Term Life Insurance Meaning: Types, Pros, Cons, And More

Term life insurance is a type of life insurance policy that provides coverage for a fixed period of time or term, usually ranging from one to thirty years

Term life insurance is a type of life insurance policy that provides coverage for a fixed period of time or term, usually ranging from one to thirty years. The policy pays out a death benefit to the beneficiaries named by the policyholder if the insured person dies within the term of the policy.

Unlike other types of life insurance policies, such as whole life insurance or universal life insurance, term life insurance does not build up any cash value over time. This makes it generally less expensive than other types of life insurance and more appropriate for individuals who are primarily concerned with providing financial protection for their loved ones in case of an unexpected death.

Term Life Insurance: All You Need to Know

In the world of insurance, Term Life Insurance is a popular and affordable option for many people. It provides protection for a specific period of time, which is why it's called "term" insurance. If the policyholder dies during the term of the policy, their beneficiaries receive a death benefit payout. However, if the policyholder outlives the term, the coverage ends, and no benefits are paid.

Term Life Insurance is generally preferred by those who want to ensure financial security for their family and loved ones in the event of their untimely death. It is a good option for people who have dependents, such as children or elderly parents, who rely on their income for financial support.

In this article, we will cover everything you need to know about Term Life Insurance, including how it works, the types of policies available, and the pros and cons of this type of insurance.

To sell this product, and many other financial products. DOWNLOAD GROMO. Where you can sell and earn a substantial income sitting at home

How does Term Life Insurance work?

Term Life Insurance works by providing coverage for a set period of time, typically ranging from 5 to 30 years. During this time, the policyholder pays a fixed premium to the insurance company. If the policyholder dies during the term, the insurance company pays out a death benefit to the beneficiaries named in the policy. The amount of the death benefit is determined by the policyholder when they purchase the policy.

Once the term of the policy ends, the coverage expires, and the insurance company no longer pays any benefits. At this point, the policyholder has the option to renew the policy, but the premium will likely increase because the policyholder is older and may have developed health conditions.

Types of Term Life Insurance policies

There are two main types of Term Life Insurance policies: Level Term and Decreasing Term.

Level Term

Level Term policies provide a fixed death benefit payout throughout the term of the policy. The premium remains the same throughout the policy term, making it easier for policyholders to budget for the premium payments. Level Term policies are popular among those who want to ensure that their beneficiaries receive a fixed amount of money in the event of their death.

Decreasing Term

Decreasing Term policies provide a decreasing death benefit payout throughout the term of the policy. The premium remains the same throughout the policy term, but the death benefit decreases over time. Decreasing Term policies are popular among those who want to ensure that their beneficiaries receive enough money to cover specific expenses, such as a mortgage or other debt, that will decrease over time.

CHECK OUT!!

- Job Loss Insurance Meaning: Financial Planning Tips

- Difference Between Insurance and Investment: Explained

- How To Get Instant Loans: Step By Step Guide

- Health Insurance Meaning: An Essential Financial Safety Net

Pros and Cons of Term Life Insurance

Pros

Affordable premiums: Term Life Insurance is generally more affordable than other types of life insurance, such as Whole Life Insurance, which makes it accessible to more people.

Flexibility:

Term Life Insurance provides coverage for a specific period of time, which makes it flexible. Policyholders can choose the term that best fits their needs and budget.

Simple:

Term Life Insurance is straightforward and easy to understand, making it a good option for those who want a simple insurance policy.

Cons

No cash value: Unlike Whole Life Insurance, Term Life Insurance does not build cash value over time. Once the policy term ends, the coverage ends, and there is no payout.

No investment component:

Term Life Insurance does not have an investment component, which means that the policyholder cannot earn dividends or interest on their premiums.

Limited coverage:

Term Life Insurance provides coverage for a specific period of time, which may not be sufficient for those who want long-term coverage.

Term Life Insurance is a popular and affordable option for those who want to ensure financial security for their loved ones in the event of their death. It provides coverage for a specific period of time, and if the policyholder dies during the term.

Who should buy term life insurance?

Anyone who has dependents and/or liabilities should consider buying term life insurance. This includes married individuals with children, single parents, individuals with outstanding loans or mortgages, and anyone with financial dependents.

In the event of the policyholder’s untimely death, the beneficiaries of the policy will receive a lump-sum payout that can help cover financial obligations such as household expenses, children’s education, and outstanding debts.

How much term life insurance should you buy?

The amount of term life insurance you need depends on various factors such as your income, debts, expenses, and financial goals. Generally, it is recommended to purchase a policy that covers 10-12 times your annual income. For instance, if your annual income is $50,000, then you should consider purchasing a policy worth $500,000 to $600,000.

However, this is just a general guideline, and the actual amount of coverage you need may vary based on your specific circumstances. You should consider factors such as your outstanding debts, mortgage, children's education expenses, and your family's future financial needs when determining the amount of coverage you require.

How to choose the right term life insurance policy?

When selecting a term life insurance policy, it is essential to consider factors such as coverage amount, premium cost, policy duration, and the insurer’s reputation. Here are some tips to help you choose the right policy:

Determine the coverage amount you need based on your financial situation and future goals.

Shop around and compare policies from different insurers to find the one that meets your needs and budget.

Consider the premium cost and choose a policy that you can afford to pay over the policy duration.

Check the policy duration and ensure that it covers you for the necessary period.

Check the insurer's reputation by reviewing customer reviews and ratings.

Conclusion

Term life insurance is an essential financial planning tool that provides protection to your loved ones in case of an unforeseen event. It is a cost-effective way to secure your family's future financial needs and provide peace of mind. By understanding the basics of term life insurance and considering your specific needs and circumstances, you can choose the right policy that meets your financial goals.

Tips for Choosing the Right Term Life Insurance Policy

When it comes to choosing a term life insurance policy, there are several factors to consider. Here are some tips to help you choose the right policy for your needs:

Determine your coverage needs:

The first step in choosing a term life insurance policy is to determine how much coverage you need. This will depend on your financial obligations, such as your mortgage, debts, and future expenses like college tuition for your children. It’s important to choose a coverage amount that will adequately protect your loved ones.

Decide on the term length:

Term life insurance policies are available in a range of term lengths, typically ranging from 5 to 30 years. Consider your current and future financial obligations when choosing the length of your term life policy.

Compare policies:

Once you have determined your coverage needs and term length, it’s important to compare policies from different insurance providers. Compare the premium costs, coverage amounts, and policy terms to find the right policy for you.

Check the insurance provider’s ratings: Make sure to check the insurance provider’s financial ratings before purchasing a policy. A strong financial rating indicates that the provider is financially stable and will be able to pay out claims.

Read the fine print:

Be sure to read the policy details carefully, including any exclusions or limitations. Ask questions if anything is unclear, and make sure you understand the terms and conditions of the policy before making a final decision.

By following these tips, you can choose the right term life insurance policy to protect your loved ones and give you peace of mind. Remember, term life insurance is an important investment in your family’s future, so take the time to choose the right policy for your needs.

How Does Term Life Insurance Work?

Term life insurance is one of the simplest forms of life insurance. Here’s how it works:

1.You purchase a policy:

You purchase a term life insurance policy for a specific period of time, usually 10, 20, or 30 years. During this time, the premium (or the amount you pay for the policy) remains level.

2.You pay the premium: You pay the premium on a regular basis, such as monthly or annually, to keep the policy in force.

3.If you die during the policy term:

If you pass away during the term of the policy, your beneficiary will receive the death benefit, which is the amount of money specified in the policy.

4.If you don’t die during the policy term: If you outlive the policy term, the policy expires, and you don’t receive any money back. However, you can renew the policy at the end of the term or convert it into a permanent life insurance policy.

5.Your premiums may increase: If you choose to renew your policy at the end of the term, your premiums may increase based on your age and health status at the time of renewal.

6.You may need to provide evidence of insurability: If you choose to convert your term policy into a permanent policy, you may need to provide evidence of insurability, such as a medical exam or answering health questions.

Benefits of Term Life Insurance

There are several benefits to purchasing a term life insurance policy:

Affordability: Term life insurance is typically more affordable than permanent life insurance, making it a great option for young families or individuals on a budget.

Flexibility: Term life insurance policies are typically available in a variety of lengths, from 10 to 30 years, allowing you to choose the policy that best fits your needs.

Simplicity: Term life insurance is straightforward and easy to understand, making it a great option for those who want simple coverage.

Customizability: Term life insurance policies can often be tailored to your specific needs, with options such as level or decreasing death benefits, and the ability to convert to a permanent policy.

Peace of mind: By purchasing a term life insurance policy, you can have peace of mind knowing that your loved ones will be financially protected in the event of your unexpected passing.

In the next section, we’ll take a closer look at some of the common types of term life insurance policies available.

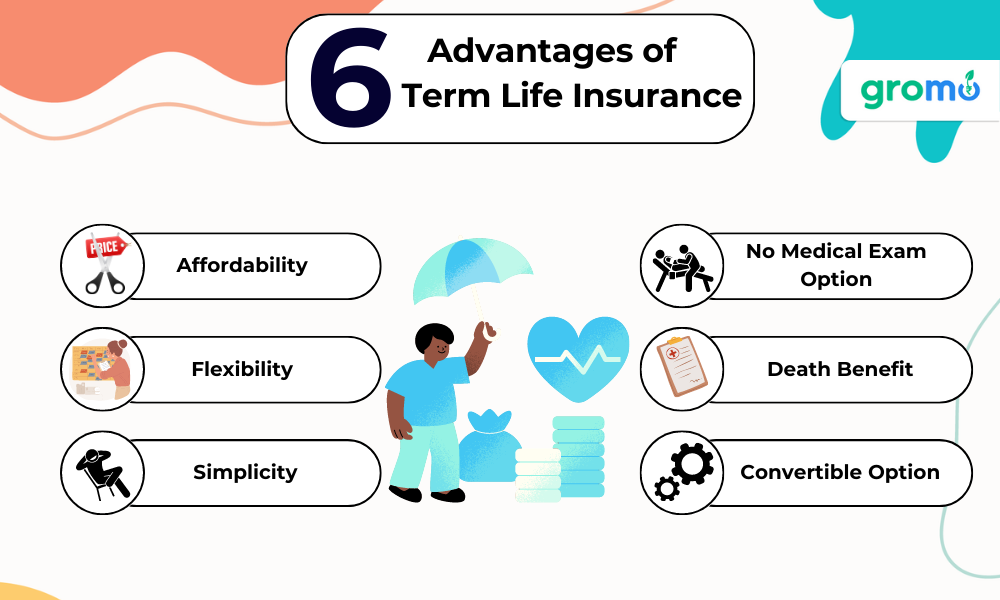

Advantages of Term Life Insurance

Affordability: The most significant advantage of term life insurance is its affordability. The premiums for term life insurance policies are much lower than those for permanent life insurance policies. This makes it easier for individuals to purchase a policy that fits their budget.

Flexibility: Term life insurance policies are flexible, meaning that individuals can choose the duration of the policy, coverage amount, and premium payments based on their needs. This allows individuals to customize their policy to fit their unique situation.

Simplicity: Term life insurance policies are simple and easy to understand. Unlike permanent life insurance policies, term policies do not have any complicated investment components or cash value accumulation. This makes it easier for individuals to understand what they are paying for and what their policy covers.

Death Benefit: The death benefit of a term life insurance policy can provide financial security to the beneficiaries in case of the insured’s death. The death benefit can be used to pay off any outstanding debts, cover the cost of funeral expenses, or provide for the family’s financial needs.

Convertible Option: Some term life insurance policies come with a convertible option. This means that policyholders can convert their term policy into a permanent policy without undergoing a medical exam or providing any other evidence of insurability. This can be a valuable option for individuals who may want to switch to a permanent policy in the future.

No Medical Exam Option: Some insurers offer term life insurance policies that do not require a medical exam. This can be a convenient option for individuals who may have health issues that could make it difficult for them to qualify for a traditional policy.

CHECK OUT!

Disadvantages of Term Life Insurance

Limited Coverage Period: The most significant disadvantage of term life insurance is that the coverage period is limited. Once the policy term ends, the coverage ceases, and there is no payout. Individuals who need coverage beyond the term may need to purchase a new policy, which could be more expensive due to age and health status.

No Cash Value Accumulation: Unlike permanent life insurance policies, term life insurance policies do not have a cash value component. This means that policyholders do not have the option to borrow against the policy or withdraw cash value.

Premium Increases: Some term life insurance policies come with a renewable feature, which allows policyholders to renew the policy at the end of the term. However, the premiums for the renewed policy could be significantly higher, depending on the age and health status of the insured at the time of renewal.

Limited Riders: Term life insurance policies typically come with limited riders compared to permanent life insurance policies. Riders such as long-term care or disability income riders may not be available with term policies.

No Investment Component: Unlike permanent life insurance policies, term life insurance policies do not have an investment component. This means that policyholders do not have the option to invest in the stock market or other investment vehicles.

Who Should Buy Term Life Insurance?

Term life insurance is an excellent option for individuals who need coverage for a limited period, such as parents with young children, individuals with outstanding debts or mortgages, or business owners with loans or partnerships.

Term life insurance policies can provide financial security for the insured’s beneficiaries in case of an unexpected death. The coverage amount and term can be customized to fit the insured’s unique situation, and the premiums are much lower than those for permanent life insurance policies.

However, individuals who need coverage for the rest of their lives or who want an investment component may want to consider permanent life insurance policies instead. It’s essential to consider one’s financial goals and needs before deciding on a life insurance policy.

KEY TAKEAWAYS

-

Term life insurance is a type of life insurance that provides coverage for a specific period of time, known as the term of the policy.

-

The policyholder pays a premium to the insurance company, which is then used to provide a death benefit to the policyholder's beneficiaries in the event of their death during the term of the policy.

-

Term life insurance is often a more affordable option than other types of life insurance, as it provides coverage for a set period of time and does not include an investment component.

-

Term life insurance policies can be customized to meet the specific needs of the policyholder and their beneficiaries, with options such as level term, decreasing term, and renewable term.

-

It is important to carefully consider the amount of coverage needed, the length of the term, and the financial stability of the insurance provider when selecting a term life insurance policy.