Credit Cards: What Are Credit Cards?

The HDFC Credit Card Login portal is an online platform provided by HDFC Bank that allows HDFC Credit Cardholders to manage their credit card accounts.

What Are Credit Cards

Credit cards are financial tools that allow individuals to make purchases on credit. They function as a form of revolving credit, meaning users can borrow money up to a certain credit limit to make purchases and repay the borrowed amount later.

When using a credit card, individuals can make payments for goods and services without immediate cash outlay. Credit cards offer convenience, flexibility, and the ability to build a credit history.

They come with various features and benefits, such as rewards programs, cashback offers, travel perks, and purchase protection. However, it's important to use credit cards responsibly, paying off the balance in full each month or making minimum payments to avoid high interest charges and potential debt accumulation. Understanding credit card terms, fees, and repayment obligations is crucial to make informed financial decisions and maintain a healthy credit profile.

Introduction to HDFC Credit Card Login

The HDFC Credit Card Login portal is an online platform provided by HDFC Bank that allows HDFC Credit Cardholders to access and manage their credit card accounts conveniently. By logging in to this portal, you can perform various tasks related to your credit card, including checking your balance, reviewing transactions, making payments, and updating your personal information.

How to Register for HDFC Credit Card Login

Before you can enjoy the benefits of HDFC Credit Card Login, you need to register for an account. The registration process is simple and can be completed in a few easy steps:

- Visit the HDFC Bank website and navigate to the Credit Card section.

- Click on the "Register" or "New User" option.

- Provide your credit card details, including the card number, expiration date, and CVV.

- Enter your registered mobile number and email address.

- Set up your login credentials, including a username and password.

- Create security questions and provide answers for added security.

- Review and accept the terms and conditions.

- Verify your details through an OTP (One-Time Password) sent to your registered mobile number.

Upon successful verification, your HDFC Credit Card Login account will be created.

Steps to Log in to your HDFC Credit Card Account

Once you have registered for HDFC Credit Card Login, you can follow these steps to log in to your account:

- Visit the HDFC Bank website and navigate to the Credit Card section.

- Click on the "Login" or "Existing User" option.

- Enter your HDFC Credit Card Login credentials, including your username and password.

- Complete the security check, such as entering the captcha code or answering the security questions.

- Click on the "Login" button to access your HDFC Credit Card account.

To sell this product, and many other financial products. DOWNLOAD GROMO. Where you can sell and earn a substantial income sitting at home

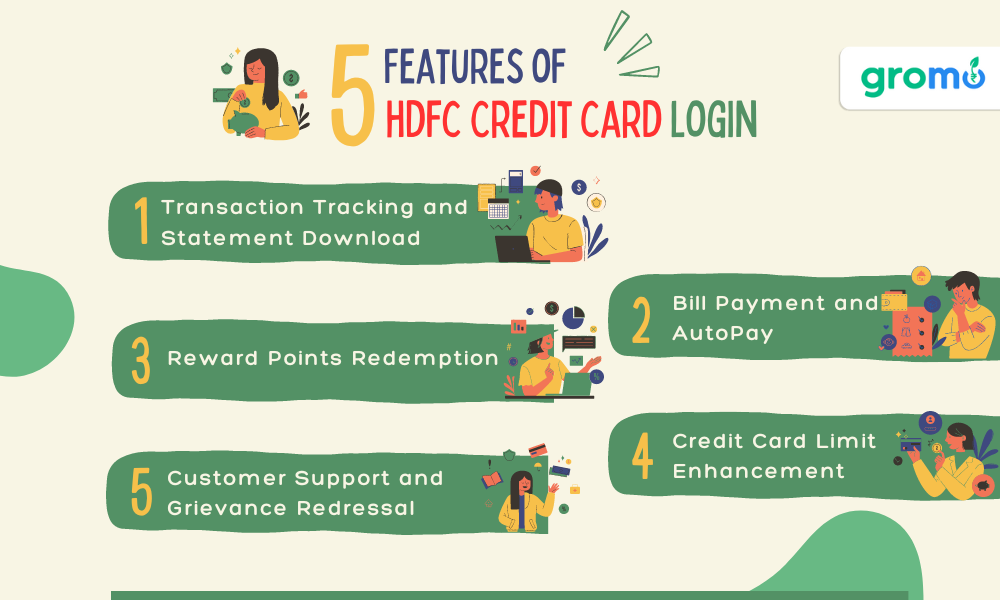

Key Features and Services of HDFC Credit Card Login

The HDFC Credit Card Login portal offers a range of features and services to enhance your credit card management experience. Let's explore some of the key functionalities it provides:

1. Transaction Tracking and Statement Download

View and track your credit card transactions in real-time.

Download monthly statements and keep track of your spending.

Access transaction details, including merchant name, date, and amount.

2. Bill Payment and AutoPay

Pay your HDFC Credit Card bills online using various payment options, such as net banking, debit card, or UPI.

Set up AutoPay to ensure timely payment of your credit card bills.

Schedule future payments or make immediate payments as per your convenience.

3. Reward Points Redemption

Check your reward points balance and explore the rewards

Redeem your accumulated reward points for a wide range of options, including merchandise, gift vouchers, travel bookings, and more.

Enjoy exclusive offers and discounts on partner brands for reward points redemption.

4. Credit Card Limit Enhancement

Request a credit limit enhancement for your HDFC Credit Card through the login portal.

Submit the necessary documents and details to support your credit limit increase request.

Track the status of your credit limit enhancement request through the portal.

5. Customer Support and Grievance Redressal

Access customer support services for any queries, issues, or assistance related to your HDFC Credit Card.

Raise service requests, escalate grievances, and track the resolution progress through the portal.

Get instant access to customer care contact information, including phone numbers and email addresses.

CHECK OUT NOW!

- Benefits Of Demat Account: 5 Benefits That You Should Know

- Life Insurance Terms And Definitions: Exhaustive List

- Top Providers Of Investment Insurance: 10 Providers List

- Savings Account Terms And Definitions: Exhaustive List

Tips for Secure HDFC Credit Card Login

To ensure the security of your HDFC Credit Card Login account, follow these tips:

-

Choose a strong and unique password that includes a combination of letters, numbers, and special characters.

-

Avoid using easily guessable information, such as your name, birthdate, or phone number, as your password.

-

Enable two-factor authentication (2FA) for an added layer of security during the login process.

-

Regularly update your login credentials and avoid sharing your username and password with anyone.

-

Be cautious while accessing your account on public or shared devices. Always log out after each session.

-

Keep your mobile number and email address updated to receive important notifications and alerts.

CHECK OUT!

- Investment Products Terms And Definitions: Exhaustive List

- Motor Insurance Terms And Definitions: Exhaustive List

- Term Life Insurance Meaning: Types, Pros, Cons, And More

- Top Providers Of Vehicle Loans: 5 Providers In India

Frequently Asked Questions (FAQs)

Can I access HDFC Credit Card Login from a mobile app?

Yes, HDFC Bank provides a mobile app that allows you to access your credit card account on-the-go.

What should I do if I forget my HDFC Credit Card Login password?

You can click on the "Forgot Password" link on the login page and follow the instructions to reset your password.

Is HDFC Credit Card Login secure?

Yes, HDFC Bank takes security measures to protect your credit card login information. However, it is essential to follow best practices for online security.

Can I access statements older than the current month through the HDFC Credit Card Login portal?

Yes, you can access and download past statements from the portal for reference and record-keeping purposes.

Is there a fee for using the HDFC Credit Card Login services?

No, HDFC Credit Card Login services are provided free of charge to HDFC Credit Cardholders.

The HDFC Credit Card Login portal is a powerful tool that empowers HDFC Credit Cardholders with convenient access to their credit card accounts. From transaction tracking to bill payments and reward points redemption, the portal offers a range of features and services to enhance your credit card management experience. By following the registration and login process, you can efficiently manage your HDFC Credit Card and stay updated on your transactions, rewards, and other important details.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as financial advice. Users are advised to contact HDFC Bank directly for specific details and clarification related to HDFC Credit Card Login and services.

Please note that the above article is a general overview and does not cover all possible aspects of HDFC Credit Card Login.

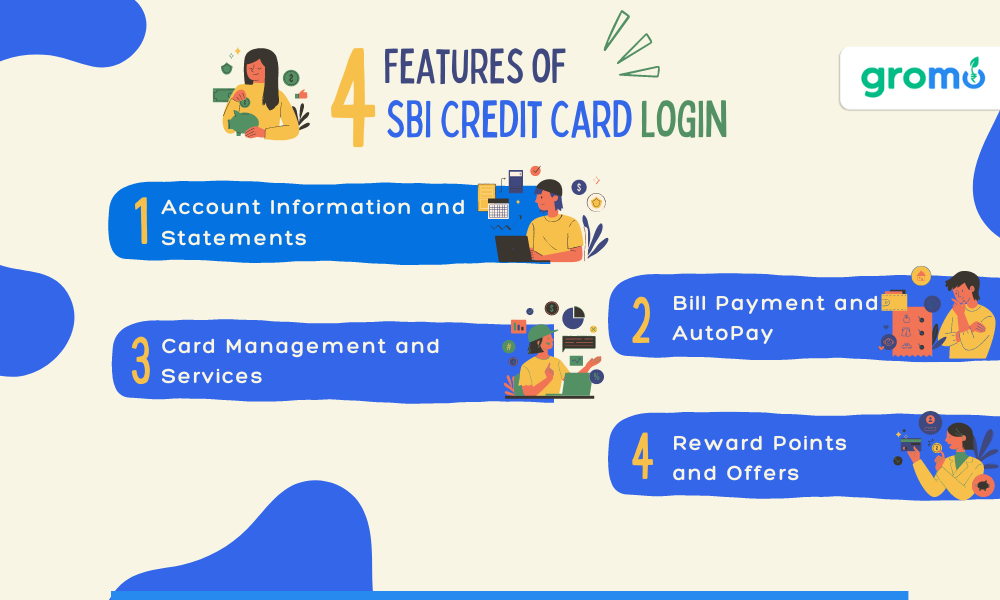

The Benefits of SBI Credit Card Login

SBI Credit Card Login is a convenient and secure online portal provided by State Bank of India (SBI) that allows cardholders to access and manage their credit card accounts easily. By logging in to your SBI Credit Card account, you can avail yourself of a range of benefits and services. In this article, we will explore the key advantages of using SBI Credit Card Login and how it can enhance your credit card management experience.

1. Account Information and Statements

Access your SBI Credit Card account details, including balance, available credit limit, and transaction history.

View and download your monthly credit card statements for record-keeping and reference purposes.

Keep track of your credit card usage and expenditure patterns to manage your finances effectively.

2. Bill Payment and AutoPay

Make timely credit card bill payments conveniently through the SBI Credit Card Login portal.

Set up AutoPay to ensure that your credit card bills are paid automatically on the due date, saving you from late payment charges.

Choose from various payment options, including net banking, debit card, and NEFT, for seamless bill settlement.

3. Reward Points and Offers

Check your reward points balance and explore the range of rewards and redemption options available.

Stay updated on the latest offers, discounts, and promotions provided by SBI and partner brands.

Make the most of your SBI Credit Card by maximizing reward points and enjoying exclusive benefits.

4. Card Management and Services

Manage your SBI Credit Card settings, such as updating personal information, contact details, and communication preferences.

Request for credit limit enhancements, add-on cards, or replacement cards through the online portal.

Track the status of your service requests, such as card blocking, card reissuance, or dispute resolution.

Tips for Secure SBI Credit Card Login

To ensure the security of your SBI Credit Card Login account, follow these tips:

-

Create a strong and unique password that combines letters, numbers, and special characters.

-

Regularly update your login credentials and avoid sharing your username and password with anyone.

-

Enable two-factor authentication (2FA) for an additional layer of security during the login process.

-

Be cautious while accessing your account on public or shared devices. Always log out after each session.

-

Keep your mobile number and email address updated to receive important notifications and alerts.

*Looking for an app for earning online? GroMo is your answer! Now earn with each sale by selling various kinds of financial products *

Frequently Asked Questions (FAQs)

Is the SBI Credit Card Login portal available as a mobile app?

Yes, SBI provides a mobile app that allows you to access your credit card account conveniently on your smartphone.

What should I do if I forget my SBI Credit Card Login password?

You can click on the "Forgot Password" link on the login page and follow the instructions to reset your password.

Is the SBI Credit Card Login portal secure?

Yes, SBI has implemented robust security measures to protect your credit card login information. However, it is important to follow best practices for online security.

Can I access statements from previous months through the SBI Credit Card Login portal?

Yes, you can access and download past credit card statements from the portal for reference and record-keeping purposes.

Is there any fee for using the SBI Credit Card Login services?

No, there is no fee for using the SBI Credit Card Login services. It is a free and convenient feature provided to SBI credit cardholders to manage their accounts online.

Can I link multiple SBI credit cards to a single SBI Credit Card Login account?

Yes, you can link multiple SBI credit cards to your SBI Credit Card Login account and manage them all through a single login.

How can I update my contact information through the SBI Credit Card Login portal?

You can easily update your contact information, such as your mobile number and email address, by accessing the "Profile" or "Settings" section within the SBI Credit Card Login portal.

Can I view my credit card transactions in real-time through the SBI Credit Card Login portal?

Yes, the SBI Credit Card Login portal provides real-time access to your credit card transactions. You can view the details of each transaction, including the merchant name, transaction amount, and date/time.

Are there any additional features or services available through the SBI Credit Card Login portal?

In addition to the aforementioned benefits, the SBI Credit Card Login portal may offer additional features such as EMI conversion, balance transfer, and instant loan offers. These services may vary based on the specific credit card and account eligibility.

Is it mandatory to register for the SBI Credit Card Login portal?

While it is not mandatory to register for the SBI Credit Card Login portal, it is highly recommended to enjoy the convenience and benefits it offers. Registering for the portal allows you to access and manage your credit card account anytime, anywhere.

The SBI Credit Card Login portal provides numerous benefits and conveniences for SBI credit cardholders. By leveraging this online platform, you can effectively manage your credit card account, track transactions, pay bills, and take advantage of exclusive offers and rewards. Ensure the security of your account by following best practices for online security and enjoy the seamless experience of managing your SBI credit card online.

KEY TAKEAWAYS

-

Convenience and flexibility: Credit cards offer a convenient and flexible payment method, allowing you to make purchases without carrying cash or writing checks. They can be used for both online and offline transactions, making them a versatile payment tool.

-

Credit-building opportunity: Proper and responsible use of credit cards can help build your credit history and improve your credit score. By making timely payments and maintaining a low credit utilization ratio, you can establish a positive credit profile, which is beneficial for future financial endeavors.

-

Rewards and benefits: Many credit cards come with reward programs that allow you to earn points, cashback, airline miles, or other incentives on your purchases. These rewards can be redeemed for various perks, such as travel discounts, gift cards, or statement credits, providing additional value for your spending.

-

Purchase protection and insurance: Credit cards often come with built-in purchase protection and insurance benefits. These can include extended warranties, price protection, and coverage against theft or damage for eligible purchases. Such features provide an added layer of security and peace of mind when making large or valuable purchases.

-

Financial management and tracking: Credit cards provide detailed monthly statements that help you track your expenses and analyze your spending patterns. This can assist in budgeting, expense management, and financial planning. Additionally, many credit card issuers offer online account management tools that allow you to monitor your transactions, set spending limits, and receive alerts for enhanced financial control.