Benefits Of Health Insurance In India: 5 Benefits Explained

Protect your health and your wallet with health insurance. Enjoy peace of mind knowing you're covered for medical expenses. Learn more about the benefits.

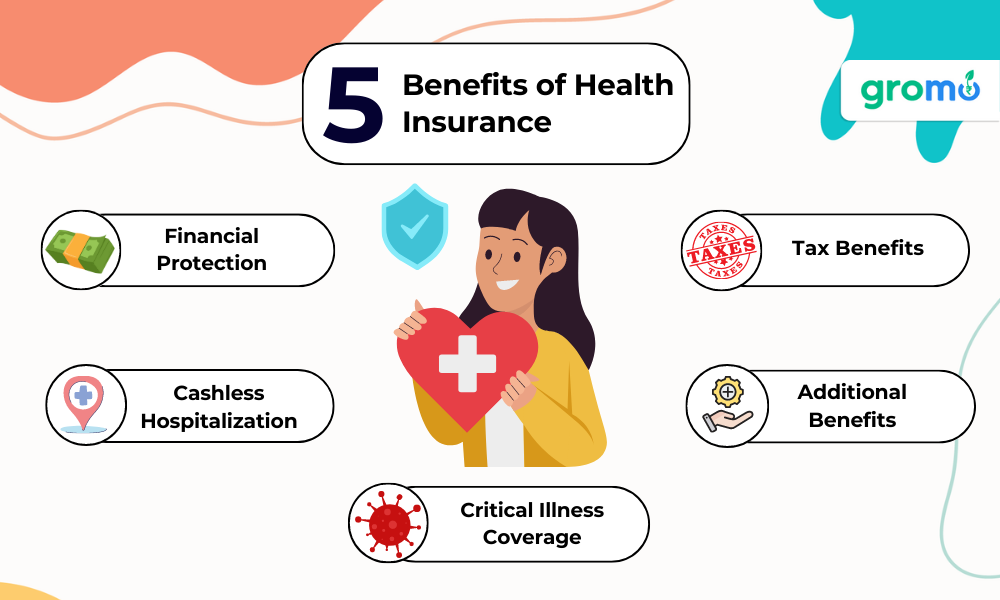

Health insurance policies offer a wide range of benefits to policyholders in India. Some of the key benefits include:

Benefits Of Health Insurance

-

Financial Protection: Health insurance provides financial coverage against medical expenses incurred due to illness, injury, or hospitalization. It safeguards the policyholder and their family against unexpected medical expenses, which can be quite expensive in India.

-

Cashless Hospitalization: Health insurance policies often provide cashless hospitalization facilities at empaneled hospitals. This ensures that the policyholder does not have to worry about making arrangements for the hospitalization expenses, and the insurance company settles the bill directly with the hospital.

-

Tax Benefits: Health insurance policies also offer tax benefits to policyholders under Section 80D of the Income Tax Act. Policyholders can claim deductions of up to INR 25,000 for themselves and their dependents, and an additional INR 25,000 for their parents who are senior citizens.

-

Critical Illness Coverage: Health insurance policies also offer critical illness coverage that provides financial protection against life-threatening illnesses such as cancer, kidney failure, and heart diseases. This coverage helps the policyholder and their family cope with the high cost of treatment and care.

-

Additional Benefits: Health insurance policies may also offer additional benefits such as maternity coverage, pre and post-hospitalization expenses, ambulance charges, and day care procedures.

Overall, health insurance and motor insurance policies are essential for individuals in India to protect themselves and their assets against unforeseen events. With the increasing awareness and availability of insurance policies, more individuals are opting for insurance to safeguard themselves and their families.

It is important to choose the right insurance policy, maintain a healthy lifestyle, and renew the policy on time to ensure uninterrupted coverage.

It is also important for individuals to understand the importance of making informed decisions while purchasing insurance policies. Insurance agents may sometimes push policies that may not be suitable for the individual's needs or provide incomplete information about the policy. It is advisable to research different policies, compare them, and make an informed decision based on one's requirements and financial situation.

Now you can sell health insurance with the GroMo App that gives you access to many other financial products.

In addition to this, individuals should also be aware of the frauds and scams that are prevalent in the insurance sector. They should avoid falling prey to fraudulent schemes that promise unrealistic benefits and returns. It is advisable to purchase insurance policies from reputable and trustworthy insurance companies and agents.

It is important to choose the right insurance policy, renew it on time, and make informed decisions while purchasing insurance policies. With the increasing availability of insurance policies and government initiatives, more individuals in India are opting for insurance to protect themselves and their families.

Furthermore, it is important for policyholders to understand the terms and conditions of their insurance policies and the process for making a claim. In case of a claim, policyholders should inform the insurance company at the earliest and provide all the necessary documents and information. Delay in informing the insurance company or providing incomplete information may result in delay or rejection of the claim.

In addition to this, policyholders should also maintain a record of their medical history and vehicle maintenance history. This can help in providing accurate information to the insurance company and can speed up the claim settlement process.

Overall, health insurance and motor insurance policies are important tools for individuals in India to protect themselves and their assets against unforeseen events. It is important to choose the right insurance policy, renew it on time, and make informed decisions while purchasing insurance policies.

Lastly, individuals should also stay updated with the latest developments in the insurance sector and changes in the regulations and policies. This can help them make informed decisions while purchasing insurance policies and can ensure that they are getting the best value for their money.

It is important to choose the right insurance policy, renew it on time, and make informed decisions while purchasing insurance policies. In addition to this, policyholders should understand the terms and conditions of their policies, maintain a healthy lifestyle, and stay updated with the latest developments in the insurance sector. By following these guidelines, individuals can ensure that they have the necessary financial protection and peace of mind.

Overall, the benefits of health insurance and motor insurance policies in India are significant and cannot be overstated. With the rising costs of healthcare and car repairs, it is becoming increasingly important for individuals to protect themselves and their assets against unforeseen events.

ALSO CHECK OUT-

- Personal Loan: What Is Personal Loan?

- How To Buy The Best Health Insurance In India

- Benefits Of Demat Account: 5 Benefits That You Should Know

- Term Life Insurance: What Is Term Life Insurance?

Additional Benefits Of Health Insurance

Mental Health Coverage

Health insurance doesn't just cover physical ailments. An often-overlooked benefit of many health insurance policies is mental health coverage. In a world where mental health has become a critical concern, this is an aspect of health insurance that needs recognition. Mental health coverage can include a variety of treatments like psychotherapy, counseling, inpatient mental health services, and substance use disorder treatment.

In India, mental health coverage is slowly gaining recognition as an integral part of health insurance. The Mental Healthcare Act, 2017, mandates that all insurance companies must provide coverage for mental health conditions, treating them at par with physical health conditions. This has opened doors for policyholders to access a host of services like psychiatric outpatient visits, residential treatment, and mental health crisis management, contributing to comprehensive mental wellbeing.

The cost of mental health care can be prohibitive, but with its inclusion in health insurance, access to these necessary services becomes significantly more feasible. It's important to check the specifics of what mental health treatments are covered under your policy, as it can vary between insurance providers.

Coverage for Alternative Medicine

Along with the conventional medical treatments, there's a growing interest in alternative or complementary medicine techniques such as Ayurveda, Yoga & Naturopathy, Unani, Siddha, and Homeopathy (AYUSH). Recognizing this trend, many health insurance companies have started offering coverage for alternative medicine treatments.

Under the AYUSH benefit, policyholders can claim expenses for treatments taken under these alternative medicine branches, provided the treatment is undergone in a government hospital or in any institute recognized by the government and/or accredited by Quality Council of India/National Accreditation Board on Health. This inclusion allows policyholders to choose the type of treatment they want and promotes holistic healing.

However, the coverage for alternative medicine often comes with certain stipulations like sub-limits and it may not include all forms of treatments or all illnesses. Therefore, it's advisable to thoroughly read the policy document to understand the extent of the coverage.

Health insurance is not just a safety net for physical health crises, it is also an enabler of holistic health and wellness. By extending coverage to mental health and alternative medicine, insurance companies are recognizing the importance of comprehensive health and wellness, thereby encouraging policyholders to take a proactive approach to their wellbeing. This broader approach to health coverage highlights the evolving nature of healthcare and the insurance industry's response to it. It underscores the importance of having health insurance as a critical tool in managing not just our physical health, but mental and holistic health as well.

Insurance policies provide a safety net and help individuals and their families cope with the financial burden of medical treatment and car damages. With the increasing awareness and availability of insurance policies, more individuals in India are opting for insurance to safeguard themselves and their families.

The government of India has also introduced various schemes and initiatives to encourage individuals to opt for health insurance. The Pradhan Mantri Jan Arogya Yojana (PM-JAY) is a flagship scheme launched by the government that provides health insurance coverage of up to INR 5 lakhs to economically weaker sections of the society. This scheme has benefitted millions of families in India who could not afford medical treatment.

In addition to this, the government also provides tax benefits to individuals who purchase health insurance policies. The premiums paid towards health insurance policies are eligible for tax deductions under Section 80D of the Income Tax Act. This has encouraged more individuals to purchase health insurance policies and avail the benefits offered by them.

Health insurance and motor insurance policies have become an integral part of the financial planning process for individuals in India. The benefits offered by these policies provide a safety net against unexpected events and help individuals and their families cope with the financial burden of medical treatment and car damages.

It is important for individuals to choose the right insurance policy and renew it on time to ensure uninterrupted coverage. With the increasing awareness and availability of insurance policies, more individuals in India are opting for insurance to protect themselves and their assets.

In addition to this, individuals should also maintain a healthy lifestyle and take preventive measures to reduce the risk of illnesses and accidents. This can help in reducing the frequency and severity of medical expenses and car damages, thus reducing the burden on insurance policies.

Health insurance and motor insurance policies are important tools for individuals in India to protect themselves and their assets against unforeseen events. The benefits offered by these policies provide financial protection and peace of mind to policyholders. With the increasing availability of insurance policies and government initiatives, more individuals in India are opting for insurance to safeguard themselves and their families.

Overall, health insurance and motor insurance policies are essential for individuals in India to protect themselves and their assets against unforeseen events. With the increasing awareness and availability of insurance policies, more individuals are opting for insurance to safeguard themselves and their families.

Insurance agents may sometimes push policies that may not be suitable for the individual's needs or provide incomplete information about the policy. It is advisable to research different policies, compare them, and make an informed decision based on one's requirements and financial situation.

In addition to this, individuals should also be aware of the frauds and scams that are prevalent in the insurance sector. They should avoid falling prey to fraudulent schemes that promise unrealistic benefits and returns. It is advisable to purchase insurance policies from reputable and trustworthy insurance companies and agents.

Health insurance and motor insurance policies are crucial for individuals in India to safeguard themselves and their assets against unforeseen events. The benefits offered by these policies provide financial protection and peace of mind to policyholders.

It is important to choose the right insurance policy, renew it on time, and make informed decisions while purchasing insurance policies. With the increasing availability of insurance policies and government initiatives, more individuals in India are opting for insurance to protect themselves and their families.

Overall, health insurance and motor insurance policies are important tools for individuals in India to protect themselves and their assets against unforeseen events. It is important to choose the right insurance policy, renew it on time, and make informed decisions while purchasing insurance policies.

GO CHECK OUT!!

- Health Insurance: What Is Health Insurance?

- Need Guidance In Buying Health Insurance - GroMo Might Be The Solution

- How To Apply For A Personal Loan With Low CIBIL Score?

KEY TAKEWAYS

-

Health insurance provides financial protection against unexpected medical expenses and can help prevent financial hardship.

-

Having health insurance can improve access to medical care and encourage individuals to seek preventive care and early treatment.

-

Health insurance plans can vary widely in terms of coverage and cost, so it's important to carefully evaluate options before selecting a plan.

-

Some health insurance plans offer additional benefits such as wellness programs, telemedicine services, and prescription drug discounts.

-

Understanding your health insurance benefits and how to use them can help you get the most out of your coverage and avoid unexpected costs.