the life of a bond ends and the principal is repaid to the investor.

3. Mutual Funds

Mutual funds pool money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities. Related terms are:

Net Asset Value (NAV): NAV represents a fund's per-share market value. It's the price at which investors buy and sell fund shares.

Expense Ratio: The expense ratio is a measure of what it costs an investment company to operate a mutual fund, expressed as a percentage of the fund's average net assets.

4. Exchange-Traded Funds (ETFs)

ETFs are funds traded on an exchange like a stock. They are designed to track the performance of a specific index, sector, commodity, or asset class. Some terms associated with ETFs include:

Index: In the context of ETFs, an index is a statistical measure of the changes in a portfolio of stocks representing a portion of the overall market.

Liquidity: Liquidity refers to the ability to rapidly buy or sell a security in the market without affecting the asset's price.

As an investor, it's crucial to understand these terms and more to navigate the investment landscape successfully. Remember, each investment product carries a unique level of risk and reward. Always consider your financial goals, risk tolerance, and time horizon before investing.

Note: This guide is informational and does not constitute financial advice. Always consult with a certified financial advisor before making investment decisions.

5. Options

Options are financial derivatives that give buyers the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified period. Key terms related to options include:

Strike Price: This is the predetermined price at which an option can be bought or sold when it is exercised.

Expiration Date: This is the date after which the option can no longer be exercised.

Looking for an app for earning online? GroMo is your answer! Now earn with each sale by selling various kinds of financial products

6. Futures

Futures are contractual agreements to buy or sell a particular commodity or financial instrument at a predetermined price at a specific future date. Some related terms include:

Contract Size: This refers to the amount of the underlying asset represented by the futures contract.

Settlement: This is the process by which the terms of the futures contract are fulfilled. It can involve physical delivery of the asset or a cash settlement.

7. Real Estate Investment Trusts (REITs)

REITs are companies that own or finance income-producing real estate across a range of property sectors. Some related terms are:

Distribution: Similar to dividends, REITs are required to distribute at least 90% of their taxable income to shareholders annually.

Capitalization Rate: This is a measure used in the real estate industry to indicate the rate of return expected on an investment.

8. Certificates of Deposit (CDs)

CDs are time deposits offered by banks with a fixed term and, usually, a fixed interest rate. Some related terms are:

Maturity Date: The date at which the CD term ends and you can withdraw your money.

Early Withdrawal Penalty: A penalty incurred if the CD is cashed in before its maturity date.

Understanding these related terms is pivotal to understanding the nuances of different investment products. With a clear understanding, you're better equipped to make informed decisions aligned with your financial goals and risk tolerance.

Note: This guide is informational and does not constitute financial advice. Always consult with a certified financial advisor before making investment decisions.

9. Exchange-Traded Funds (ETFs)

ETFs are investment funds traded on stock exchanges, much like individual stocks. They offer an avenue for investors to diversify their portfolios without purchasing each individual security. Some related terms are:

Net Asset Value (NAV): This is the total asset value (less liabilities) per unit of the ETF at the end of the trading day.

Expense Ratio: This is the annual fee that all funds charge their shareholders. It expresses the percentage of assets deducted each fiscal year for fund expenses.

10. Annuities

Annuities are financial products sold by insurance companies designed to pay out an income for a certain period. There are many types of annuities, but they all share some common features and terms:

Annuity Owner/Annuitant: The owner is the individual or entity who purchases the annuity and makes the contributions. The annuitant is the individual whose life expectancy is used to calculate the annuity payments.

Accumulation Phase: This is the period when the annuity owner makes contributions to the annuity and builds up the cash value.

CHECK OUT!

- Savings Account Meaning: Important Related Terms

- Demat Account Meaning: Meaning, Significance, and Other Key Detail

- Instant Loan Meaning: A Comprehensive Guide to Related Terms

- Investment Products: A Comprehensive Guide

11. Money Market Accounts (MMAs)

MMAs are interest-bearing accounts at banks which offer higher interest rates than traditional savings accounts. Related terms include:

Minimum Balance: The minimum amount that a customer must maintain in an account to avoid fees.

Tiered Interest: Interest rates that increase with the amount of money held in the account.

To sell this product, and many other financial products. DOWNLOAD GROMO. Where you can sell and earn a substantial income sitting at home.

12. Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate independently of a central bank. Some related terms are:

Blockchain: A digital ledger in which transactions made in bitcoin or another cryptocurrency are recorded chronologically and publicly.

Mining: The process of adding transaction records to the public ledger of past transactions (blockchain).

The investment product landscape can be complex, but understanding these terms can provide a solid foundation. The precise definitions can vary between financial institutions and jurisdictions, so always ensure you understand the terms and conditions of any investment product you are considering.

13. Commodity Futures

Commodity futures are contracts to buy or sell a specific quantity of a commodity at a specified price on a particular future date. The commodity could be oil, wheat, or gold, among other things. Related terms include:

Futures Contract: An agreement to buy or sell a particular commodity or financial instrument at a predetermined price at a specific future date.

Spot Price: The current price in the marketplace at which a given asset—such as a security, commodity, or currency—can be bought or sold for immediate delivery.

14. Venture Capital

Venture capital is a type of private equity and a form of financing that investors provide to startup companies and small businesses that are believed to have long-term growth potential. Related terms include:

Seed Funding: The initial capital used when starting a business, often coming from the founders' personal assets.

Series A, B, C Funding: These terms represent successive rounds of funding for a business.

15. Collectibles

Collectibles are items worth collecting because they are rare or desirable. They can be items like coins, stamps, antiques, or artwork. Related terms include:

Appraisal: A professional assessment of the value of a collectible or other items.

Provenance: The history of ownership of a collectible or artwork.

Understanding the meaning of these investment products and their related terms can help you navigate the complex world of investing. By becoming familiar with these terms, you are one step closer to making informed decisions that can help grow your wealth.

16. Hedge Funds

Hedge Funds are alternative investments using pooled funds that employ different strategies to earn active returns for their investors. Related terms include:

Absolute Return: The return that an asset achieves over a certain period.

High Water Mark: The highest peak in value that an investment fund/account has reached.

17. Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that use cryptography for security. They are primarily used as a medium of exchange like traditional currencies. Related terms include:

Blockchain: The technology that enables the existence of cryptocurrency. A blockchain is a decentralized ledger of all transactions across a peer-to-peer network.

Bitcoin: The first-ever cryptocurrency that was created in 2009.

This knowledge of investment products and their related terms will aid you in understanding the nuances of investing, helping you to make well-informed financial decisions.

CHECK OUT!!

- Job Loss Insurance Meaning: Financial Planning Tips

- Difference Between Insurance and Investment: Explained

- How To Get Instant Loans: Step By Step Guide

- Health Insurance Meaning: An Essential Financial Safety Net

KEY TAKEAWAYS

-

Diversification of Investment Products: Investment products can be broadly categorized into stocks, mutual funds, ETFs, real estate, bonds, and more, offering a range of risk and return profiles. Understanding these categories can help investors diversify their portfolios effectively.

-

Understanding Risk and Returns: Each investment product carries a unique set of risks and potential returns. For instance, stocks may offer high potential returns but carry greater risk, while bonds are relatively safer but offer lower returns.

-

Role of Time Horizon: Different investment products are suited to different investment horizons. Short-term investors might prefer liquid assets like stocks or ETFs, while long-term investors might lean towards real estate or index funds.

-

Influence of Market Conditions: The performance of investment products can significantly be influenced by market conditions. For instance, bond prices are sensitive to interest rate changes, and stocks can fluctuate with company performance and broader economic indicators.

-

Increasing Automation in Investments: With the advent of robo-advisors, investment management has become highly automated. These platforms use algorithms to manage and adjust portfolios based on an investor's risk tolerance and goals, increasing accessibility for novice investors.