Buy Now Pay Later Meaning: Guide To All Related Terms

Introduction Buy Now Pay Later (BNPL) is an increasingly popular financial service that allows consumers to purchase products and services

Introduction

Buy Now Pay Later (BNPL) is an increasingly popular financial service that allows consumers to purchase products and services without paying the full amount upfront. Instead, payments are deferred, and customers can repay their purchases over a set period of time, often interest-free. This guide explores the meaning, advantages, disadvantages, top providers, and responsible use of BNPL services.

How Does Buy Now Pay Later Work?

BNPL services provide an alternative to traditional credit cards and loans. They generally follow these steps:

-

Selecting a BNPL option: When making a purchase, customers choose a BNPL service as their payment method.

-

Approval process: The BNPL provider conducts a soft credit check to determine eligibility.

-

Payment schedule: Customers receive a repayment plan, which typically involves fixed installments over a specific period (e.g., 4 weeks or 6 months).

-

Making payments: Customers make regular payments until the full amount is repaid.

DOWNLOAD GROMO!

To sell financial products like credit cards, insurance and earn as much as you can by earning per sale.

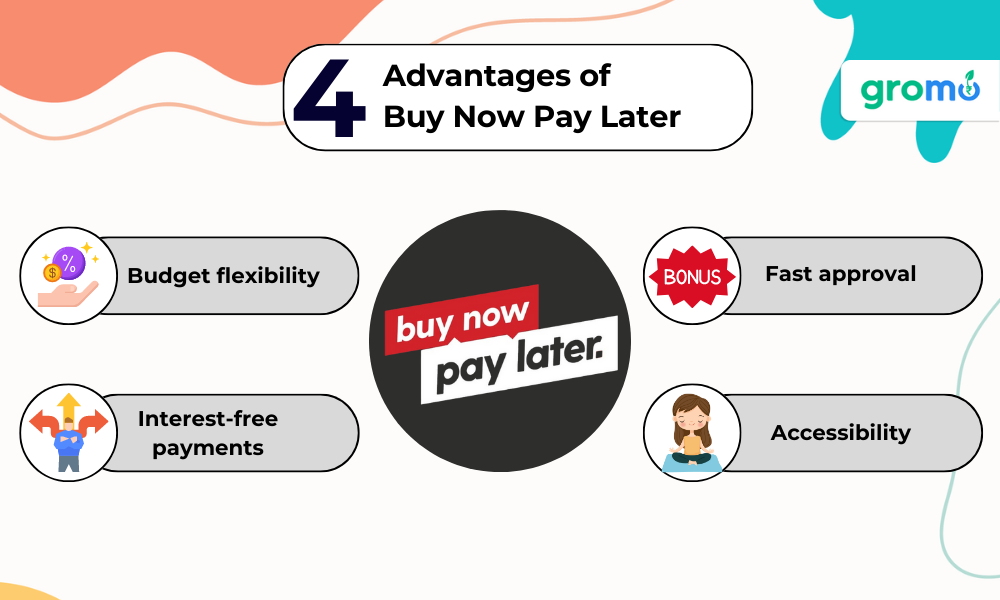

Advantages of Buy Now Pay Later

BNPL offers numerous benefits, such as:

Budget flexibility: Customers can spread the cost of purchases over time, making large or unexpected expenses more manageable.

Interest-free payments: Many BNPL providers offer interest-free repayment plans, reducing the overall cost of purchases.

Fast approval: BNPL providers usually have a quick and easy approval process, making it convenient for customers.

Accessibility: BNPL services can be an alternative credit option for those with limited or poor credit history.

Disadvantages of Buy Now Pay Later

Despite its benefits, BNPL also has potential drawbacks:

Debt accumulation: BNPL can encourage overspending, leading to unmanageable debt.

Missed payments: Failing to make timely payments can result in late fees and damage to credit scores.

Interest charges: Some BNPL providers charge interest on outstanding balances after the interest-free period ends.

Impact on credit applications: High utilization of BNPL services can affect a customer's ability to secure credit from other sources.

Top Buy Now Pay Later Providers

Several BNPL providers dominate the market, offering varying terms and features:

Affirm: Offers installment plans from 3 to 48 months, with interest rates ranging from 0% to 30%.

Afterpay: Provides interest-free, 4-installment plans, with payments due every 2 weeks.

Klarna: Features three payment options, including interest-free 4-installment plans and 30-day payment deferrals.

PayPal Credit: Extends interest-free financing for 6 months on purchases over $99, with a variable annual percentage rate (APR) after the promotional period.

Sezzle: Offers interest-free, 4-installment plans, with payments due every 2 weeks.

Tips for Responsible Use of Buy Now Pay Later**

To maximize the benefits of BNPL services and minimize potential risks, follow these best practices:

Create a budget: Set a monthly spending limit for BNPL purchases to avoid overspending and accumulating debt.

Track your payments: Monitor your BNPL accounts to ensure timely payments and avoid late fees.

Prioritize essential purchases: Use BNPL for necessary expenses or items with a clear return on investment.

Compare BNPL providers: Research the terms and conditions of various providers to find the best fit for your financial needs.

Be mindful of interest charges: Choose interest-free options or repay balances before the interest-free period ends to minimize interest costs.

Buy Now Pay Later has become a popular financial tool for consumers, offering flexibility and convenience in purchasing goods and services. By understanding the advantages and disadvantages of BNPL and following best practices, customers can make informed decisions and use these services responsibly.

Factors to Consider When Choosing a BNPL Provider

Before selecting a BNPL provider, consider the following factors to ensure you choose the right option for your financial needs:

Repayment terms: Assess the length and frequency of the repayment plan, as well as any interest rates or fees associated with the service.

Customer service: Evaluate the responsiveness and quality of the provider's customer support, as you may need assistance throughout the repayment process.

Merchant partnerships: Some BNPL providers have exclusive partnerships with retailers or service providers, limiting your choice of shopping destinations.

Security: Investigate the provider's data privacy and security measures to ensure your personal and financial information is protected.

User experience: Explore the provider's website or mobile app to determine ease of use and functionality.

Impact of BNPL on Retail and E-commerce**

BNPL services have had a significant impact on retail and e-commerce, including:

Increased sales: BNPL options can encourage consumers to make larger or more frequent purchases, driving up revenue for retailers.

Higher conversion rates: Offering BNPL can reduce cart abandonment and increase checkout conversion rates by providing a convenient payment alternative.

Customer loyalty: BNPL services can foster brand loyalty by making purchases more affordable and accessible to customers.

Competitive advantage: Retailers that offer BNPL can differentiate themselves from competitors and attract a broader customer base.

Future of Buy Now Pay Later**

As BNPL continues to gain popularity, it is expected to evolve and shape the future of consumer finance in several ways:

Global expansion: BNPL services are likely to expand into new markets and geographies, increasing their global presence.

Regulatory changes: Governments may introduce new regulations to protect consumers and ensure responsible lending practices within the BNPL industry.

Innovative payment solutions: As competition intensifies, BNPL providers may develop new payment options and features to attract and retain customers.

Integration with other financial services: BNPL providers may partner with banks, credit card companies, and fintech firms to offer integrated financial solutions and a seamless user experience.

By staying informed about BNPL trends and developments, consumers can make the most of these financial services and adapt to the changing landscape of consumer finance.

GO CHECK OUT!!

- Insurance Meaning: What Is It And Related Terms Explained

- Investment Products: What Are Investment Products?

- Personal Loan: What Is Personal Loan?

Responsible Lending in the BNPL Industry**

As BNPL services continue to grow in popularity, responsible lending practices are crucial to ensure the financial well-being of consumers. These practices may include:

Transparent terms and conditions: BNPL providers should clearly communicate their terms and conditions, including repayment schedules, interest rates, and fees, to ensure consumers fully understand their financial obligations.

Affordability checks: BNPL providers should conduct thorough assessments of a customer's financial situation, including income, credit history, and outstanding debt, to determine their ability to repay without undue financial stress.

Flexible repayment options: To accommodate varying financial circumstances, BNPL providers should offer a range of repayment options and payment plans.

Financial education: BNPL providers should provide resources and tools to help consumers make informed decisions about their finances and the use of BNPL services.

Support for struggling customers: BNPL providers should have procedures in place to assist customers who are struggling to make repayments, such as offering payment deferrals or connecting them with debt management services.

The Role of Consumers in BNPL Success**

While BNPL providers have a responsibility to offer transparent and fair services, consumers also play a crucial role in the success and sustainability of the industry. By adopting responsible financial habits, consumers can ensure a positive BNPL experience:

Understand your financial limits: Before using BNPL services, assess your financial situation and set realistic spending limits to avoid overextending your budget.

Read the fine print: Familiarize yourself with the terms and conditions of your chosen BNPL provider, including any fees, interest rates, and penalties for missed or late payments.

Stay organized: Keep track of your BNPL obligations, including payment due dates and outstanding balances, to ensure timely payments and maintain a healthy credit score.

Seek assistance if needed: If you're struggling to make repayments or experiencing financial difficulties, reach out to your BNPL provider or a financial professional for advice and support.

BNPL's Impact on Traditional Credit**

-

As BNPL gains traction, it has the potential to disrupt the traditional credit industry in several ways:

-

Alternative to credit cards: BNPL services offer a more flexible and potentially cost-effective alternative to credit cards, particularly for younger consumers or those with limited credit history.

-

Changing consumer preferences: As more consumers become accustomed to BNPL services, they may increasingly opt for these alternatives over traditional credit options.

-

Competition and innovation: The growth of BNPL may prompt traditional credit providers to adapt their offerings and introduce new, innovative products to remain competitive in the market.

However, it is important to note that BNPL services may not completely replace traditional credit options, as they serve different purposes and cater to different consumer needs.

Instead, they are likely to coexist and complement each other, offering consumers a diverse range of financial solutions.

BNPL and Financial Inclusion**

BNPL has the potential to increase financial inclusion by providing access to credit for consumers who may not qualify for traditional financial products, such as credit cards or personal loans:

Easier approval: BNPL providers often have less stringent eligibility requirements, enabling individuals with limited or poor credit history to access financing options.

Credit-building opportunities: Some BNPL providers report repayment history to credit bureaus, allowing users to build or improve their credit scores over time.

Financial management: BNPL services can help users develop budgeting and financial planning skills by breaking down purchases into manageable installments.

Despite these benefits, it is essential to recognize that BNPL is not a one-size-fits-all solution for financial inclusion.

Consumers should still exercise caution and responsibility when using BNPL services to avoid potential pitfalls, such as debt accumulation and negative impacts on their credit scores.

BNPL and Small Business Growth**

Small businesses can benefit from integrating BNPL options into their payment systems, both in-store and online:

Increased sales: By offering BNPL, small businesses can encourage customers to make larger or more frequent purchases, which can lead to increased revenue.

Improved cash flow: BNPL providers typically settle payments with merchants quickly, enabling small businesses to maintain healthy cash flow.

Expanded customer base: Offering BNPL services can help small businesses attract a wider range of customers, including those who prefer alternative payment methods or require financial flexibility.

To optimize the benefits of BNPL for small businesses, it is crucial to research and select a BNPL provider that aligns with the business's specific needs and target customer base.

Navigating BNPL During Economic Downturns**

During economic downturns, consumers and businesses may face financial challenges, making it crucial to approach BNPL services with caution:

For consumers: During tough economic times, prioritize essential purchases and avoid using BNPL services for discretionary spending. Ensure that you can commit to the repayment schedule before using BNPL, as missed payments can lead to late fees and credit score damage.

For businesses: Monitor the performance of BNPL services within your business and adjust offerings as needed to maintain financial stability. Ensure that your chosen BNPL provider remains committed to responsible lending practices, even during economic downturns.

By exercising caution and responsibility, consumers and businesses can continue to benefit from BNPL services while minimizing potential risks during challenging economic periods.

BNPL and Consumer Data Privacy**

As with any financial service, data privacy is a crucial consideration for BNPL providers and users. Here are some key points to keep in mind:

-

Data collection: BNPL providers collect various types of data, including personal information, financial details, and transaction history, to assess creditworthiness and provide tailored services.

-

Data security: BNPL providers must implement robust security measures to protect sensitive customer information from unauthorized access, data breaches, and cyberattacks.

-

Privacy policies: BNPL users should review the privacy policies of their chosen providers to understand how their data is collected, used, and shared, as well as their rights and options regarding data privacy.

To minimize privacy risks, consumers should opt for BNPL providers with strong data protection policies and practices, while providers must continuously invest in improving their data security infrastructure.

DOWNLOAD GROMO! for more knowledge about the finacial products, you can sell these products and earn with each sale.

Environmental Impact of BNPL**

While the environmental impact of BNPL services may not be immediately apparent, there are potential indirect effects to consider:

Increased consumption: BNPL can encourage higher levels of consumption by making purchases more accessible and affordable. This can lead to greater resource use, waste generation, and carbon emissions associated with production, transportation, and disposal of goods.

Promotion of sustainable choices: BNPL providers can play a role in promoting sustainable consumption by partnering with eco-friendly retailers or offering incentives for environmentally responsible purchases.

To minimize the environmental impact of BNPL, both consumers and providers should be mindful of their consumption habits and promote sustainable choices where possible.

BNPL and Customer Satisfaction**

Customer satisfaction is crucial for the success and growth of BNPL services. Providers can enhance customer satisfaction by focusing on the following areas:

-

User experience: Ensuring seamless integration with retailers, easy-to-use platforms, and transparent terms and conditions can create a positive user experience.

-

Customer support: Providing responsive, knowledgeable, and empathetic customer service can help address user concerns and build trust in the BNPL provider.

-

Flexibility: Offering a range of repayment options and accommodating customer needs, such as payment deferrals or extensions, can improve satisfaction and loyalty.

By prioritizing customer satisfaction, BNPL providers can build long-lasting relationships with their users and maintain a competitive edge in the market.

The Evolving Role of BNPL in Modern Finance**

BNPL services have already transformed the way consumers and businesses approach financing, and this evolution is expected to continue as the industry matures:

-

New partnerships: BNPL providers may collaborate with traditional financial institutions, fintech firms, and other stakeholders to create innovative, integrated financial products.

-

Advanced technology: BNPL providers may leverage emerging technologies, such as artificial intelligence and machine learning, to enhance credit assessment, fraud detection, and customer experience.

-

Adapting to market trends: As consumer preferences and market trends evolve, BNPL providers will need to adapt their offerings to remain relevant and competitive.

By staying informed about the latest developments in BNPL and modern finance, consumers and businesses can make well-informed decisions and adapt to the changing financial landscape.

ALSO CHECK OUT!!

- Demat Account Meaning: Meaning, Significance, and Other Key Details

- Savings Account Meaning: Important Related Terms

- Benefits Of Term Life Insurance: About Term Life Insurance

- Health Insurance: What Is Health Insurance?

KEY TAKEAWAYS

-

Personal loans are unsecured loans that can be used for a wide range of purposes, such as debt consolidation, home improvements, or emergencies.

-

These loans typically come with fixed interest rates and repayment terms, providing predictable monthly payments.

-

Credit scores, income, and debt-to-income ratios play a significant role in determining eligibility and interest rates for personal loans.

-

Shopping around and comparing offers from different lenders can help borrowers secure better loan terms and save on interest costs.

-

Responsible borrowing and timely repayments are essential to maintain a healthy credit score and avoid potential financial stress.