Buy Now Pay Later Terms & Definitions: Exhaustive List

The concept of "Buy Now Pay Later" (BNPL) has gained significant popularity as a payment option among consumers.

Buy Now Pay Later Terms & Definitions: An Exhaustive List

In recent years, the concept of "Buy Now Pay Later" (BNPL) has gained significant popularity as a payment option among consumers. With BNPL services, individuals can make purchases upfront and then pay for them in installments over a specified period. To help you navigate the world of BNPL, this comprehensive list provides definitions of key terms associated with this payment method.

1.Buy Now Pay Later (BNPL)

Buy Now Pay Later refers to a payment method that allows consumers to make purchases and delay the payment for those purchases over a specific period. It provides an alternative to traditional credit cards or upfront payment, allowing consumers to spread the cost of their purchases.

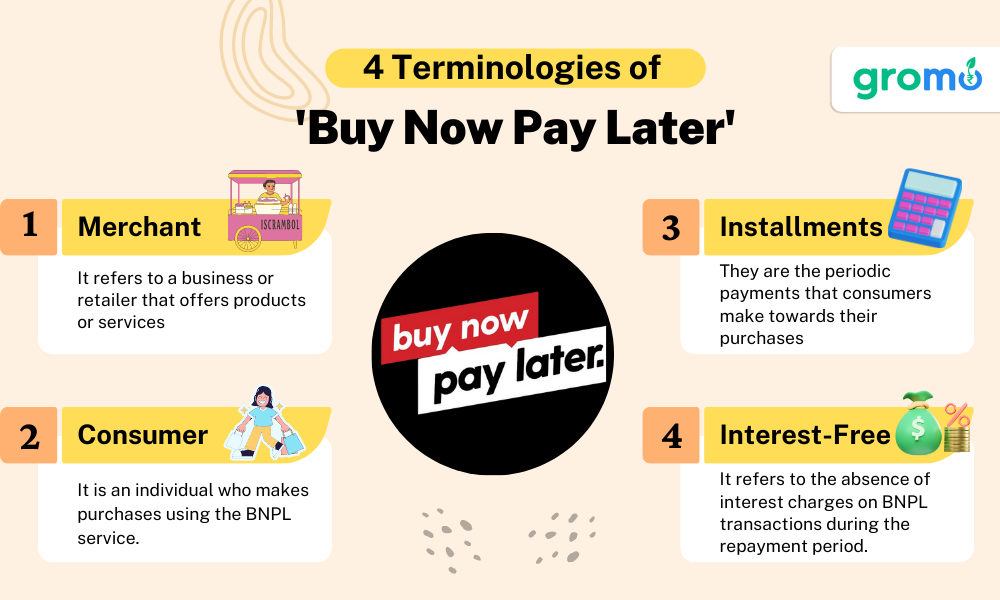

2.Merchant

A merchant refers to a business or retailer that offers products or services and accepts BNPL as a payment option. Merchants collaborate with BNPL providers to offer their customers the convenience of deferred payments.

3.Consumer

A consumer is an individual who makes purchases using the BNPL service. Consumers choose BNPL as a payment option to divide their payment into manageable installments.

4.Installments

Installments are the periodic payments that consumers make towards their purchases through the BNPL service. Instead of paying the full amount upfront, consumers can split the total cost into smaller, more affordable payments.

5.Interest-Free

Interest-Free refers to the absence of interest charges on BNPL transactions during the repayment period. Some BNPL providers offer interest-free periods, allowing consumers to pay for their purchases without incurring additional costs.

CHECK OUT NOW!!

- Personal Loan Terms And Definitions: Exhaustive List

- Life Insurance Terms And Definitions: Exhaustive List

- Top Providers Of Investment Insurance: 10 Providers List

- Savings Account Terms And Definitions: Exhaustive List

6.Late Payment Fees

Late payment fees are charges imposed on consumers who fail to make their BNPL installment payments within the specified due date. These fees serve as an incentive for timely payments and may vary among BNPL providers.

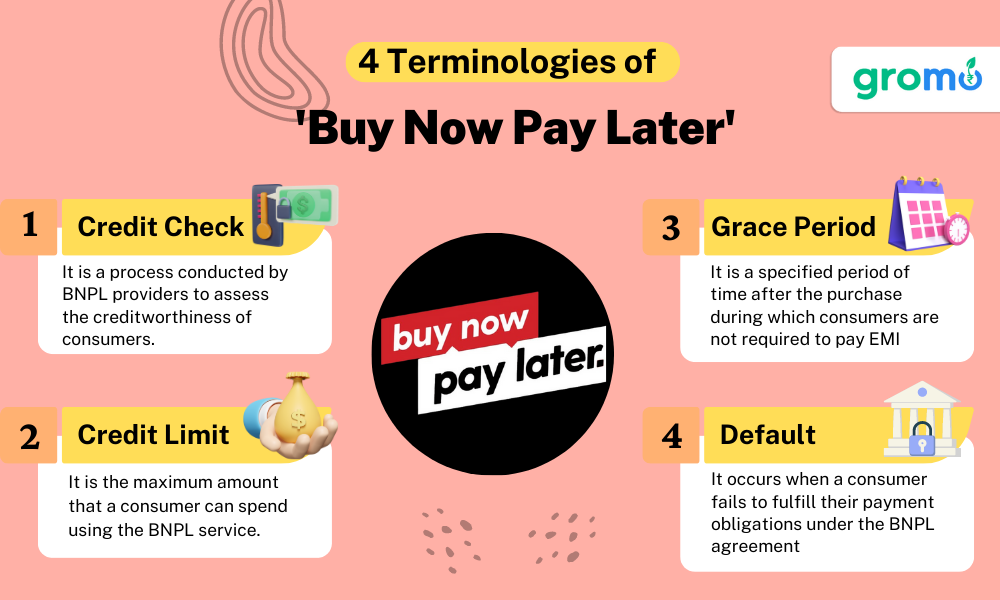

7.Credit Check

A credit check is a process conducted by BNPL providers to assess the creditworthiness of consumers. It involves reviewing the consumer's credit history and financial standing to determine their eligibility for the BNPL service.

8.Credit Limit

A credit limit is the maximum amount that a consumer can spend using the BNPL service. It is determined based on various factors such as the consumer's creditworthiness, income, and repayment history.

9.Payment Schedule

A payment schedule outlines the specific dates and amounts of installment payments that consumers need to make to repay their BNPL purchases. It helps consumers plan their finances and ensures timely payments.

10.Repayment Period

The repayment period refers to the duration over which consumers need to repay the total amount of their BNPL purchases. It can vary depending on the BNPL provider and the terms of the specific BNPL agreement. Repayment periods can range from a few weeks to several months, depending on the size of the purchase and the terms agreed upon

11.Grace Period

A grace period is a specified period of time after the purchase during which consumers are not required to make any installment payments. It provides some breathing space for consumers to manage their finances before they start making payments on their BNPL purchases.

12.Account Statement

An account statement is a document provided by the BNPL provider that details the consumer's transactions, outstanding balances, installment payments, and any additional charges or fees associated with the BNPL service. It helps consumers track their purchases and stay informed about their payment obligations.

13.Default

Default occurs when a consumer fails to fulfill their payment obligations under the BNPL agreement. It usually happens when a consumer consistently misses installment payments or fails to repay the full amount within the specified repayment period. Defaults can have negative consequences, such as damage to the consumer's credit score and potential legal action by the BNPL provider.

14.Collection Agency

A collection agency is a third-party organization that BNPL providers may engage to recover outstanding payments from consumers who have defaulted on their BNPL agreements. Collection agencies use various methods, including contacting consumers and implementing collection strategies, to collect the outstanding debt on behalf of the BNPL provider.

15.. Credit Score

A credit score is a numerical representation of an individual's creditworthiness based on their credit history and financial behavior. BNPL providers may consider the consumer's credit score when assessing their eligibility for the service and determining the credit limit and terms of the BNPL agreement.

16.. Consumer Protection

Consumer protection refers to the legal and regulatory measures in place to safeguard consumers' rights and interests in financial transactions, including BNPL services. It aims to ensure transparency, fair practices, and the availability of remedies for consumers in case of disputes or issues with the BNPL provider.

17.Regulation

Regulation in the context of BNPL refers to the rules and guidelines set by government authorities or regulatory bodies to govern the operations of BNPL providers. Regulatory frameworks ensure that BNPL services are offered responsibly, consumers are protected, and the industry operates in a fair and transparent manner.

-

Limited Policy Options: While life insurance offers various policy options, such as term life, whole life, and universal life, the choices may still be limited compared to other investment or savings options. Individuals with specific financial goals or preferences may find the available policies insufficient to meet their unique needs.

-

Policy Exclusions and Limitations: Life insurance policies often come with certain exclusions and limitations. For example, there may be a waiting period before the policy pays out in the event of suicide, or certain risky activities may not be covered. It's crucial for policyholders to thoroughly review the policy terms to understand the scope of coverage and any restrictions that may apply.

-

Premium Adjustments: Some life insurance policies have premium adjustments over time. This means that the initial premium paid may increase over the years, making it more expensive to maintain the policy. These adjustments are typically associated with certain types of policies, such as adjustable life or variable life insurance.

-

Surrender Charges: If a policyholder decides to surrender their life insurance policy before its maturity, they may be subject to surrender charges. These charges can significantly reduce the cash value or the amount the policyholder receives upon surrendering the policy. It's important to be aware of these charges and consider them when making decisions about the policy.

-

Lack of Cash Value Growth: While certain types of life insurance policies, such as whole life or universal life, accumulate cash value over time, the growth rate may be relatively low compared to other investment options. Individuals seeking higher returns may find that alternative investment vehicles provide better opportunities for wealth accumulation.

-

Policy Lapses due to Non-Payment: Failure to pay premiums on time can result in the lapse of a life insurance policy. When a policy lapses, the policyholder loses the coverage and may not be able to reinstate the policy without undergoing additional medical underwriting or facing higher premiums. It's important to maintain timely premium payments to keep the policy in force.

-

Policy Ownership Limitations: In certain situations, the ownership of a life insurance policy may be restricted. For example, if the policy is owned by a trust or a business entity, the policyholder may have limited control over the policy's terms and beneficiaries. Understanding the ownership structure and limitations is crucial, especially for estate planning purposes.

CHECK OUT!!

- Investment Products Terms And Definitions: Exhaustive List

- Motor Insurance Terms And Definitions: Exhaustive List

- Term Life Insurance Meaning: Types, Pros, Cons, And More

- Top Providers Of Vehicle Loans: 5 Providers In India

-

Potential Denial of Claims: While life insurance is intended to provide financial protection to beneficiaries upon the death of the insured, there is a possibility that claims may be denied. This can happen if the policyholder provided inaccurate information during the application process or if the death occurred under specific circumstances excluded by the policy. Policyholders should be diligent in providing accurate information and understanding the policy's terms to mitigate the risk of claim denial.

-

Inflation Risk: Over time, the value of a life insurance policy's death benefit may be eroded by inflation. While the policy's face value remains the same, the purchasing power of that amount may decrease due to the rising costs of goods and services. Periodic policy reviews and adjustments can help account for inflation and ensure that the coverage remains adequate.

-

Understanding the drawbacks of life insurance allows individuals to make informed decisions about their financial planning and risk management strategies. By considering these limitations, individuals can better align their insurance needs with their long-term goals and overall financial picture. It's essential to consult with a qualified insurance professional or financial advisor to explore the options and choose the most suitable life insurance policy based on individual circumstances and objectives.

-

Complexity of Policy Features: Life insurance policies can be complex, with various features, riders, and options that may require careful consideration. Understanding the intricacies of these features and how they affect the policy's benefits, costs, and flexibility can be challenging for individuals without a deep understanding of insurance concepts.

-

Potential Over-Insurance: In some cases, individuals may end up purchasing more life insurance coverage than they actually need. Over-insurance can lead to higher premiums and unnecessary financial burden. It's important to evaluate one's insurance needs based on factors such as income, dependents, outstanding debts, and future financial goals to avoid over-insuring.

-

Cost of Premiums: Life insurance premiums can be a significant financial commitment, especially for policies with higher coverage amounts or additional features. Individuals with limited financial resources may find it challenging to afford the premiums, potentially causing strain on their overall budget. It's crucial to consider the affordability of premiums before committing to a life insurance policy.

*Looking for an app for earning online? GroMo is your answer! Now earn with each sale by selling various kinds of financial products *

-

Risk of Policy Termination: Life insurance policies can be terminated if the policyholder fails to meet the contractual obligations, such as non-payment of premiums or material misrepresentation. In such cases, the policyholder may lose the protection and any accumulated cash value, which can be a significant loss if the policy was held for an extended period.

-

Dependency on Insurance Company Stability: The stability and financial strength of the insurance company providing the policy are important considerations. In the event that the insurance company faces financial difficulties or goes out of business, policyholders may face challenges in receiving the promised benefits. It's advisable to choose reputable and financially secure insurance companies to mitigate this risk.

-

Limited Investment Flexibility: Certain types of life insurance policies, such as whole life or universal life, may allow policyholders to accumulate cash value and potentially earn investment returns. However, the investment options within these policies are typically limited compared to other investment vehicles. Individuals seeking more diverse investment opportunities may find better options outside of life insurance.

-

Opportunity Cost of Premium Payments: The premium payments made towards a life insurance policy represent an opportunity cost. These funds could potentially be invested in other financial instruments or used for other purposes, such as debt repayment or retirement savings. It's important to evaluate the potential returns and benefits of life insurance against alternative uses of the premium payments.

-

Changes in Personal Circumstances: Life insurance needs can change over time due to various factors, such as changes in income, family structure, or financial goals. It's important to regularly reassess the adequacy of the coverage and make adjustments as needed to ensure that the policy aligns with the current circumstances and objectives.

-

Potential Policy Underperformance: The returns generated by certain types of life insurance policies, such as cash value policies, may not match the performance of other investment options. The growth rate of the cash value component is influenced by various factors, including policy expenses and market conditions. Individuals seeking higher returns may find alternative investment vehicles more suitable.

-

Inflexibility in Changing Policies: Once a life insurance policy is in force, it can be challenging to make changes to the coverage or switch to a different policy. Altering the policy terms, such as increasing or decreasing the coverage amount, may require additional underwriting or result in changes to the premium structure. It's important to carefully consider the long-term implications before finalizing the policy.

-

Potential Policy Lapses: Life insurance policies can lapse if the policyholder fails to pay premiums or maintain the policy according to the terms and conditions. In such cases, the policyholder may lose the accumulated cash value, and the coverage may terminate. It's crucial to stay vigilant about premium payments and ensure the policy remains in force.

-

Limited Flexibility in Beneficiary Designation: Once a life insurance policy is issued, the beneficiary designation is generally irrevocable without their consent. This lack of flexibility can be a drawback if circumstances change, such as in cases of divorce or estrangement. Individuals should review and update their beneficiary designations periodically to ensure they align with their current wishes.

-

Potential Disputes with Beneficiaries: In some instances, disputes may arise among beneficiaries regarding the distribution of the life insurance proceeds. These disputes can lead to legal battles and delays in the beneficiaries receiving the intended benefits. It's important to clearly communicate intentions and consider involving legal professionals to draft appropriate beneficiary designations or trusts.

-

Disclosure of Personal Information: Life insurance applications often require extensive personal and medical information, including details about health history, lifestyle habits, and financial circumstances. Some individuals may be uncomfortable with providing such sensitive information to insurance companies. It's essential to ensure the privacy and security of personal data during the application process.

-

Premiums Based on Generalized Risk Assessment: Life insurance premiums are typically determined based on generalized risk assessment factors, such as age, gender, and health status. This means that healthier individuals may end up paying higher premiums to offset the risk of less healthy individuals within the same age group. Some individuals may find this lack of personalized pricing unfair.

-

Potential Overemphasis on Insurance Coverage: Relying too heavily on life insurance coverage as a financial solution can lead to neglecting other important aspects of financial planning, such as savings, investments, and retirement planning. It's crucial to consider life insurance as one component of a comprehensive financial strategy rather than the sole solution.

-

Emotional Considerations: Life insurance is a product that deals with the topic of mortality, which can evoke emotional responses and discomfort for some individuals. The thought of planning for one's own demise or discussing beneficiaries in the event of death may be challenging for some people to confront.

To sell this product, and many other financial products. DOWNLOAD GROMO. Where you can sell and earn a substantial income sitting at home

KEY TAKEAWAYS

-

Consider the trade-offs: Life insurance comes with its own set of limitations and drawbacks. It's important to weigh the benefits of coverage against the potential drawbacks before committing to a policy.

-

Understand the policy terms: Thoroughly review the terms and conditions of the life insurance policy, including exclusions, limitations, and premium adjustments. Being aware of these factors helps in making informed decisions and managing expectations.

-

Regularly reassess your needs: Life insurance needs can change over time due to various factors. Regularly evaluate your coverage to ensure it aligns with your current financial goals, family situation, and overall risk management strategy.

-

Explore alternative options: Life insurance is not the only financial product available for risk management and wealth accumulation. Consider other investment vehicles and savings strategies that may offer more flexibility, higher returns, or better suitability for your specific needs.

-

Seek professional guidance: Consulting with a qualified insurance professional or financial advisor is highly recommended. They can provide expert insights, help navigate the complexities of life insurance, and assist in finding the most suitable coverage based on your individual circumstances.