Top Providers Of Investment Insurance: 10 Providers List

Investment insurance products, commonly known as investment-linked insurance policies.

Investment insurance products, commonly known as investment-linked insurance policies, provide a unique blend of insurance coverage and investment opportunities. They offer the dual benefits of a life cover and potential growth of your investment to help you achieve your financial goals.

In India, several insurance companies offer these types of products. Below, we explore the top 10 providers of investment insurance products in the country.

1. LIC (Life Insurance Corporation of India)

LIC is one of the oldest and most trusted insurance providers in India. They offer a range of investment-linked insurance plans, including endowment plans and money-back plans, which provide both insurance cover and returns on the investment.

2. ICICI Prudential Life Insurance

ICICI Prudential is known for its diverse range of investment insurance products. Their Unit Linked Insurance Plans (ULIPs) are popular for combining the benefits of life insurance with market-linked returns.

3. HDFC Life

HDFC Life provides a plethora of investment insurance products tailored to meet various life stage requirements. Their range of ULIPs offer potentially high returns by investing a portion of the premiums in equity or debt markets.

4. SBI Life Insurance

SBI Life offers a range of investment insurance products, including ULIPs and traditional endowment plans. They have plans suitable for different investment horizons and risk appetites.

5. Bajaj Allianz Life Insurance

Bajaj Allianz Life Insurance offers a mix of traditional and unit-linked investment insurance plans. Their goal-based ULIPs are designed to cater to specific financial goals like retirement or child's education.

6. Max Life Insurance

Max Life Insurance offers a range of investment insurance products, including ULIPs and child plans, providing long-term savings and insurance coverage.

7. Kotak Life Insurance

Kotak Life Insurance offers a range of investment plans that cater to different financial goals and risk profiles. Their ULIPs offer multiple fund options to choose from.

8. Tata AIA Life Insurance

Tata AIA offers a range of investment insurance products, including ULIPs and traditional wealth creation plans. Their plans offer flexibility in premium payment and fund selection.

9. Reliance Nippon Life Insurance

Reliance Nippon Life Insurance offers a variety of investment insurance products, including ULIPs, child plans, and retirement plans. They offer a wide choice of funds for investment.

10. Aditya Birla Sun Life Insurance

Aditya Birla Sun Life Insurance provides a range of investment insurance products including ULIPs, savings plans, and retirement plans. They offer customized solutions based on life stage and financial goals.

To sell this product, and many other financial products. DOWNLOAD GROMO. Where you can sell and earn a substantial income sitting at home

Investment insurance products can be a good way to achieve dual benefits of life cover and potential growth of your investment. However, it's crucial to understand your financial goals, risk appetite, and investment horizon before choosing a plan. Always read the terms and conditions carefully and consider seeking professional financial advice if needed.

India has a plethora of reputable insurance providers offering a wide range of investment insurance products. The best company for you will depend on your individual needs and circumstances. It's advisable to compare different plans and providers before making a decision.

CHECK OUT!!

Job Loss Insurance Meaning: Financial Planning Tips

Difference Between Insurance and Investment: Explained

How To Get Instant Loans: Step By Step Guide

Health Insurance Meaning: An Essential Financial Safety Net

Deep Dive into Top Providers

Having discussed the top 10 providers of investment insurance products in India, let's now delve into more detail about each provider and their standout investment insurance plans.

1. LIC (Life Insurance Corporation of India)

LIC offers a variety of investment insurance plans, one of which is the New Endowment Plan. This plan provides financial support in the form of a lump sum to the policyholder at the end of the policy term or to the nominee in case of the policyholder's untimely demise.

2. ICICI Prudential Life Insurance

ICICI Prudential's ICICI Pru iProtect Smart is a comprehensive term insurance plan that offers health cover against 34 critical illnesses. In addition, it provides life cover and an option for increasing income replacement.

3. HDFC Life

HDFC Life Click 2 Wealth is a ULIP that provides market-linked returns and life cover. It offers 10 fund options with different risk profiles, allowing the policyholder to choose based on their risk tolerance and investment goals.

4. SBI Life Insurance

SBI Life - eWealth Insurance is an online ULIP that offers twin benefits of life insurance cover and market-linked returns. It provides two plan options: Growth and Balanced, catering to different risk appetites.

5. Bajaj Allianz Life Insurance

Bajaj Allianz Life Goal Assure is a ULIP that offers the dual benefit of life cover and return on investment. It offers a choice of eight funds and provides return of mortality charges at maturity.

6. Max Life Insurance

Max Life Online Savings Plan is a ULIP that provides life insurance cover and savings growth potential. It offers five fund options, allowing policyholders to invest based on their risk appetite.

7. Kotak Life Insurance

Kotak Life e-Investment Insurance Plan is an online ULIP that offers life cover and returns linked to the capital market. It provides seven fund options and flexibility in premium payment.

8. Tata AIA Life Insurance

Tata AIA Life Insurance Wealth Pro Plan is a ULIP that offers comprehensive life insurance coverage and the potential for high returns. It provides seven fund options to cater to the investment needs of individuals.

9. Reliance Nippon Life Insurance

Reliance Nippon Life Premier Wealth Insurance Plan is a ULIP that provides life cover and an opportunity to invest in one or more of the eight available fund options.

10. Aditya Birla Sun Life Insurance

Aditya Birla Sun Life Insurance Wealth Secure Plan is a ULIP that provides the dual benefits of life insurance cover and wealth creation. It provides flexibility in premium payment and fund selection.

Choosing the Right Provider

While all these providers offer excellent investment insurance products, the choice largely depends on your financial goals, risk tolerance, and investment horizon. It's essential to compare the various plans, their features, benefits, and premiums before making a decision.

Remember, investment insurance is a long-term commitment, and it's essential to choose a plan that aligns with your financial objectives and risk appetite. Whether you're planning for your retirement, your child's education, or simply aiming to grow your wealth, there's an investment insurance product out there for you.

A Closer Look at Investment Insurance Products

Having reviewed the top providers of investment insurance products in India, it's crucial to understand what these products entail. Investment insurance products, often known as Unit Linked Insurance Plans (ULIPs), combine the benefits of investment and insurance in a single plan. They offer the dual advantage of life cover and the opportunity to grow money by investing in various fund options.

Understanding ULIPs

ULIPs are insurance products that provide the benefits of both insurance and investment. A part of the premium paid goes towards life insurance and the remaining portion is invested in debt, equity, or balanced funds. These funds are managed by fund managers of the insurance company.

ULIPs have a lock-in period of five years, which means that the policyholder cannot withdraw the invested amount before this period. After the lock-in period, the policyholder has the flexibility to make partial withdrawals.

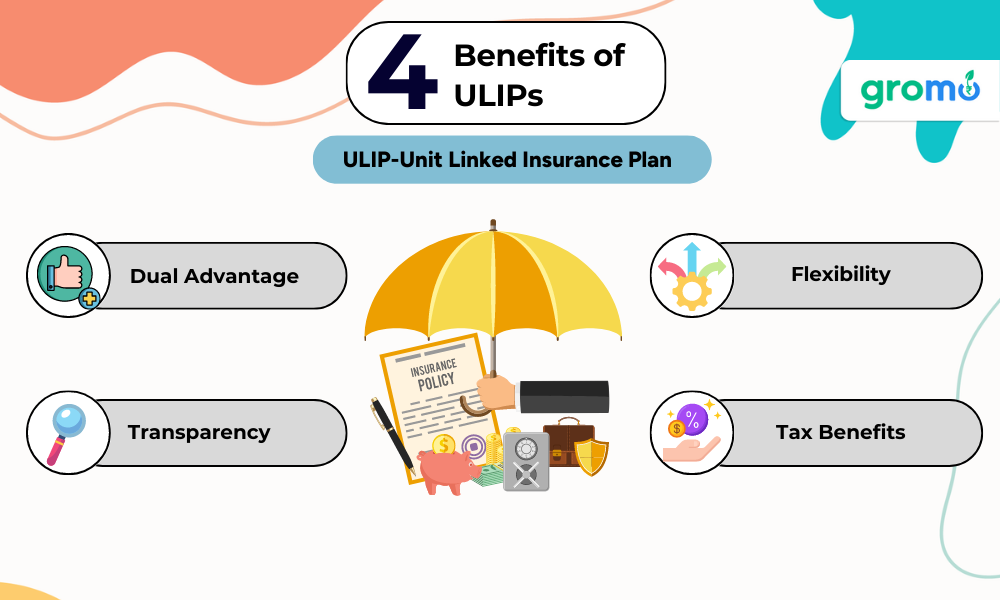

Benefits of ULIPs

ULIPs provide several benefits to policyholders:

Dual Advantage: ULIPs provide life cover and an investment opportunity, offering a comprehensive financial solution.

Flexibility: Policyholders have the flexibility to switch between fund options based on their risk appetite and market conditions.

Transparency: ULIPs offer transparency as the policyholder knows where and how much of their money is invested.

Tax Benefits: Premiums paid towards ULIPs are eligible for tax deductions under Section 80C of the Income Tax Act, and the payout received upon maturity is tax-free under Section 10(10D).

ULIPs vs Mutual Funds

While ULIPs and mutual funds both offer the benefit of investing in market-linked instruments, they differ in various aspects:

Insurance Cover: ULIPs provide a life insurance cover, while mutual funds do not.

Lock-in Period: ULIPs have a lock-in period of five years, while most mutual funds (except tax-saving mutual funds) do not have a lock-in period.

Charges: ULIPs involve several charges such as policy administration charges, fund management charges, mortality charges, etc. Mutual funds involve fewer charges, mainly fund management charges.

Taxation: ULIPs offer more tax benefits as compared to mutual funds.

Important Factors to Consider While Choosing a ULIP

When choosing a ULIP, it's important to consider several factors:

Financial Goals: Choose a ULIP that aligns with your financial goals, whether it's wealth creation, retirement planning, or child's education.

Risk Appetite: Consider your risk tolerance as ULIPs invest in various funds ranging from low-risk debt funds to high-risk equity funds.

Charges: Be aware of the various charges involved in ULIPs and how they will affect your returns.

Fund Performance: Look at the past performance of the fund options available in the ULIP.

Investment insurance products or ULIPs can be an excellent financial tool for those looking for the dual benefits of insurance and investment. With a multitude of options available in the market, it's vital to choose a plan that best suits your financial needs and goals. Always remember to read the fine print and understand the terms and conditions before purchasing a ULIP.

Looking for an app for earning online? GroMo is your answer! Now earn with each sale by selling various kinds of financial products

The Role of ULIPs in Financial Planning

In the world of personal finance, ULIPs can play a significant role in financial planning. They serve as a hybrid product that caters to the need for long-term savings and insurance coverage. While understanding the benefits and structure of ULIPs, it's also important to see how these investment insurance products fit into the broader picture of financial planning.

Retirement Planning

ULIPs can be a suitable vehicle for retirement planning. By consistently investing in a ULIP, you can accumulate a substantial corpus by the time you retire. The compounded returns of the invested portion can contribute significantly to your retirement savings. Some ULIPs also provide the option of systematic withdrawals after maturity, providing a regular income stream during retirement.

Child's Education

ULIPs can also serve as a tool for securing your child's future educational needs. Given the rising costs of higher education, having a ULIP can ensure that you have a substantial corpus when your child reaches the age of higher education. In case of an unfortunate event, the life cover will ensure that your child's education is not disrupted.

Wealth Creation

ULIPs can be an effective tool for wealth creation. With the potential for high returns over the long term, disciplined investing in ULIPs can help in building a significant investment portfolio. The option of investing in different types of funds allows you to maximize returns based on your risk tolerance and market conditions.

Life Cover

While ULIPs serve as an investment tool, the life insurance cover they provide should not be overlooked. The life cover ensures financial security for your family in case of an unfortunate event. It's a crucial aspect that provides a safety net and ensures that your family's financial needs will be taken care of.

Tax Planning

The premium paid towards ULIPs is eligible for tax deduction under Section 80C of the Income Tax Act. Furthermore, the maturity proceeds from ULIPs are tax-free under Section 10(10D). This dual tax benefit makes ULIPs an attractive option for tax planning purposes.

ULIPs, as an investment insurance product, can serve various financial needs, making them a versatile addition to your financial portfolio. However, like any financial product, it's essential to understand your financial needs, risk tolerance, and investment horizon before investing in a ULIP. A well-informed decision can help you leverage ULIPs to achieve your financial goals effectively.

CHECK OUT!

- Buy Now Pay Later Meaning: Guide To All Reated Terms

- Vehicle Loan Meaning:Guide To Understand Vehicle Loans

- Buy Now Pay Later App: Popular Apps In India

- Demat Account Meaning: Meaning, Significance, and Other Key Details

KEY TAKEAWAYS

-

Investment insurance products like ULIPs are versatile financial tools that can serve various needs, including retirement planning, wealth creation, child's education, and tax planning.

-

ULIPs provide a dual benefit of life insurance cover and investment returns, which can lead to substantial wealth accumulation over the long term.

-

The flexibility to switch between different fund types based on market conditions and risk tolerance makes ULIPs a preferred choice for many investors.

-

ULIPs offer tax benefits under Section 80C for premiums paid and Section 10(10D) for maturity proceeds, making them an attractive option for tax planning.

-

Before investing in any investment insurance product like a ULIP, understanding your financial needs, risk tolerance, and investment horizon is critical for achieving desired financial goals.