Top Providers Of Credit Cards: Top 10 Providers

Top 10 Providers of Credit Cards in India Credit cards have become an essential financial tool in today's world, offering convenience, flexibility.

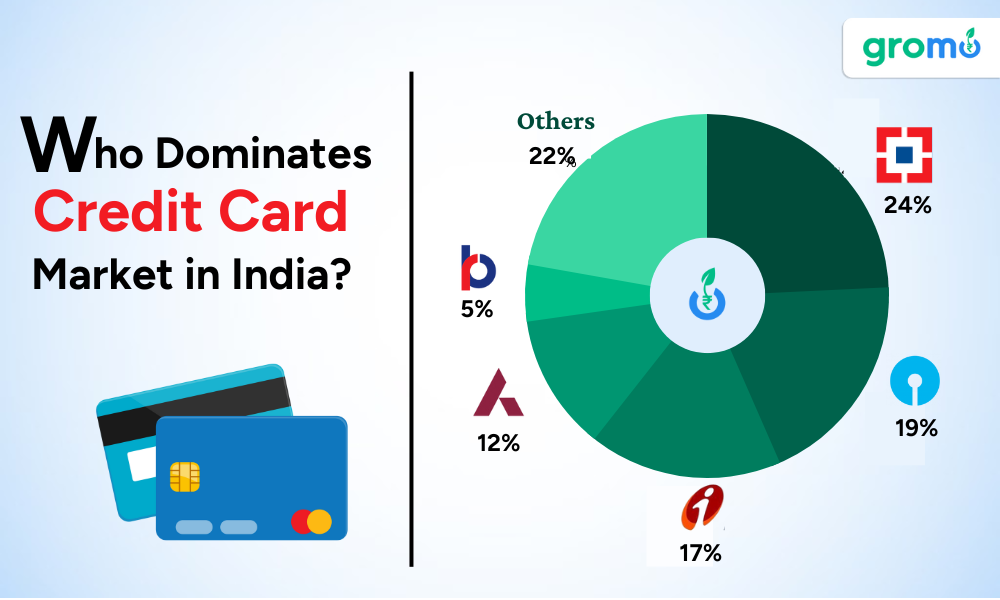

Top 10 Providers of Credit Cards in India

Credit cards have become an essential financial tool in today's world, offering convenience, flexibility, and a wide range of benefits. In India, several financial institutions provide credit cards to cater to different customer needs and preferences. Here are the top 10 credit card providers in India:

HDFC Bank:

HDFC Bank offers a diverse range of credit cards with attractive features, rewards programs, and exclusive privileges. Their credit cards cater to various categories like travel, shopping, dining, and more.

State Bank of India (SBI):

SBI is one of the largest public sector banks in India and provides a wide range of credit cards. SBI credit cards come with attractive rewards, cashback offers, and lifestyle benefits.

ICICI Bank:

ICICI Bank is known for its innovative credit card offerings with features like reward points, cashback, fuel surcharge waivers, and airport lounge access. They have credit cards tailored to different lifestyles and customer preferences.

Axis Bank:

Axis Bank offers a comprehensive range of credit cards with benefits like reward points, discounts on shopping and dining, travel privileges, and more. Their credit cards cater to diverse customer segments.

Standard Chartered Bank:

Standard Chartered Bank provides a variety of credit cards with features such as cashback, reward points, exclusive discounts, and lifestyle benefits. Their credit cards are designed to suit different spending patterns and preferences.

Citi Bank:

Citi Bank offers a range of credit cards with attractive benefits like accelerated reward points, cashback, travel benefits, and dining privileges. They have credit cards tailored to specific customer needs and preferences.

Kotak Mahindra Bank:

Kotak Mahindra Bank provides credit cards with features like accelerated reward points, cashback, movie ticket discounts, fuel surcharge waivers, and airport lounge access. Their credit cards cater to various customer segments.

IndusInd Bank:

IndusInd Bank offers a wide array of credit cards with features like reward points, cashback, complimentary lounge access, concierge services, and travel benefits. Their credit cards come with personalized offers and exclusive privileges.

CHECK OUT!!

- Benefits Of Demat Account: 5 Benefits That You Should Know

- Life Insurance Terms And Definitions: Exhaustive List

- Top Providers Of Investment Insurance: 10 Providers List

- Savings Account Terms And Definitions: Exhaustive List

HSBC Bank:

HSBC Bank provides credit cards with features like reward points, cashback, fuel surcharge waivers, travel benefits, and lifestyle privileges. Their credit cards cater to different customer needs and preferences.

RBL Bank:

RBL Bank offers a range of credit cards with features like reward points, cashback, discounts on shopping, dining, and entertainment, and complimentary airport lounge access. Their credit cards are designed to provide value to customers.

These are the top 10 providers of credit cards in India, each offering a variety of credit cards with unique benefits and features. When choosing a credit card, it's important to consider your spending habits, lifestyle, and specific requirements to find the one that best suits your needs. Remember to compare the features, fees, and rewards offered by different providers before making a decision.

Yes Bank:

Yes Bank offers a range of credit cards with features such as reward points, cashback, complimentary lounge access, fuel surcharge waivers, and attractive discounts on various categories. Their credit cards cater to different customer segments and lifestyles.

IDFC First Bank:

IDFC First Bank provides credit cards with features like reward points, cashback, complimentary airport lounge access, fuel surcharge waivers, and exclusive offers on dining and entertainment. Their credit cards are designed to offer convenience and value to customers.

PNB (Punjab National Bank):

PNB offers a variety of credit cards with features such as reward points, cashback, discounts on shopping, dining, and entertainment, and travel benefits. Their credit cards cater to different customer needs and preferences.

Bank of Baroda (BOB):

Bank of Baroda provides credit cards with features like reward points, cashback, discounts on shopping and dining, airport lounge access, and travel privileges. Their credit cards offer value and convenience to customers.

Federal Bank:

Federal Bank offers a range of credit cards with features such as reward points, cashback, travel benefits, and lifestyle privileges. Their credit cards come with attractive offers and personalized services.

Kotak Mahindra Bank:

Kotak Mahindra Bank offers a variety of credit cards with features like reward points, cashback, movie ticket discounts, fuel surcharge waivers, and airport lounge access. Their credit cards cater to various customer segments and preferences.

RBL Bank:

RBL Bank provides credit cards with features such as reward points, cashback, discounts on shopping, dining, and entertainment, and complimentary airport lounge access. Their credit cards are designed to provide value and convenience to customers.

American Express:

American Express offers a range of credit cards with features like reward points, cashback, travel benefits, airport lounge access, and exclusive offers on dining, shopping, and entertainment. Their credit cards are known for their premium services and privileges.

Karnataka Bank:

Karnataka Bank provides credit cards with features such as reward points, cashback, discounts on shopping and dining, and travel benefits. Their credit cards cater to different customer needs and preferences.

Karur Vysya Bank:

Karur Vysya Bank offers credit cards with features like reward points, cashback, fuel surcharge waivers, and discounts on various categories. Their credit cards provide convenience and value to customers.

These are additional credit card providers in India that offer a variety of credit cards with unique features and benefits. It's important to research and compare the offerings of different providers to choose the credit card that best aligns with your financial goals and lifestyle.

Factors to Consider When Choosing a Credit Card Provider

When choosing a credit card provider in India, it's essential to consider various factors to ensure that you select the right option that suits your needs and preferences. Here are some key factors to consider:

Interest Rates:

Compare the interest rates offered by different credit card providers. Lower interest rates can save you money on outstanding balances.

Annual Fees:

Check whether the credit card provider charges an annual fee and evaluate if the benefits offered justify the fee. Some providers may waive the annual fee for the first year or offer it as a lifetime-free card.

Credit Limit:

Consider the credit limit offered by the provider. Ensure that the credit limit aligns with your spending requirements and financial capacity.

Rewards and Benefits:

Assess the rewards and benefits offered by different credit card providers. Look for features like reward points, cashback offers, discounts on shopping, dining, and entertainment, complimentary airport lounge access, travel benefits, and insurance coverage.

Customer Service:

Evaluate the customer service quality of the credit card provider. Prompt and reliable customer support can be valuable when you have queries or face any issues with your credit card.

Acceptance:

Check the acceptance of the credit card provider's network. Ensure that the credit card is widely accepted across various merchants and online platforms.

Security Features:

Look for robust security features provided by the credit card issuer, such as fraud protection, secure online transactions, and the option to set spending limits.

Additional Fees and Charges:

Read the terms and conditions carefully to understand any additional fees and charges associated with the credit card, such as late payment fees, cash advance fees, and foreign transaction fees.

Online Banking Services:

Evaluate the online banking services offered by the credit card provider, including mobile app features, account management, and access to transaction history and statements.

To sell this product, and many other financial products. DOWNLOAD GROMO. Where you can sell and earn a substantial income sitting at home

Credit Card Eligibility:

Understand the eligibility criteria set by the credit card provider. Check if you meet the minimum income requirements and other eligibility criteria before applying for a credit card.

By considering these factors, you can make an informed decision while choosing a credit card provider in India that aligns with your financial goals and lifestyle.

Credit cards have become an integral part of the financial landscape in India, offering convenience, flexibility, and a wide range of benefits to cardholders. From reward points and cashback offers to travel benefits and exclusive discounts, credit cards provide a host of advantages that enhance the overall consumer experience.

In this comprehensive guide, we have explored the world of credit cards, delving into their meaning, types, benefits, and the top providers in India. We have discussed the different types of credit cards, including lifestyle cards, travel cards, and rewards cards, highlighting their unique features and advantages. Additionally, we have examined the top credit card providers in India, showcasing their offerings and benefits.

Remember, while credit cards can be powerful financial tools, it's important to use them responsibly and manage your finances wisely. Paying your credit card bills on time, keeping track of your expenses, and staying within your credit limit are crucial aspects of maintaining a healthy credit history.

So, whether you're looking to earn rewards, enjoy travel perks, or manage your expenses more efficiently, explore the world of credit cards and find the one that suits your needs. Choose wisely, use responsibly, and make the most of the benefits that credit cards have to offer.

Credit cards are payment cards issued by financial institutions, typically banks, that allow cardholders to borrow money up to a predetermined credit limit. They provide a convenient way to make purchases without the need for cash. When a credit card is used for a transaction, the cardholder essentially borrows money from the credit card issuer to complete the purchase.

Benefits of Credit Cards

Credit cards offer numerous benefits to cardholders, making them a popular choice for many individuals. Here are some key advantages of using credit cards:

Convenience:

Credit cards provide a convenient and secure way to make purchases both online and offline. They eliminate the need to carry large amounts of cash, offering a more streamlined and hassle-free shopping experience.

Access to Credit:

Credit cards allow individuals to access credit and make purchases even if they don't have immediate funds available. This can be particularly useful in emergencies or when making large purchases.

Build Credit History:

Responsible credit card usage can help individuals build a positive credit history. Making timely payments and managing credit card balances effectively can improve credit scores, making it easier to qualify for loans and other financial products in the future.

Rewards and Benefits:

Many credit cards offer rewards programs, allowing cardholders to earn points, cashback, or other incentives for their spending. These rewards can be redeemed for various benefits such as travel discounts, merchandise, or statement credits.

Security:

Credit cards offer enhanced security features, including fraud protection and zero-liability policies. If a fraudulent transaction occurs, cardholders are typically not held responsible for unauthorized charges.

Emergency Funds:

Credit cards can serve as a backup source of funds during emergencies or unexpected expenses. They provide a financial safety net when immediate cash is not available.

Types of Credit Cards

Credit cards come in various types, each designed to cater to different needs and lifestyles. Here are some common types of credit cards:

Rewards Credit Cards:

These cards offer rewards for eligible purchases, such as cashback, travel points, or loyalty program benefits. Rewards credit cards are popular among individuals who want to earn benefits for their spending.

Travel Credit Cards:

Designed for frequent travelers, travel credit cards offer perks such as airline miles, hotel discounts, airport lounge access, and travel insurance. These cards often have partnerships with airlines or hotel chains to provide exclusive benefits.

Balance Transfer Credit Cards:

Balance transfer cards allow cardholders to transfer high-interest debt from one card to another with a lower or zero-interest introductory period. This can help individuals save on interest and consolidate their debt.

Student Credit Cards:

Designed for students, these cards offer credit-building opportunities and often come with features tailored to student needs, such as low credit limits and rewards for educational expenses.

Secured Credit Cards:

Secured credit cards require a security deposit that serves as collateral. They are typically offered to individuals with limited credit history or poor credit scores. Secured cards can help individuals build or rebuild credit.

Cashback Credit Cards:

Cashback credit cards provide a percentage of the purchase amount back to the cardholder as cash rewards. These cards are popular for their straightforward and tangible benefits.

KEY TAKEAWAYS

-

Research and Compare: Before choosing a credit card provider, it's essential to conduct thorough research and compare the offerings of different providers. Consider factors such as interest rates, annual fees, rewards programs, and customer reviews to find the provider that best suits your needs.

-

Customer Service and Support: When selecting a credit card provider, consider the quality of their customer service and support. Look for providers that offer 24/7 customer assistance, easy access to account information, and prompt resolution of any issues or concerns.

-

Card Features and Benefits: Evaluate the features and benefits offered by different credit card providers. Look for perks such as cashback rewards, travel benefits, insurance coverage, and discounts on partner merchants. Choose a provider that aligns with your spending habits and lifestyle.

-

Interest Rates and Fees: Carefully review the interest rates and fees associated with credit cards from different providers. Look for providers that offer competitive interest rates, low or no annual fees, and reasonable penalties for late payments or exceeding credit limits.

-

Credit Card Security: Consider the security measures implemented by credit card providers to protect cardholders' personal and financial information. Look for providers that offer features such as fraud protection, EMV chip technology, and secure online transactions to ensure your peace of mind.