How To Get Personal Loan: Things To Keep In Mind

Are you in need of urgent funds for your financial needs? Personal loans can be a viable solution to meet your immediate monetary requirements

Are you in need of urgent funds for your financial needs? Personal loans can be a viable solution to meet your immediate monetary requirements.

In this comprehensive guide, we will walk you through the step-by-step process of obtaining a personal loan from various lenders, including Bajaj Finserv, HDFC Bank, Canara Bank, and LIC, regardless of your credit score.

We will also cover topics such as instant personal loans in India, getting personal loan statements, top-ups on existing HDFC personal loans, and how to get out of a personal loan if needed. So, let's dive in and explore the MECE framework to exhaustively cover each topic.

How to Get a Bajaj Personal Loan

Bajaj Finserv is a prominent lender in India that offers personal loans with attractive interest rates and flexible repayment options. Follow these steps to apply for a Bajaj personal loan:

-

Check Eligibility: Visit the Bajaj Finserv website or use their mobile app to check your eligibility for a personal loan. Provide your basic details such as age, income, employment status, and credit score.

-

Choose Loan Amount and Tenure: Based on your eligibility, select the desired loan amount and tenure that suits your needs.

-

- Submit Application: Fill out the online application form with accurate details and submit it along with the required documents, including identity proof, address proof, income proof, and bank statements.

-

- Verification and Approval: Bajaj Finserv will verify your application and documents. If approved, you will receive a confirmation and further instructions on the loan disbursal process.

-

- Disbursal: Once the loan is approved, the funds will be disbursed to your registered bank account.

How to Get HDFC Personal Loan Statement

HDFC Bank is a leading private sector bank in India that provides personal loans to individuals with a good credit score. To obtain an HDFC personal loan statement, follow these steps:

-

Visit HDFC Bank's official website or mobile app and log in to your account using your customer ID and password.

-

Navigate to the 'Loans' section and select 'Personal Loan' to view your loan details.

-

Choose the relevant loan account and select 'Statement' to generate your loan statement.

-

You can download the statement in PDF format or request a physical copy from the bank.

How to Get a Personal Loan from Canara Bank

Canara Bank is a renowned public sector bank in India that offers personal loans to eligible borrowers. To apply for a personal loan from Canara Bank, follow these steps:

-

Check Eligibility: Visit the Canara Bank website or visit the nearest branch to check your eligibility for a personal loan. Provide your basic details, employment details, and income details.

-

Choose Loan Amount and Tenure: Based on your eligibility, select the desired loan amount and tenure that fits your requirements.

-

Submit Application: Fill out the application form with accurate details and submit it along with the required documents, including identity proof, address proof, income proof, and bank statements.

-

Verification and Approval: Canara Bank will verify your application and documents. If approved, you will receive a confirmation and further instructions on the loan disbursal process.

-

- Disbursal: Once the loan is approved, the funds will be disbursed to your registered bank account.

Now you can download GroMo App to sell personal loan and other financial products!!

How to Get a Personal Loan with Bad Credit or Poor Credit

Having a bad credit or poor credit score can make it challenging to get a personal loan from traditional lenders. However, there are still options available. Follow these steps to increase your chances of obtaining a personal loan with bad credit or poor credit:

Improve Credit

-

Score: If possible, take steps to improve your credit score by paying off outstanding debts, correcting errors in your credit report, and maintaining a good payment history.

-

Research Alternative Lenders: Look for lenders who specialize in providing personal loans to borrowers with bad credit or poor credit. These may include online lenders, credit unions, or peer-to-peer lending platforms.

-

Provide Collateral or Co-signer: Offering collateral, such as a vehicle or property, or having a co-signer with a good credit history can increase your chances of getting approved for a personal loan despite bad credit.

-

Compare Loan Offers: Get quotes from multiple lenders and compare their interest rates, fees, and terms to find the most suitable option for your needs.

-

Submit Detailed Application: When applying for a personal loan with bad credit, provide detailed and accurate information in your application, including your income, employment history, and reasons for the poor credit score.

-

Be Prepared for Higher Interest Rates: Personal loans for borrowers with bad credit or poor credit usually come with higher interest rates compared to loans for borrowers with good credit. Be prepared for this and factor it into your budget.

-

Repay on Time: Once you are approved for a personal loan with bad credit, make sure to repay it on time to improve your credit score and establish a positive payment history.

GO CHECK OUT!

- Demat Account Meaning: Meaning, Significance, and Other Key Details

- Savings Account Meaning: Important Related Terms

- Vehicle Loan Interest Rate: What Is The Meaning Of Vehicle Loan Interest?

- Job Loss Insurance: What Is Job Loss Insurance?

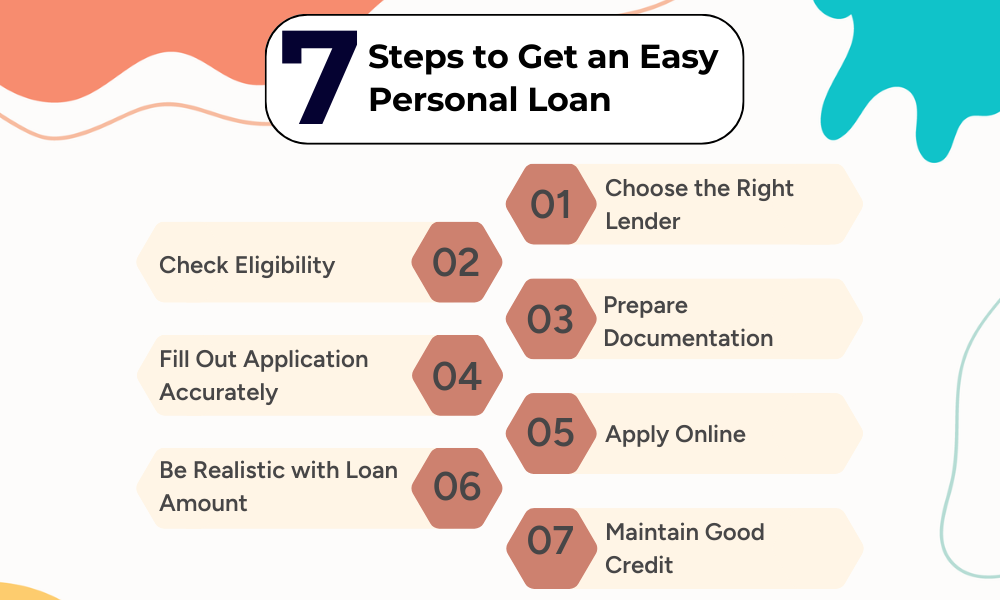

How to Get an Easy Personal Loan

While there is no such thing as an "easy" personal loan, there are certain steps you can take to simplify the process and increase your chances of approval.

Follow these tips to make getting a personal loan easier:

-

Choose the Right Lender: Research and compare different lenders to find the one that offers favorable terms, reasonable interest rates, and a streamlined application process.

-

Check Eligibility: Before applying for a personal loan, check the eligibility requirements of the lender to ensure that you meet the minimum criteria, such as age, income, employment, and credit score.

-

Prepare Documentation: Gather all the necessary documents, including identity proof, address proof, income proof, bank statements, and any other relevant information required by the lender.

-

Fill Out Application Accurately: Double-check the application form and ensure that all the information provided is accurate and complete. Any discrepancies or errors can lead to delays or rejection of your loan application.

-

Apply Online: Many lenders offer online loan applications, which can save time and effort compared to visiting a physical branch. Fill out the online application carefully, providing all the required details.

-

Be Realistic with Loan Amount: Request a loan amount that you can realistically afford to repay based on your current income and expenses. Avoid borrowing more than you need, as it can lead to financial strain in the long run.

-

Maintain Good Credit: A good credit score can make the loan approval process easier. Make sure to pay your bills on time, reduce outstanding debts, and maintain a healthy credit utilization ratio to improve your credit score.

-

Review Loan Terms: Carefully review the loan terms, including the interest rate, repayment tenure, and any additional fees or charges before accepting the loan offer.

-

Repay on Time: Once you are approved for a personal loan, make sure to repay it on time as per the agreed-upon terms to avoid any penalties, late fees, or negative impact on your credit score.

How to Get Instant Personal Loan in India

Instant personal loans are becoming popular in India due to their quick approval and disbursal process. Here's how you can get an instant personal loan in India:

Choose a Reliable Lender: Research and compare different lenders who offer instant personal loans in India. Look for lenders with a good reputation, transparent terms and conditions, and reasonable interest rates.

Check Eligibility: Check the eligibility criteria of the lender to ensure that you meet the minimum requirements, such as age, income, employment, and credit score.

Apply Online: Many lenders offer online application for instant personal loans in India. Fill out the online application form with accurate details, including your personal, employment, and income information.

Provide Required Documents: Upload the required documents, such as identity proof, address proof, income proof, employment details, and bank statements, as per the lender's requirements.

Wait for Approval: The lender will review your application and verify the information provided. If approved, you will receive an instant loan offer with the loan amount, interest rate, and other terms and conditions.

Accept the Loan Offer: If you are satisfied with the loan offer, accept it by signing the loan agreement and submitting any additional documents, if required.

Receive Loan Disbursement: Upon acceptance of the loan offer, the lender will disburse the loan amount to your bank account instantly or within a few hours, depending on the lender's process.

Repay the Loan: Make sure to repay the instant personal loan on time as per the agreed-upon repayment schedule to avoid any penalties, late fees, or negative impact on your credit score.

How to Get Instant Personal Loan in India

If you are in need of urgent funds and looking for ways to get an instant personal loan in India, here are some steps you can follow:

Choose a Lender: Research and compare different lenders in the market who offer instant personal loans. Look for factors such as interest rates, loan amount, repayment tenure, and eligibility criteria to select a lender that suits your requirements.

Check Eligibility: Once you have selected a lender, check their eligibility criteria to ensure that you meet the requirements. Eligibility criteria may include factors such as age, income, employment status, credit score, and more.

Prepare Required Documents: Most lenders will require certain documents for loan verification. These may include identity proof, address proof, income proof, bank statements, and more. Collect and keep these documents ready to speed up the loan application process.

Apply Online: Many lenders offer online loan application options, which can make the process faster and more convenient. Fill out the loan application form accurately with all the required details, and submit the necessary documents online.

Await Loan Approval: Once you have submitted the loan application, the lender will review your application, verify the documents, and assess your creditworthiness. If approved, you will receive a loan offer with the loan amount, interest rate, and repayment terms.

Accept the Loan Offer: Carefully review the loan offer and ensure that you understand the terms and conditions before accepting it. If you are satisfied with the offer, provide your consent by digitally signing the loan agreement.

Receive Loan Disbursement: After accepting the loan offer, the lender will disburse the loan amount to your registered bank account. The disbursal time may vary depending on the lender's policies.

Repay the Loan: Make sure to repay the loan on time as per the agreed-upon repayment schedule to avoid any penalties, late fees, or negative impact on your credit score.

To sell and earn with each sale on as many financial products as you want

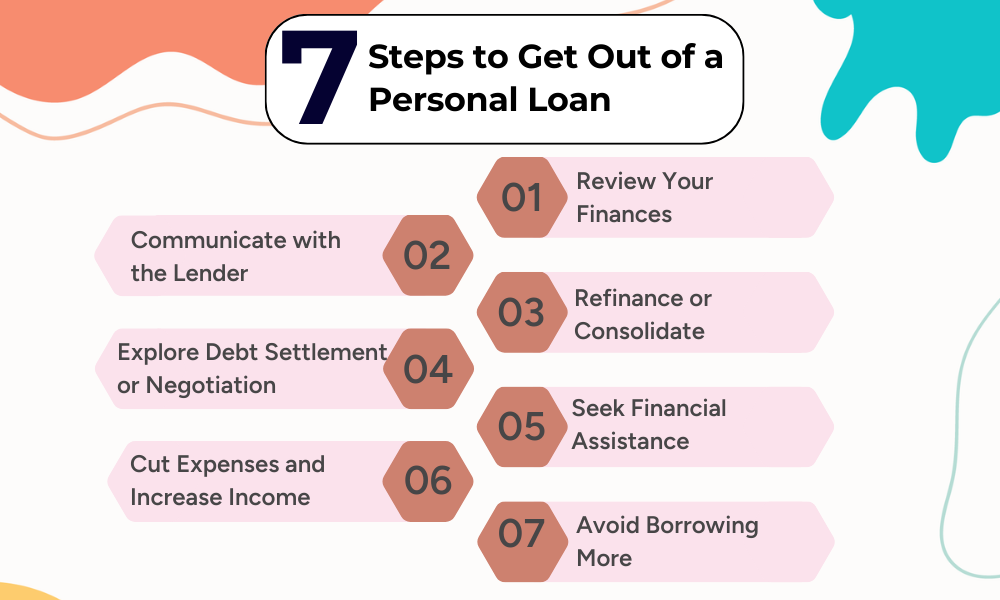

How to Get Out of a Personal Loan

If you're struggling to repay a personal loan, here are some steps you can take to get out of it:

-

Review Your Finances: Take a close look at your financial situation and create a budget to understand your income, expenses, and debts. Identify areas where you can cut expenses and increase your income to allocate more funds towards repaying the personal loan.

-

Communicate with the Lender: If you're facing financial difficulties, communicate with the lender as early as possible. Discuss your situation and explore options such as restructuring the loan, deferring payments, or negotiating a new repayment plan.

-

Refinance or Consolidate: If you have multiple debts, consider refinancing or consolidating them into a single loan with lower interest rates or more favorable repayment terms.

-

Explore Debt Settlement or Negotiation: You may also try negotiating with the lender for a debt settlement or a reduced payoff amount. This may involve negotiating a lump sum payment or a lower interest rate to make the repayment more manageable.

-

Seek Financial Assistance: If you're struggling to repay the personal loan, consider seeking financial assistance from family, friends, or credit counseling agencies. They may be able to provide you with advice, support, or even a loan to help you repay the personal loan.

-

Cut Expenses and Increase Income: Look for ways to cut down on unnecessary expenses and increase your income. This may include reducing discretionary spending, finding additional sources of income, or taking up a part-time job to generate more funds for loan repayment.

-

Avoid Borrowing More: Avoid taking on additional debts or borrowing more money to repay the personal loan. This may only worsen your financial situation and create a cycle of debt.

8.Stay Committed to Repayment: Make sure to stick to the repayment plan agreed upon with the lender and make regular payments on time. This will help you gradually pay off the personal loan and improve your financial situation.

- Seek Professional Help: If you're overwhelmed with debt and struggling to repay the personal loan, consider seeking professional help from a financial advisor or credit counselor. They can provide you with personalized advice and guidance on managing your debts and getting back on track financially.

Remember, getting out of a personal loan may take time and effort, but with careful financial planning, budgeting, and communication with the lender, it is possible to overcome the challenges and repay the loan successfully.

GO CHECK OUT!!

- Job Loss: What Is Job Loss?

- Vehicle Loan- What Is Vehicle Loan?

- Buy Now Pay Later: What Is BNPL?

- Instant Loans: What Are Instant Loans?

KEY TAKEWAYS

-

Understand your financial situation: Before applying for a personal loan, it's important to have a clear understanding of your financial situation. This includes assessing your credit score, calculating your monthly income and expenses, and determining your repayment capacity. This information will help you determine the loan amount you can afford and the interest rate you may be eligible for.

-

Compare loan options: It's essential to compare different loan options from multiple lenders to find the best fit for your needs. Consider factors such as interest rates, loan tenure, processing fees, and prepayment charges. Use online comparison tools or seek assistance from a financial advisor to make an informed decision.

-

Gather required documents: Lenders typically require certain documents, such as proof of identity, address, income, and employment, to process a personal loan application. Make sure to gather all the necessary documents in advance to streamline the application process and improve your chances of approval.

-

Maintain a good credit score: A good credit score is crucial when applying for a personal loan. Lenders assess your creditworthiness based on your credit score, and a higher score may result in better loan terms and conditions. Make sure to pay your bills on time, avoid defaulting on loans or credit card payments, and keep your credit utilization ratio low to maintain a healthy credit score.

-

Read and understand loan terms and conditions: Before signing the loan agreement, thoroughly read and understand the terms and conditions of the loan. Pay attention to aspects such as interest rates, loan tenure, prepayment options, late payment fees, and other charges. Seek clarification from the lender if needed to avoid any surprises later.