Vehicle Loan Terms & Definitions: Exhaustive List

A vehicle loan is a great way to pay for your new car, but knowing the terms and definitions of a vehicle loan before taking one is important.

"All of those cars were once just a dream in somebody's head."

— Peter Gabriel

But not anymore!

Why?

Today, we have options like vehicle loans, using which we can buy our dream cars within a few minutes. When you're shopping for a new or used car, you'll likely need to take out a vehicle loan. Vehicle loans can be a great way to finance your purchase, but it's important to understand vehicle loan terms and definitions involved before you sign on the dotted line.

List Of Vehicle Loan Terms And Definitions

Below is an exhaustive list of vehicle loan terms and definitions that one should go through and understand to get the best vehicle loan possible. So, let's have a look at these vehicle loan terms and definitions:

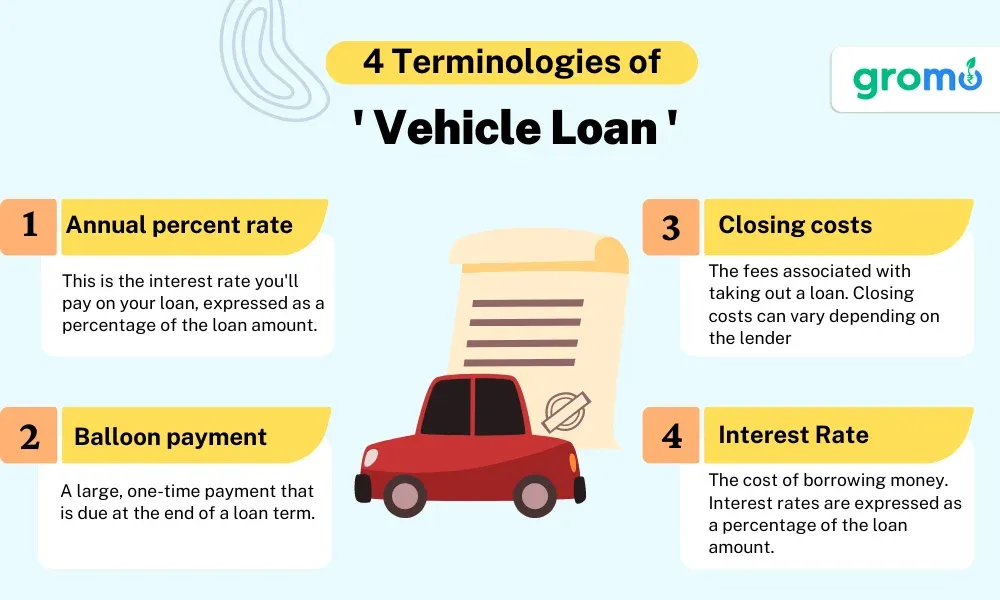

1. Vehicle Loan APR: Annual percentage rate. This is the interest rate you'll pay on your loan, expressed as a percentage of the loan amount.

2. Vehicle Loan Balloon Payment: A large, one-time payment that is due at the end of a vehicle loan term. Balloon payments can be risky, as they can make it difficult to repay the vehicle loan if you experience financial difficulties.

3. Vehicle Loan Closing Costs: The fees associated with taking out a vehicle loan. In addition to the interest rate, there are other costs associated with taking out a vehicle loan. Closing costs can vary depending on the lender, but they typically include origination fees, appraisal fees, and title fees. These are referred to as closing costs.

4. Vehicle Loan Depreciation: The loss of value that a vehicle experiences over time. This is known as vehicle loan depreciation. Vehicle loan depreciation is a major factor in the cost of owning a vehicle, as you'll need to make up for the depreciation through your monthly payments.

5. Vehicle Loan Down Payment: The portion of the purchase price of a vehicle that you pay upfront. A down payment can help you get a lower interest rate and reduce the amount of interest you'll pay over the life of the loan.

6. Vehicle Loan Interest Rate: The cost of borrowing money. The interest rate is calculated as a percent of the total loan amount. The interest rate on a vehicle loan is determined by several factors, including your credit score, the amount of the vehicle loan, and the term of the vehicle loan.

In general, people with good credit scores will get lower interest rates than people with bad credit scores.

7. Vehicle Loan Term: The length of time you have to repay your vehicle loan. Vehicle loan terms typically range from 36 to 72 months, but they can be longer in some cases.

8. Vehicle Loan Monthly Payment: The amount of money you'll pay each month to repay your vehicle loan. Your monthly payment will be based on the loan amount, interest rate, and vehicle loan term. Monthly payments are the most common way to repay a vehicle loan. You'll pay a set amount of money each month until the vehicle loan is paid off.

The longer the vehicle loan term, the lower your monthly payment will be, but you'll pay more interest overall.

9. Vehicle Loan Prepayment Penalty: You can pay off your vehicle loan early, which can save you money on interest. However, a fee may be charged if you pay off your vehicle loan early. Prepayment penalties are rare, but they're worth checking for before you sign a vehicle loan agreement. Be sure to check your vehicle loan agreement to see if there is a prepayment penalty.

10. Vehicle Loan Refinance: To replace an existing loan with a new loan. Refinancing can be a good option if you can get a lower interest rate on a new loan. Refinancing can save you money on interest in the long run.

11. Vehicle Loan Title: The document that proves ownership of a vehicle. The title will be held by the lender until the vehicle loan is repaid.

12. Vehicle Loan: A loan that is used to finance the purchase of a vehicle. Vehicle loans can be secured or unsecured.

It's important to understand all of these terms and definitions before you take out a vehicle loan. By doing your research, you can make sure that you're getting the best possible deal on your vehicle loan.

To sell personal loans and many other financial products. Download GroMo, where you can sell and earn a substantial income of up to ₹1 Lakh from home.

Tips For Getting A Good Vehicle Loan

Not every vehicle loan that is being offered in the market will prove to be a good vehicle loan option for you. So here are a few tips that will help you get a good vehicle loan:

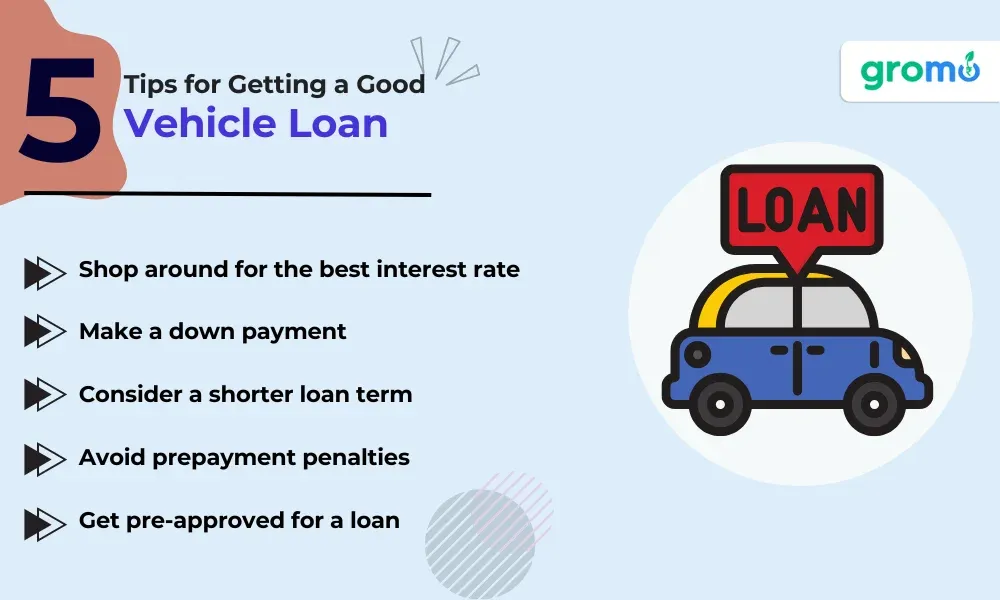

1. Shop Vehicle Loan Interest Rates: Shop around for the best interest rate. Interest rates can vary from lender to lender, so it's important to shop around and compare rates before you choose a vehicle loan.

2. Make A Down Payment: A down payment can help you get a lower interest rate and reduce the amount of interest you'll pay over the life of the vehicle loan.

3. Consider A Shorter Vehicle Loan Term: A shorter vehicle loan term will mean higher monthly payments, but you'll pay less interest overall.

4. Avoid Prepayment Penalties: Prepayment penalties can be costly, so be sure to check for them before you sign a vehicle loan agreement.

5. Get Pre-approved: Getting pre-approved for a vehicle loan will give you an idea of how much you can borrow and what your monthly payments will be. This will help you make an informed decision when you're shopping for a car.

By following these tips, you can increase your chances of getting a good vehicle loan.

Types Of Vehicle Loans

There are two main types of vehicle loans: secured and unsecured.

Secured Vehicle Loans

Secured vehicle loans are backed by collateral, which is an asset that the lender can take possession of if you default on the loan. In the case of a vehicle loan, the collateral is the vehicle itself. Secured loans typically have lower interest rates than unsecured loans.

Unsecured Vehicle Loans

Unsecured vehicle loans are not backed by collateral. This means that if you default on the loan, the lender has no recourse but to sue you for the money. Unsecured loans typically have higher interest rates than secured loans.

Also Check Out:

Types Of Vehicle Loan Insurance

In India, you'll need to have insurance on your vehicle to get a loan. Insurance protects you financially if your vehicle turns out to be damaged or is stolen. There are a few different types of insurance that you can get for your vehicle. Let's have a look at them:

1. Own Damage Cover: When you choose own damage insurance coverage, you get reimbursement for repairs to your damaged vehicle.

2. Third-Party Cover: Also known as liability only insurance, this type of policy protects you from liability if you cause damage to another person or property.

3. Comprehensive Cover: This type of insurance covers damage to your vehicle caused by fire, theft, or vandalism as well as damage to another person or property. It provides the benefits of Own Damage Cover as well as Third Party Cover.

Your lender would certainly require you to have third-party insurance, but you may want to consider getting own damage and/or comprehensive insurance as well depending on your needs.

If you are a Financial Advisor looking for a platform to sell personal loans then check out the GroMo App now. You can earn up to ₹1 Lakh by selling personal loans through GroMo.

Vehicle Loan Repayment Tips

At times, it might get difficult for people to repay their vehicle loans. Here are a few tips that can help you avoid this situation:

1. On-Time Payments: Make your payments on time and in full each month. This will help you build your credit score and avoid late fees.

2. Make Extra Payments: Consider making extra payments each month. This will help you pay off your vehicle loan sooner and save money on interest.

3. Loan Refinancing: Refinance your loan if you can get a lower interest rate. This can help you save on interest charges over the long term.

By following these tips, you can make sure that you repay your vehicle loan as quickly and easily as possible.

How To Refinance Vehicle Loan?

Refinancing your vehicle loan can be a good option if you can get a lower interest rate on a new loan. Refinancing can save you money on interest in the long run.

To refinance your vehicle loan, you'll need to get a new loan from a different lender. The new lender will appraise your vehicle to determine its current value.

They will then use this value to calculate the amount of money you can borrow. The interest rate on your new loan will depend on some factors, including your credit score, the amount of the vehicle loan, and the term of the vehicle loan. In general, people with good credit scores will get lower interest rates than people with bad credit scores.

Once you've been approved for a new loan, you'll need to pay off your old vehicle loan. You can do this by sending a check to your old lender or by having the new lender make the payment for you. Refinancing your vehicle loan can be a good way to save money on interest.

However, it's important to make sure that you're not going to end up paying more in fees. Be sure to compare the interest rates and fees of different lenders before you choose a new loan.

What Is Vehicle Loan Consolidation?

Vehicle loan consolidation is a type of loan that can be used to pay off multiple vehicle loans. This can be beneficial if you are having difficulty making several payments a month. When you consolidate your vehicle loans, you'll take out a new loan to pay off all of your existing loans.

The new loan will have a single monthly payment. This can make it easier to manage your finances and make sure that you're not overspending. To qualify for a vehicle loan consolidation, you'll need to have good credit. You'll also need to be able to afford the monthly payments on the new loan.

If you're considering vehicle loan consolidation, be sure to compare rates from different lenders. You should also make sure that you understand the terms of the loan, including the interest rate, the fees, and the repayment period.

What Is Vehicle Loan Default?

If you default on your vehicle loan, the lender may take possession of your vehicle. This is known as repossession. Repossession can have many negative consequences, including:

- A negative impact on your credit score

- Difficulty getting approved for future loans

- Legal action by the lender

If you're struggling to make your vehicle loan payments, it's important to contact your lender as soon as possible. They may also be able to come up with an affordable payment plan for you. Vehicle loans can be a great way to finance the purchase of a new or used car.

Also Check Out:

Key Takeaways

- Vehicle loans are a type of loan that can be used to purchase a new car or pre-owned vehicle.

- There are two main types of vehicle loans: secured and unsecured.

- There are two main ways to repay a vehicle loan: monthly payments and balloon payments.

- You can pay off your vehicle loan early, which can save you money on interest.

- When you refinance your vehicle loan, you may be able to get a better interest rate on your new loan.

The information provided by us on our website or App (""Platform"") is for general informational purposes only and is provided in good faith, however, we make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of any information on the Site or our mobile application.