Motor Insurance Terms And Definitions: Exhaustive List

Motor Insurance: An Essential Shield for Your Vehicle Motor insurance is a contract between an individual and an insurance company,

Motor Insurance: An Essential Shield for Your Vehicle

Motor insurance is a contract between an individual and an insurance company, wherein the insurer provides financial coverage for damages incurred by the insured's vehicle. Here, we'll dive deep into the meaning and intricacies of motor insurance and its related terms.

What is Motor Insurance?

Motor insurance is a type of policy that provides financial coverage to the policyholder against physical damage, theft, and third-party liability. It safeguards the policyholder from the financial implications arising due to unforeseen events such as an accident, theft, or natural disaster.

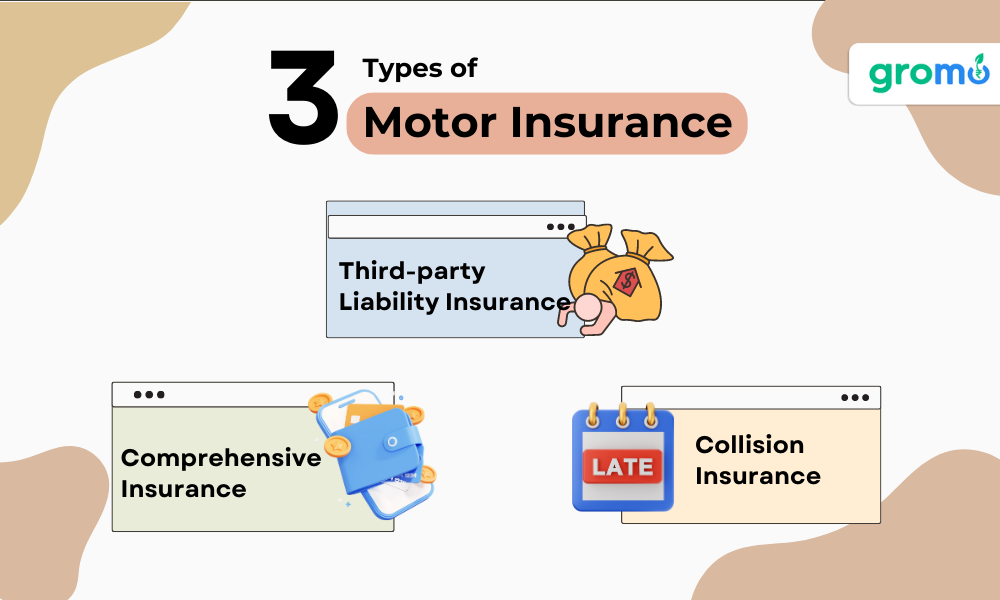

Types of Motor Insurance

1. Third-party Liability Insurance

This is the most basic type of motor insurance. It covers the damages inflicted on a third-party property or person by your vehicle. This is mandatory as per the Motor Vehicles Act, 1988.

2. Comprehensive Insurance

As the name suggests, comprehensive insurance provides complete protection. It includes coverage for damages to your vehicle and third-party liability.

3. Collision Insurance

Collision insurance provides coverage for damages resulting from a collision with another vehicle or object. It doesn't cover theft or damages due to natural calamities.

Key Terms Related to Motor Insurance

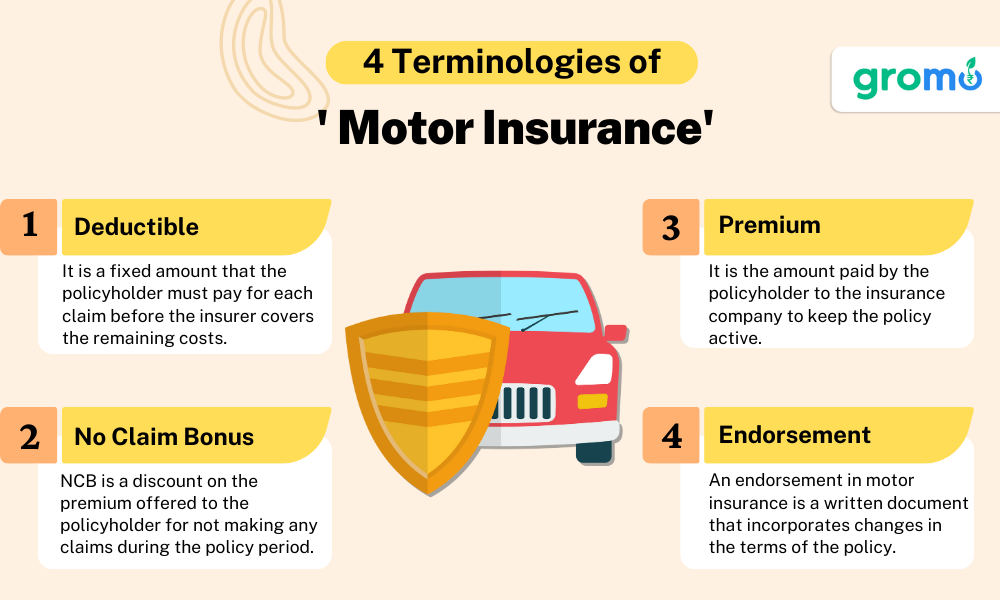

1- Deductible

The deductible is a fixed amount that the policyholder must pay out-of-pocket for each claim before the insurer covers the remaining costs.

2-No Claim Bonus (NCB)

NCB is a discount on the premium offered to the policyholder for not making any claims during the policy period. It acts as a reward for safe driving.

3-IDV (Insured Declared Value)

IDV is the maximum sum assured provided by the insurer in case of total loss or theft of the vehicle. It's essentially the market value of the vehicle.

4-Premium

The premium is the amount paid by the policyholder to the insurance company to keep the policy active.

5-Endorsement

An endorsement in motor insurance is a written document that incorporates changes in the terms of the policy.

To sell this product, and many other financial products. DOWNLOAD GROMO. Where you can sell and earn a substantial income sitting at home

Add-On Covers in Motor Insurance

Apart from the standard coverage, insurers offer additional benefits known as add-on covers, such as:

Zero depreciation cover: Provides complete coverage without factoring in depreciation.

Engine protection cover: Covers damages to the engine due to water ingression or oil leakage.

Roadside assistance cover: Provides services like towing, tire change, etc., in case of a vehicle breakdown.

Claims Process in Motor Insurance

In case of an accident or theft, the policyholder should follow the claim process to avail the financial coverage. This involves informing the insurer, filing a FIR if required, submitting the required documents, and getting the vehicle repaired at a network garage.

Motor insurance is an essential financial tool to shield against the high costs associated with vehicle damage or loss. Understanding its various aspects can help you make an informed decision and choose the right protection for your vehicle.

Remember, your vehicle is a valuable asset and protecting it with the right motor insurance policy can provide you peace of mind on the road.

There you have it - an in-depth understanding of motor insurance, from what it is to the crucial terms related to it. Armed with this knowledge, you can now navigate the complex world of motor insurance with greater ease and confidence.

CHECK OUT!

- Demat Account Meaning: Meaning, Significance, and Other Key Details

- Buy Now Pay Later App: Popular Apps In India

- Instant Loan Meaning: A Comprehensive Guide to Related Terms

- Investment Products: A Comprehensive Guide

The Importance of Motor Insurance

Motor insurance is not just a statutory requirement, but it also serves a greater purpose - protecting the policyholder from potentially crippling financial expenses arising from unexpected incidents. Apart from safeguarding your financial interests, it ensures that you are legally compliant and shields you from legal liabilities arising from an accident caused by your vehicle.

1.Personal Accident Cover

This is a vital part of motor insurance. Personal Accident Cover provides coverage to the owner-driver of the vehicle in case of any bodily injury or death caused due to a vehicular accident. This cover ensures the financial stability of the policyholder or their family in the event of severe mishaps.

2.Cashless Claim Service

One of the significant benefits of motor insurance is the cashless claim service. With this feature, if your vehicle is damaged, you don't need to pay for the repairs upfront. Instead, the insurance company settles the repair costs directly with the network garage, subject to the policy terms and conditions.

3.Policy Term

Policy term refers to the duration for which your motor insurance policy is valid. Typically, a motor insurance policy is issued for a period of one year. However, long-term motor insurance policies are also available, providing coverage for three years for cars and five years for two-wheelers.

4.The Bottom Line

Motor insurance is not a luxury but a necessity in today's world. With increasing incidents of road accidents and thefts, having a robust motor insurance policy is a must for every vehicle owner. This policy doesn't just protect you against financial losses but also gives you peace of mind knowing that you're covered in case of unexpected events.

By understanding the key terms associated with motor insurance, you're better equipped to assess the fine print of your policy. Always remember, the more informed you are, the better decisions you will make regarding your motor insurance coverage.

Navigating the world of motor insurance may seem daunting at first, but understanding these key terms and concepts can make the process far simpler. Secure your journey, protect your vehicle, and drive worry-free with the right motor insurance policy.

5.Third-Party Liability Cover

The Third-Party Liability Cover is a mandatory part of your motor insurance policy as per the Motor Vehicles Act, 1988. It provides coverage against the legal liability that arises due to accidental damages resulting in permanent injury or death of a third party. It also covers damage caused to surrounding property.

6.Comprehensive Cover

A comprehensive motor insurance policy offers complete protection against damages to your vehicle and any third party liability. It covers losses from events beyond accidents such as theft, fire, natural disasters like flood and earthquake, and man-made disasters like riots or terrorist activities.

7.No-Claim Bonus (NCB)

No-Claim Bonus is a reward that a policyholder receives from the insurer for making no claims during the policy term. This reward is given in the form of a discount on the premium amount during policy renewal. The NCB can accumulate over years, reaching up to a significant discount on the premium.

-

Add-On Covers

Add-on covers are additional covers that you can opt for over and above your standard motor insurance policy. These could include engine protection cover, zero depreciation cover, roadside assistance, among others. Add-ons increase the scope of your coverage but also result in a higher premium. -

Insured Declared Value (IDV)

Insured Declared Value is the maximum Sum Assured that the insurer will provide if your vehicle gets stolen or damaged beyond repair. It is the current market value of your vehicle and is subject to depreciation. IDV is a critical aspect of motor insurance as it impacts the premium and the claim amount.

Understanding these terms related to motor insurance will make it easier for you to comprehend the details of your policy and make the best use of it. Drive safely and stay insured!

Looking for an app for earning online? GroMo is your answer! Now earn with each sale by selling various kinds of financial products

- Own Damage Cover

Own Damage Cover is an integral part of a comprehensive motor insurance policy that offers compensation for damage to the policyholder's vehicle. The damage could be due to natural calamities, fire, explosion, or man-made disasters like riots or vandalism.

11.Personal Accident Cover

A Personal Accident Cover provides compensation for bodily injury or death of the driver while driving the vehicle. It also offers coverage against permanent total disability.

-

Depreciation

Depreciation refers to the decrease in the value of your vehicle over time due to wear and tear. In a motor insurance claim, the depreciation rate is applied to certain parts of your car like tyres, batteries, and glass components, which affects the claim amount. -

Zero Depreciation Cover

A Zero Depreciation Cover, also known as a Bumper to Bumper cover, offers full claim without considering the depreciation. That means, in case of damage, the insurer will cover the entire cost of body part replacements. -

Break-in Insurance

A break-in insurance is when the policyholder fails to renew the policy before the due date. It can lead to loss of benefits like No-Claim Bonus. Hence, maintaining the continuity of your motor insurance policy is crucial.

Being familiar with these terms not only helps in understanding your motor insurance policy better but also empowers you to make informed decisions about the covers you need, helping you get the most out of your policy. Safe driving!

Third-Party Liability Cover

Third-Party Liability Cover is a mandatory part of motor insurance as per the Motor Vehicles Act, 1988. It provides coverage against the legal liability arising due to accidental damages leading to permanent injury or death of a third party. It also covers damage caused to surrounding property.

Comprehensive Insurance Cover

A comprehensive motor insurance policy offers extensive coverage. It includes third-party liability, own-damage cover, and personal accident cover. The policy also covers damages due to theft, natural calamities, or man-made disasters.

14.No-Claim Bonus (NCB)

No-Claim Bonus is a discount offered by the insurance company to the policyholder for not making any claim during the policy period. The NCB can be accumulated over years and often results in substantial discounts on the premium of the comprehensive policy.

15.Insured Declared Value (IDV)

Insured Declared Value is the current market value of your vehicle. It is the maximum amount you can claim under a motor insurance policy in case of theft or total loss of the vehicle in an accident.

16.Total Loss

Total Loss in motor insurance terms refers to a situation where the repair cost of the vehicle after an accident is higher than its current market value or IDV. In such a case, the insurer declares the vehicle as a 'total loss'.

Remember, while motor insurance may seem like a complex subject, understanding these terms can make it significantly easier. Plus, being aware of these definitions can aid in making a better choice while purchasing or renewing your motor insurance policy. Stay insured, stay safe!

17.Zero Depreciation Cover

Zero Depreciation Cover, also known as Bumper to Bumper cover, ensures full coverage for your vehicle without factoring in depreciation. It means if your car gets damaged following a collision, no depreciation is subtracted from the coverage for body parts of the car excluding tyres and batteries.

18.Roadside Assistance Cover

Roadside Assistance is an add-on cover and is helpful in situations where the insured vehicle breaks down or if an insured encounters a vehicle-related issue in the middle of the road. The services may include repair of the vehicle, towing, battery jumpstart, fuel delivery, etc.

-

Own Damage Cover

Own Damage cover is an important part of motor insurance. It offers compensation in case of damage or loss to the insured vehicle due to accidents, theft, or natural disasters. It is different from third-party cover as it provides cover for your own vehicle. -

Cashless Garage Network

Cashless Garage Network refers to a network of garages where the insured can get his car repaired without paying anything. The insurance company settles the bill directly with the garage. It is a feature offered by most motor insurance companies.

- Voluntary Deductible

A Voluntary Deductible is a portion of the claim amount that the policyholder opts to pay before the insurer fulfills the claim. Opting for a voluntary deductible reduces the premium as it reduces the liability of the insurer.

By understanding these related terms, you can not only make an informed choice when selecting your motor insurance policy but also ensure you get the best coverage that suits your needs. Stay insured and enjoy your drive!

CHECK OUT!!

- Job Loss Insurance Meaning: Financial Planning Tips

- Difference Between Insurance and Investment: Explained

- How To Get Instant Loans: Step By Step Guide

- Health Insurance Meaning: An Essential Financial Safety Net

KEY TAKEAWAYS

-

Motor Insurance Definition: Motor insurance is a financial contract between an insurance company and an individual. It provides coverage against financial losses that could occur due to accidents, theft, natural disasters, or any damage to the vehicle.

-

Types of Coverage: Motor insurance typically includes three types of coverages: Third-Party Liability Coverage, Collision Coverage, and Comprehensive Coverage. Third-Party Liability Coverage protects against damages to others caused by your vehicle. Collision Coverage covers damage to your own vehicle in an accident. Comprehensive Coverage offers a broader protection, covering damage to the vehicle caused by events other than collision, such as fire, theft, vandalism, and natural disasters.

-

Policy Premium: The cost of motor insurance, known as the premium, depends on various factors such as the type of vehicle, the age of the vehicle, the driver's age and driving history, and the coverage options selected.

-

Deductibles: A deductible is an amount you are required to pay out-of-pocket before your insurance coverage begins. Choosing a higher deductible can lower your insurance premium, but it also means you'll have to pay more out-of-pocket in the event of an accident or damage.

-

Claims Process: If an insured event occurs, the policyholder is required to inform the insurance company as soon as possible. The insurance company then reviews the claim and, if it is covered by the policy, pays the claim after deducting the applicable deductible. It's important to understand your insurance company's claims process and requirements to ensure a smooth process in case of a claim.