Life Insurance Terms And Definitions: Exhaustive List

What is Term Life Insurance? Term Life Insurance is a type of life insurance policy that provides coverage for a specific period or "term.

What is Term Life Insurance?

Term Life Insurance is a type of life insurance policy that provides coverage for a specific period or "term". If the insured person dies during the term, the death benefit is paid out to the beneficiaries. The purpose of term life insurance is to provide financial protection and security to your dependents in the event of your untimely demise.

Key Terms Related to Term Life Insurance

A premium is the amount you pay to the insurance company to keep your term life insurance policy active. It can be paid monthly, quarterly, semi-annually, or annually, depending on the insurance provider's terms and conditions. If you fail to pay the premium within the grace period, your policy may lapse, and you may lose coverage.

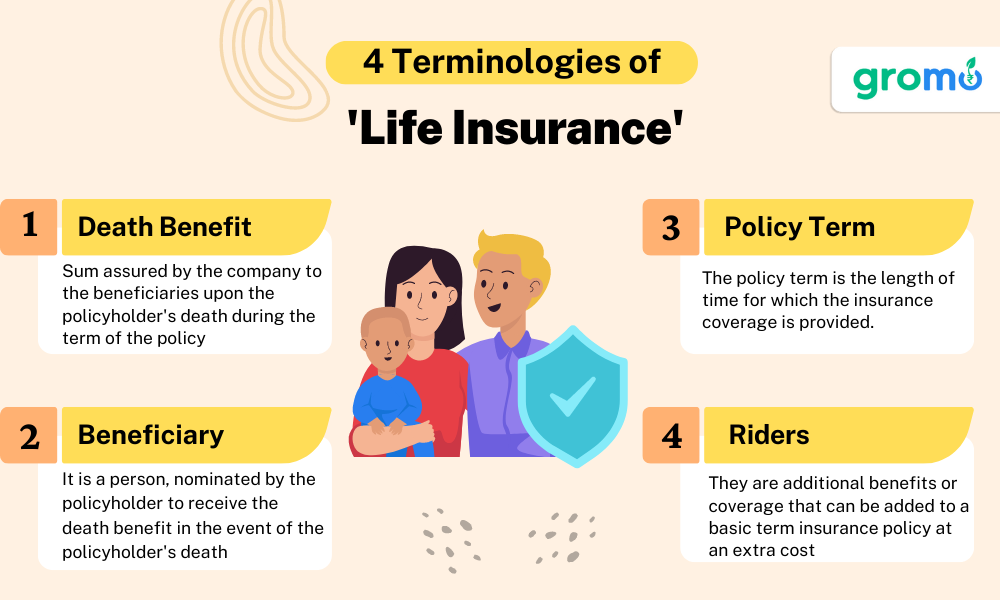

1. Death Benefit

The death benefit is the sum assured by the insurance company to the policyholder's beneficiaries upon the policyholder's death during the term of the policy. This payout is usually tax-free and can be used by the beneficiaries in any way they see fit.

2. Beneficiary

A beneficiary is a person, or entity, nominated by the policyholder to receive the death benefit in the event of the policyholder's death. Policyholders can nominate more than one beneficiary and also designate the proportion of the benefit each beneficiary will receive.

3. Policy Term

The policy term is the length of time for which the insurance coverage is provided. It could range anywhere from 1 year (annual renewable term) to 40 years. The premiums may increase after the completion of the term, or the policy may lapse.

4. Convertible Term Life Insurance

A convertible term life insurance policy is a term life policy that includes a provision allowing the policyholder to convert the policy into a permanent life insurance policy, without having to undergo a medical examination or provide proof of insurability.

5. Renewability

The renewability feature allows the policyholder to renew the policy for another term without having to undergo a medical examination, though the premium may increase based on the age at renewal.

6. Riders

Riders are additional benefits or coverage that can be added to a basic term insurance policy at an extra cost. These can include critical illness riders, accidental death benefit riders, waiver of premium riders, and more.

CHECK OUT!

- Job Loss Insurance Meaning: Financial Planning Tips

- Difference Between Insurance and Investment: Explained

- How To Get Instant Loans: Step By Step Guide

- Health Insurance Meaning: An Essential Financial Safety Net

Importance of Understanding the Terms

Knowing these terms can assist you in fully understanding your term life insurance policy. It allows you to make an informed decision about the policy you're purchasing and how it can cater to your specific needs and circumstances. Understanding these key terms can also make it easier to compare different term life insurance policies, thereby enabling you to choose the best one for you and your loved ones.

Importance of Understanding the Terms

Knowing these terms can assist you in fully understanding your term life insurance policy. It allows you to make an informed decision about the policy you're purchasing and how it can cater to your specific needs and circumstances. Understanding these key terms can also make it easier to compare different term life insurance policies, thereby enabling you to choose the best one for you and your loved ones.

To sell this product, and many other financial products. DOWNLOAD GROMO. Where you can sell and earn a substantial income sitting at home

How Term Life Insurance Works

When you purchase a term life insurance policy, you select a coverage amount (death benefit) and a term length. You then pay premiums for the duration of the term. If you die during the term of the policy, the insurance company pays the death benefit to your beneficiaries. However, if you're still living at the end of the term, the policy expires with no payout.

Considerations When Choosing Term Life Insurance

When choosing a term life insurance policy, consider your financial obligations, your health, your age, and the financial needs of your dependents. Consider, too, the financial strength of the insurance company, the cost of the premiums, and any available riders that may be beneficial to your situation.

Term life insurance is an essential financial tool for ensuring the financial security of your loved ones in the event of your death. By understanding the key terms associated with term life insurance, you can make informed decisions and select the right policy for your needs.

Term life insurance provides coverage for a specific term. If the

policyholder dies during the term, the death benefit is paid out to the beneficiaries.

Key terms related to term life insurance include the premium, death benefit, beneficiary, policy term, convertible term life insurance, renewability, and riders. Understanding these terms can help you make informed decisions about your policy.

Convertible term life insurance allows you to convert your term policy into a permanent one without having to undergo a medical examination.

Renewability allows you to renew the policy for another term without having to undergo a medical examination, though premiums may increase.

Riders are additional benefits or coverage options that can be added to a basic term insurance policy for an extra cost. They provide a way to customize your policy to better fit your individual needs and circumstances.

Importance of Term Life Insurance

Term life insurance plays a critical role in financial planning. It provides a safety net for your loved ones, ensuring they will be financially secure even in your absence. The lump-sum death benefit can be used to clear outstanding debts, cover living expenses, fund children's education, or even invest to generate a regular income.

Choosing the Right Term Life Insurance Policy

While selecting a term life insurance policy, it's crucial to accurately estimate your coverage needs. Consider all financial obligations, such as mortgages, loans, child care costs, and future educational expenses. Also, take into account your family's lifestyle needs. The rule of thumb is to have a cover that is 10-15 times your annual income.

Apart from the cover amount, the policy term is also significant. It should ideally cover you until your retirement age or until your financial liabilities are expected to reduce significantly.

*Looking for an app for earning online? GroMo is your answer! Now earn with each sale by selling various kinds of financial products *

The Role of Insurance Providers

Insurance providers play a critical role in providing term life insurance coverage. They evaluate the risk associated with insuring you based on various factors such as age, health status, and lifestyle habits. This risk assessment, in turn, determines the premiums you'll pay for the policy.

Insurance providers offer a variety of term life insurance products with different features, benefits, and premium payment options. It's essential to compare the products of different providers to make an informed choice.

Understanding term life insurance and its associated terms can seem overwhelming, but it's crucial when choosing the policy that best fits your needs. This understanding can also give you peace of mind, knowing that your loved ones' financial future is secure.

Term life insurance is a simple, affordable solution for those seeking substantial life coverage for a specific period. By understanding the nuances of term life insurance, you can ensure your family's financial stability in your absence.

Term life insurance is an affordable way to get substantial life coverage for a specific term.

Understanding the key terms related to term life insurance, like premium, death benefit, beneficiary, policy term, convertible term life insurance, renewability, and riders, can help you navigate the insurance buying process more effectively.

Riders offer a way to customize your term life insurance policy to meet specific needs.

Choosing the right term life insurance policy involves estimating your coverage needs accurately and considering all financial obligations.

Comparing products from different insurance providers can help you make an informed choice about the best term life insurance policy for you.

CHECK OUT!

- Demat Account Meaning: Meaning, Significance, and Other Key Details

- Buy Now Pay Later App: Popular Apps In India

- Instant Loan Meaning: A Comprehensive Guide to Related Terms

- Investment Products: A Comprehensive Guide

Term Life Insurance: Types and Features

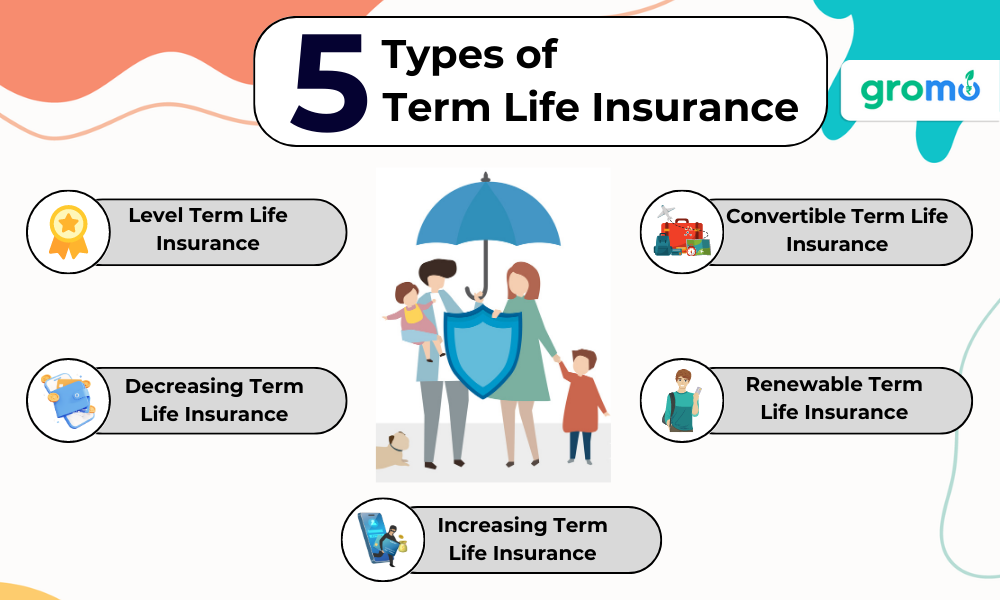

Term life insurance comes in various forms, each designed to suit different insurance needs. Here are a few types:

-

Level Term Life Insurance: This is the most common type of term life insurance. In this policy, the death benefit and premium remain the same or "level" throughout the term. This predictability makes it easier for policyholders to plan their budget.

-

Decreasing Term Life Insurance: In this variant, the death benefit decreases over the policy term, often yearly, while the premiums usually remain constant. This type is typically used to cover a diminishing liability like a mortgage or a loan.

-

Increasing Term Life Insurance: Contrary to decreasing term insurance, in increasing term insurance, the death benefit increases over the policy term while premiums usually stay the same. This type may appeal to those who anticipate their financial responsibilities growing over time, like a growing family or increasing business obligations.

-

Convertible Term Life Insurance: This policy allows you to convert your term insurance into a whole life insurance policy, without a medical exam or any health questions. It's a good option if your health has declined, and you want to extend coverage beyond the term.

-

Renewable Term Life Insurance: Renewable term insurance gives you the option to renew your policy at the end of the term, regardless of changes to your health. However, the premium may increase upon renewal to reflect your older age.

The Application Process

Applying for term life insurance typically involves several steps:

Needs Assessment: It's essential to determine how much coverage you need and how long you need it.

Choosing a Provider: You'll want to select a reputable insurance provider that offers the type of policy you need at a competitive rate.

Application: Once you've chosen a provider, you'll fill out an application detailing your personal information, lifestyle habits, and medical history.

Medical Examination: Most insurance providers require a medical exam to determine your health status and calculate your premium rate.

Policy Issuance: If your application is approved, you'll receive a policy document that details the terms and conditions of your coverage. You'll start paying premiums as per the agreed-upon schedule.

The Role of Term Life Insurance in Financial Planning

Term life insurance plays a pivotal role in financial planning. It can:

Provide Income Replacement: If you're the primary earner in your family, the death benefit from your policy can replace your income and help your loved ones maintain their standard of living.

Cover Debts: The death benefit can be used to pay off outstanding debts, such as a mortgage or car loan, preventing these obligations from falling to your family.

Fund Future Expenses: You can use term life insurance to plan for future expenses, like your children's college education.

Leave a Legacy: By naming a non-profit organization as your beneficiary, you can leave a legacy that aligns with your values.

Insurable Interest: For someone to purchase a life insurance policy on your life, they must have an insurable interest, meaning they would suffer a financial loss if you died. This often exists between family members, but it can also exist in business relationships.

Contestability Period: This is a two-year period after your policy goes in effect during which the insurance company can review your original application and contest or deny a claim if they find that you gave false or incomplete information.

Term life insurance can seem complex, but understanding these terms can help you make an informed decision about the coverage you need. As always, it's a good idea to talk to a licensed insurance agent or broker if you have any questions.

Converting a Term Life Insurance Policy

One significant element of term life insurance that policyholders should understand is the possibility of conversion. Some term life insurance policies offer the feature of Conversion, which allows you to convert your term policy into a permanent life insurance policy such as a whole life or universal life insurance policy.

Typically, you don't need to go through the underwriting process again, and your new premium is based on your age at the time of conversion. This feature can be incredibly beneficial if your health has declined since you first purchased the term policy.

Group Term Life Insurance

Group Term Life Insurance is a type of term life insurance that's often provided by an employer as part of a comprehensive employee benefits package. Group term life is typically provided at a low cost or even free, and generally offers a death benefit that may be a multiple of the employee's salary. Coverage often ends when the employee leaves the company.

Level Term vs. Decreasing Term Policies

Level Term Policies guarantee that the death benefit and premium will remain the same throughout the entirety of the policy term, while Decreasing Term Policies feature a death benefit that decreases each year until it reaches zero. The premium for a decreasing term policy typically remains the same, despite the reduction in the death benefit.

Importance of Policy Renewal

With Policy Renewal, at the end of the policy term, some policies allow for renewal for another term or terms, without a medical examination but at higher premiums. Some term insurance policies also offer a feature that allows you to return the premium paid for coverage if no claims are made for the benefit during the term period.

Insurance policies typically have Exclusions that outline specific situations, conditions, or circumstances that are not covered under the policy. Common exclusions in life insurance policies include suicide, fraud, death in a specific location, or death due to specific causes.

It's critical to understand the details and fine print of a life insurance policy before purchasing. Policy terms, including the period of coverage, depend on the product, the age and health of the insured, and other factors determined by the insurer. Always consult with a professional financial advisor or insurance agent to make sure you're choosing the best policy for your specific needs and circumstances.

KEY TAKEAWAYS

-

Term Life Insurance Offers Financial Protection: This type of policy provides a predetermined amount of money to beneficiaries if the insured passes away during the term of the policy. It's an efficient way to secure the financial future of loved ones.

-

Duration is Key in Term Life Policies: The 'term' in term life insurance refers to the policy's duration. It can vary widely, from a year to 30 years or more, and the policy only pays out if the insured dies within this term.

-

Premiums are Typically Lower: Due to the nature of term life insurance (being only for a specified term), it's often less expensive than other types of life insurance, making it an affordable choice for many people.

-

The Importance of Riders: Riders are additional benefits that can be added to the basic term life policy, such as critical illness riders or accidental death benefit riders. These add-ons can enhance the coverage of a term life policy.

-

Conversion Options: Some term life policies offer the option to convert the policy to a permanent life insurance policy. This flexibility can be an important consideration for those who may want to extend their coverage beyond the original term.