Top Providers of Personal Loans: 10 Providers In India

Personal loans in India have become a go-to financial solution for many due to their ease of application, quick processing, and flexible usage.

Personal loans in India have become a go-to financial solution for many due to their ease of application, quick processing, and flexible usage. Here, we bring you a comprehensive list of the top 10 personal loan providers in India.

1. State Bank of India (SBI)

SBI is a premier public sector bank in India offering personal loans with competitive interest rates and transparent processing.

Loans up to ₹20 lakh

Interest rates starting at 9.60%

Repayment tenure up to 72 months

Processing fee up to 1.50%

2. HDFC Bank

HDFC Bank is known for its quick and hassle-free personal loan approval process.

Loans from ₹50,000 to ₹40 lakh

Interest rates starting at 10.25%

Repayment tenure up to 60 months

Up to 2.50% processing fee

3. ICICI Bank

ICICI Bank provides personal loans with minimal documentation and speedy approval.

Loans up to ₹20 lakh

- Interest rates starting at 10.50%

- Repayment tenure up to 60 months

- Up to 2.25% processing fee

4. Axis Bank

Axis Bank offers flexible repayment options and attractive interest rates for personal loans.

- Loans from ₹50,000 to ₹15 lakh

- Interest rates starting at 10.25%

- Repayment tenure up to 60 months

- Up to 2.00% processing fee

5. Kotak Mahindra Bank

Kotak Mahindra Bank is well-known for its customer service and competitive interest rates.

- Loans from ₹50,000 to ₹20 lakh

- Interest rates starting at 10.25%

- Repayment tenure up to 60 months

- Up to 2.50% processing fee

Looking for an app for earning online? GroMo is your answer! Now earn with each sale by selling various kinds of financial products

6. Bajaj Finserv

Bajaj Finserv is a popular choice for personal loans due to its quick disbursal and flexible repayment options.

Loans up to ₹25 lakh

Interest rates starting at 12.99%

Repayment tenure up to 60 months

Up to 4.13% processing fee

7. IndusInd Bank

IndusInd Bank offers personal loans with flexible repayment tenures and competitive interest rates.

Loans from ₹50,000 to ₹15 lakh

Interest rates starting at 10.00%

Repayment tenure up to 60 months

Up to 2.50% processing fee

8. IDFC First Bank

IDFC First Bank offers personal loans with no collateral requirement and flexible repayment options.

Loans up to ₹25 lakh

Interest rates starting at 10.49%

Repayment tenure up to 60 months

Up to 2.00% processing fee

9. Tata Capital

Tata Capital provides personal loans with easy application and quick disbursal.

Loans from ₹75,000 to ₹25 lakh

Interest rates starting at 10.99%

Repayment tenure up to 72 months

Up to 2.75% processing fee

10. Yes Bank

Yes Bank is recognized for its seamless processing and customer-friendly personal loan schemes.

Loans from ₹1 lakh to ₹40 lakh

Interest rates starting at 10.75%

Repayment tenure up to 60 months

Up to 2.25% processing fee

CHECK OUT!

- Job Loss Insurance Meaning: Job Loss And Related Terms

- Motor Insurance Meaning: Related Terms

- Personal Loan Meaning: Understanding and Utilizing Personal Loans

- Difference Between Insurance and Investment: Explained

Remember, while the listed providers offer competitive rates and benefits, your personal loan eligibility, interest rate, and terms are subject to individual credit history, income level, and the lender's terms and conditions. Always compare and read the fine print before making a decision.

Ensure you maintain a good credit score, have a steady income, and manage your debts effectively to improve your chances of loan approval and get better interest rates. Make a wise decision that suits your financial requirements and repayment capabilities.

A Comprehensive Guide to Applying for a Personal Loan

After assessing the top personal loan providers, you must be wondering about the application process. Here's a step-by-step guide to help you navigate through it:

Step 1: Assess Your Requirement

Identify the purpose of your loan, whether it's for home renovation, debt consolidation, or meeting medical expenses. This will help you determine the exact amount you need.

Step 2: Check Your Credit Score

A high credit score can fetch you a loan at a lower interest rate. It's advisable to check your credit score before applying. If it's low, consider improving it before loan application.

Step 3: Compare Loan Offers

Review various loan offers from different banks and NBFCs. Look for the lowest interest rates, minimal processing fees, and flexible repayment terms.

Step 4: Decide on the Loan Amount and Repayment Tenure

The loan amount should align with your requirement and repayment capacity. Similarly, choose a repayment tenure that ensures your EMI is not a financial burden.

Step 5: Apply for the Loan

Most lenders have an online application process. Fill in the required details, submit the necessary documents, and apply.

Step 6: Loan Disbursal

Upon verification, the loan amount will be disbursed to your bank account.

Remember, timely repayment of your personal loan is crucial for maintaining your credit score. Use the funds responsibly and plan your finances well to ensure a smooth repayment journey.

Understanding Personal Loan Interest Rates

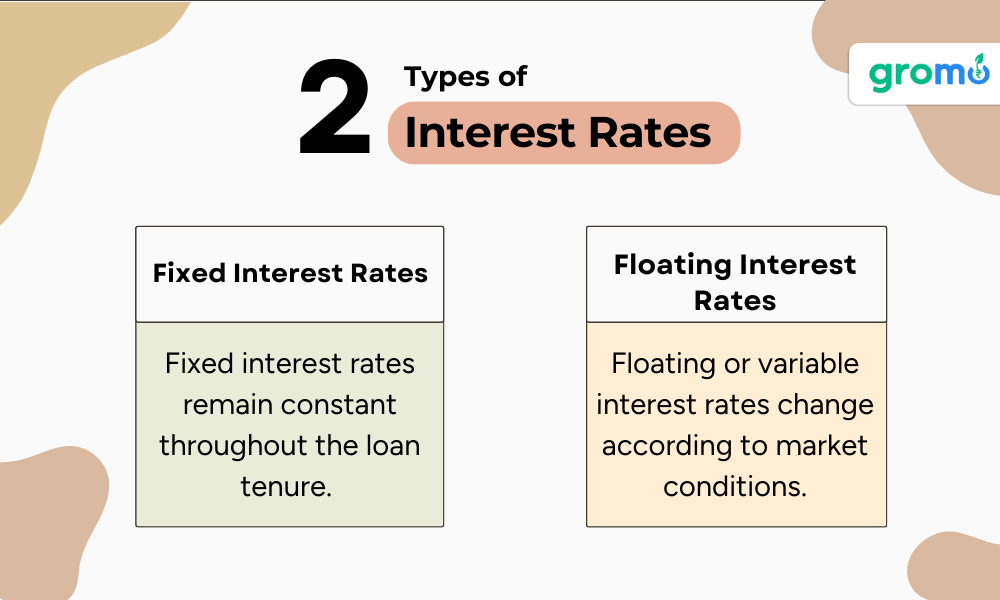

Interest rates play a crucial role in your personal loan journey. They directly impact your Equated Monthly Installments (EMIs) and the total amount payable. Here's a detailed explanation:

-

Fixed Interest Rates

Fixed interest rates remain constant throughout the loan tenure. They allow you to predict your future payments and manage your budget accordingly. -

Floating Interest Rates

Floating or variable interest rates change according to market conditions. They might be lower than fixed rates initially, but there's always the risk of increase.

Factors Affecting Interest Rates

Several factors can influence the personal loan interest rates offered by lenders:

Credit Score: A high credit score often leads to lower interest rates as it indicates a lower risk for the lender.

-

Income: Higher income can also result in lower interest rates because it suggests that the borrower has a higher repayment capacity.

-

Employer Reputation: If you work for a reputed organization, lenders might offer you lower interest rates.

-

Existing Debts: If you already have multiple loans or high credit card dues, lenders might consider you a high-risk borrower and increase the interest rates.

Always remember to read the loan agreement carefully and understand the implications of the interest rate on your loan repayment. Use online EMI calculators to plan your monthly payments better.

Choosing the right personal loan provider is an important financial decision. The best provider for you will depend on a variety of factors including loan amount, interest rate, processing fee, and payment period. By understanding your needs and thoroughly researching different lenders, you can find a personal loan that fits your budget and financial goals. Remember to borrow responsibly and make timely repayments to maintain a healthy credit score.

CHECK OUT!!

Job Loss Insurance Meaning: Job Loss And Related Terms

Difference Between Insurance and Investment: Explained

How To Get Instant Loans: Step By Step Guide

Motor Insurance Meaning: Related Terms

Frequently Asked Questions (FAQs) About Personal Loans in India

Given the complexities of financial products, it's natural to have queries. Here are the answers to some commonly asked questions about personal loans in India:

1. What is the Eligibility Criteria for a Personal Loan?

Eligibility criteria vary from lender to lender. However, general requirements include:

Indian citizenship or residency status

Age between 21 and 60 years

Regular source of income

Good credit score

Minimum income requirement (differs across lenders)

2. What Documents are Required for a Personal Loan?

Typically, you'll need the following documents:

Identity proof (Aadhaar, PAN, Passport, etc.)

Address proof (Utility bills, Rent agreement, etc.)

Income proof (Salary slips, Income tax return, etc.)

Bank statement

3. Can I Prepay or Foreclose My Personal Loan?

Yes, most lenders allow prepayment or foreclosure of personal loans. However, this might attract a prepayment fee. Check the terms and conditions or discuss with your lender.

4. Can I Get a Personal Loan if I Have a Low Credit Score?

While a high credit score enhances your loan approval chances, some lenders may offer personal loans to individuals with low credit scores, albeit at higher interest rates.

5. What Happens if I Default on My Personal Loan?

Defaulting can severely affect your credit score, making it challenging to get credit in the future. Lenders may also impose a penalty or take legal action in severe cases.

Remember, personal loans are a significant financial commitment. Understanding their aspects thoroughly can help you manage them better.

Final Word

Acquiring a personal loan in India is a relatively straightforward process, thanks to the numerous reliable providers. Whether it's for an emergency, a big-ticket purchase, or debt consolidation, these loans can provide a substantial financial boost when you need it the most. But remember to compare your options, read the fine print, and most importantly, ensure that you're capable of timely repayments to avoid any financial distress.

6. Can I Take a Personal Loan for Business Purposes?

Yes, you can take a personal loan for business purposes. This could be a convenient option for those who cannot access business loans due to lack of collateral, lower business vintage or unsatisfactory financial documents. However, the interest rates on personal loans may be higher than specific business loans.

7. Can I Take Multiple Personal Loans at the Same Time?

While it's not prohibited, taking multiple personal loans simultaneously is not advisable due to the higher risk of default. Managing multiple EMIs can be challenging and could strain your finances.

8. How Long Does It Take to Get a Personal Loan?

Depending on the lender, you could get a personal loan within a few hours to a few days. Digital and online lenders typically have shorter turnaround times.

9. How Does the Repayment Process Work?

Repayments are made in Equated Monthly Installments (EMIs), which consist of a part of the principal amount and interest. The EMI starts from the month following the loan disbursement.

10. How to Choose the Best Personal Loan?

Choosing the best personal loan depends on various factors:

Interest Rate: Lower rates mean lower total repayment cost.

Loan Tenure: Longer tenure reduces the EMI but increases the total interest payout.

Processing Fees: Lower processing fees can reduce the cost of your loan.

Prepayment/Foreclosure Charges: Lower or no prepayment charges offer more flexibility.

Customer Service: Efficient customer service can make the loan process smoother.

Remember, it's crucial to compare different lenders and read the fine print before making a decision.

CHECK OUT!!

- Savings Account Meaning: Important Related Terms

- Demat Account Meaning: Meaning, Significance, and Other Key Details

- Instant Loan Meaning: A Comprehensive Guide to Related Terms

- Personal Loan Meaning: Understanding and Utilizing Personal Loans

If you are a Financial Advisor looking for a platform to sell financial Product then checkout the GroMo App now. You can earn upto rs. 1 Lakh by selling through GroMo.

KEY TAKEAWAYS

-

Diversity of Lenders: Personal loans in India are provided by a range of lenders, from traditional banks and NBFCs to fintech startups. Each has its unique product offerings and eligibility criteria.

-

Online Application: Most top lenders offer an online application process for personal loans, providing the convenience of applying from anywhere, anytime.

-

Interest Rates: Depending on the lender and the borrower's credit score, the interest rates on personal loans can vary significantly. Top providers often offer competitive rates.

-

Flexible Tenures: Personal loans usually come with flexible repayment tenures. Top lenders often provide the flexibility to choose a repayment period that suits the borrower's financial circumstances.

-

Unsecured Loans: Personal loans are typically unsecured, meaning they don't require collateral. This makes them a popular choice for borrowers who may not have assets to pledge as security.